Cisco Systems (NASDAQ: CSCO), one of the world’s largest networking and cybersecurity companies, is scheduled to report fiscal Q3 2025 earnings on May 14, after market close. With slowing traditional hardware growth and increasing demand for AI infrastructure, Cisco is navigating a pivotal transformation — one that Wall Street will dissect closely in this report.

Here’s a full breakdown of what to expect and why it matters.

Wall Street Expectations (Consensus Estimates)

According to Investopedia, Nasdaq, MarketBeat, and Zacks, analysts are forecasting:

- Revenue: ~$12.44–$12.49 billion

→ Down ~14–15% YoY from $14.6B Q3 FY24 - EPS (non-GAAP): ~$0.83–$0.84

→ Down from $1.00 in Q3 FY24

This revenue contraction reflects lingering macro uncertainty, slower enterprise spending, and deferred orders — especially in hardware-focused segments.

Cisco previously guided for a 13–15% YoY drop in revenue, aligning with this forecast.

What to Watch: Business Segment Breakdown

Secure, Agile Networks (Core Switches, Routers, Wireless): Still the largest revenue driver (~45% of total), but analysts expect YoY declines of ~20%.

- Demand in this segment is soft, with delayed enterprise and public sector projects.

- Hardware backlogs are shrinking, and excess inventory from 2023 orders is being digested.

- New AI-optimized switches are gaining attention but may not yet move the needle in Q3.

Internet for the Future (Optical, Silicon One, 5G): Expected to decline slightly YoY but benefit longer term from hyperscaler AI spending.

- Cisco’s partnerships with Meta and Microsoft on AI interconnect fabrics (via Silicon One and routers) could boost revenue in 2H 2025.

- SeekingAlpha notes limited impact on Q3 due to long procurement cycles.

End-to-End Security: A relative bright spot. Analysts expect mid-single-digit YoY growth, driven by:

- Strong demand for cloud-delivered firewall and XDR (extended detection and response) solutions

- Cisco’s $28 billion Splunk acquisition, though not yet closed in Q3, is expected to accelerate this segment in late 2025

Collaboration (WebEx, UCaaS): Expected to decline YoY, as Cisco loses ground to Microsoft Teams and Zoom.

Services & Recurring Revenue (Subscription Software): Now ~45% of total revenue — this is Cisco’s big strategic shift.

- Over 85% of software revenue is now recurring, with customers adopting Cisco+ and other subscription bundles.

AI Infrastructure Exposure: How Real Is It?

- Cisco has positioned itself as an AI-enabling networking company, with next-gen switches, data center fabrics, and interconnect solutions tailored for GPU-based clusters.

- Partnerships with Meta, Microsoft, NVIDIA, and public cloud providers are part of Cisco’s longer-term bet.

- However, AI revenue impact in Q3 will likely be minimal, per Zacks, as adoption is still early and tied to project-specific deployments.

Still, CEO Chuck Robbins continues to emphasize AI infrastructure as a multi-billion-dollar opportunity beginning in FY2026.

Earnings Surprise History and Stock Reactions

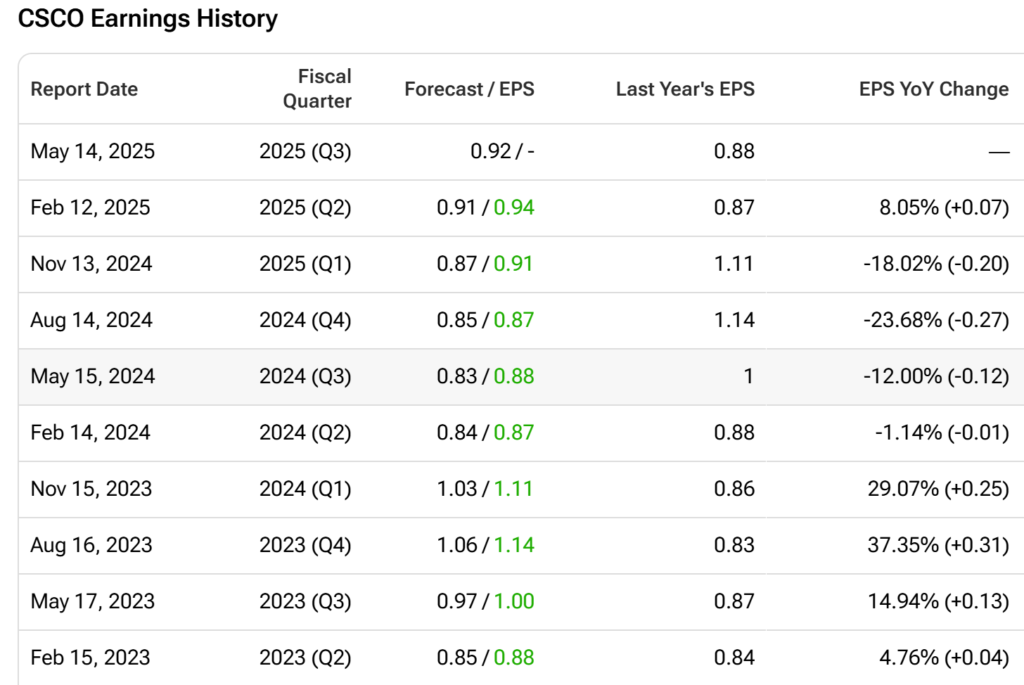

- Cisco beat EPS estimates in 10 of the last 12 quarters.

