Chinese stocks are surging even as the economy shows deep cracks — raising fears of another boom-bust cycle.

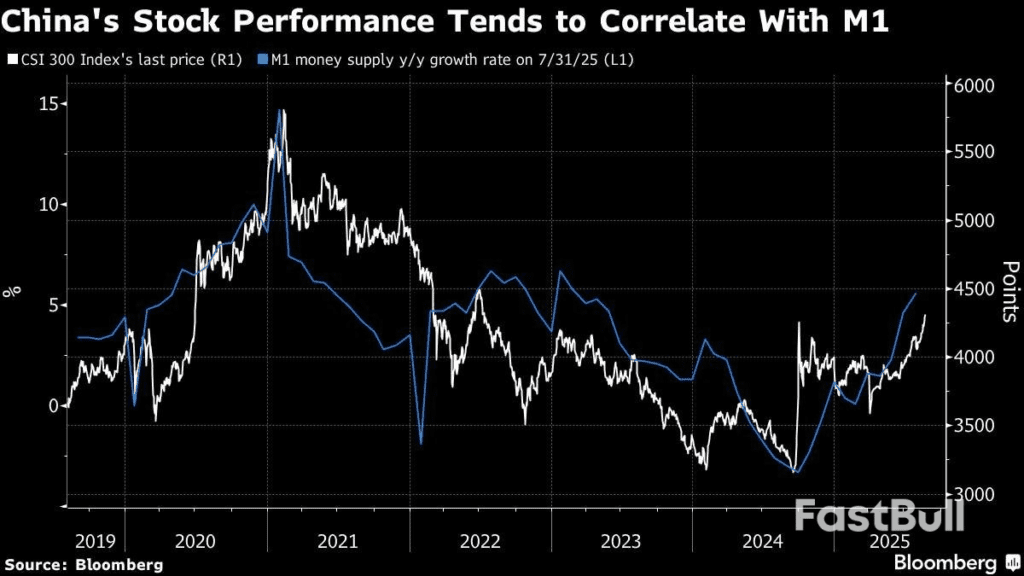

China’s stock market has added nearly $1 trillion in value over the past month, with the Shanghai Composite Index hitting a 10-year high and the CSI 300 Index climbing more than 20% from this year’s lows. The rally has come despite a gloomy economic backdrop — US tariffs, a worsening property crisis, weak consumer spending, and deflationary pressures.

Analysts warn the disconnect may be setting the stage for a bubble. Nomura has cautioned against “irrational exuberance,” while TS Lombard calls it a standoff between “market bulls and macro bears.”

“Markets might be expecting, either correctly or incorrectly, that fundamentals will improve,” said Homin Lee, senior macro strategist at Lombard Odier in Singapore. “But a bull market will not be sustainable if inflation stays near 0% and demand remains weak.”

Deflation Worries

China’s consumer prices were flat in July, producer prices fell for a 34th straight month, and the GDP deflator stayed negative. Retail sales, investment, and factory activity all disappointed, with Trump’s tariffs further dampening growth. Corporate earnings have reflected the squeeze — forward profit estimates for CSI 300 firms are down 2.5% from earlier this year, while heavy competition has hit margins at companies like JD.com and Geely Auto.

Déjà Vu of 2015?

The rally also recalls the 2015