- But stock reactions have been muted or negative due to weak forward guidance or macro caution.

- Q2 FY25 saw an EPS beat of $0.87 vs. $0.84 expected, but shares dropped as Cisco forecasted a 13–15% YoY revenue decline for Q3.

The last three quarters saw post-earnings price drops of 3–7% despite beating the bottom line.

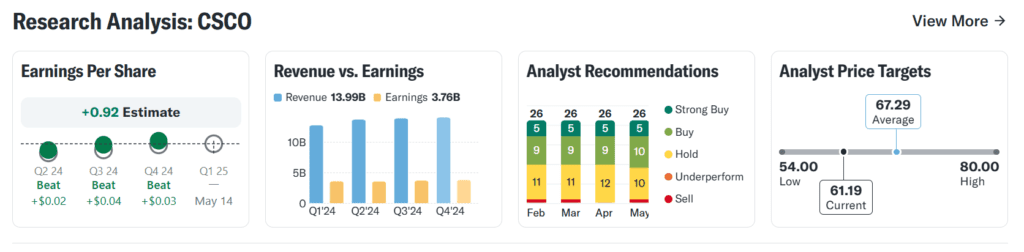

Valuation and Analyst Sentiment

- Forward P/E: ~12.5x → well below tech peers, reflecting low growth expectations

- Dividend yield: ~3.3% → attractive for income investors

- Market cap: ~$210B

- Wall Street ratings (consensus): 7 Buy, 16 Hold, 3 Sell

- Average price target: ~$54 vs. ~$49 current → ~10% implied upside

Cisco trades like a value stock, not a growth stock — even as it pivots toward software and AI.

Bullish Case

Recurring Revenue Momentum: Cisco now derives 45%+ of revenue from software and subscriptions. This mix shift supports more predictable cash flow and higher margins.

Valuation Support + Dividend Yield: With a forward P/E of ~12.5x and a dividend yield over 3%, Cisco is considered a safe, cash-rich tech holding for defensive investors.

AI Infrastructure Positioning: Cisco is supplying high-performance networking and optical gear to major hyperscalers building AI datacenters — a potential multi-billion revenue stream in FY2026 and beyond.

Splunk Acquisition Synergy: The pending $28B acquisition of Splunk will integrate observability, security, and real-time telemetry — bolstering Cisco’s security platform at a time of rising demand.

Bearish Case

Top-Line Contraction: Revenue is expected to drop 14–15% YoY in Q3, with hardware order softness and weak public sector spending impacting results.

Limited Near-Term AI Revenue: Despite AI positioning, Cisco has yet to show meaningful revenue growth tied to AI infrastructure. Most deployments are multi-quarter or multi-year rollouts.

Competitive Pressures: In security (Palo Alto, CrowdStrike), collaboration (Zoom, Teams), and even networking (Arista, Juniper), Cisco faces fierce innovation-driven competition.

Splunk Integration Risks: Though potentially transformative, integrating a $28B software company poses execution risk, culture clashes, and near-term dilution to earnings.

Stock Reaction Trends: Recent earnings beats haven’t helped stock performance. Traders may remain skeptical without strong guidance or revenue acceleration.

Prediction & Market Implications

- Cisco is likely to beat EPS on cost discipline and strong recurring revenue.

- Revenue may meet low expectations, but any upside will depend on deferred orders converting.

- Guidance for Q4 and commentary on AI orders will drive the stock reaction.

Final Takeaway: What Should Investors, Traders, and Beginners Know?

For long-term investors: Cisco remains a solid, cash-rich, dividend-paying company undergoing a digital transformation. If you’re betting on recurring revenue and enterprise security growth, it offers stability — but don’t expect explosive upside unless AI infrastructure takes off.

For traders: Expect modest post-earnings movement. Look for: Guidance revisions, AI order commentary, Margin improvements

For beginners: Cisco is a lower-risk way to invest in enterprise tech and AI infrastructure indirectly. Its long-term story hinges on whether it can replace legacy hardware revenue with cloud-driven, recurring models.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Qatar Buys 160 Boeing Jets as Trump Accepts $400M Gift Jet

Elon Musk, Robotaxis, and Starlink: Inside Multi-Billion Dollar US–Saudi Tech Power Play

Nvidia’s Partnership With Saudi Arabia Opens a New Frontier in Global AI

Trump Secures $600 Billion Saudi Investment in US Tech, Energy, and AI

US Drug Price Revolution Begins: Trump Targets 30–80% Cuts

US and China announce deal to cut reciprocal tariffs for 90 days

Zelensky Tells Putin to Show Up in Turkey for Talks After Trump Pushes for Meeting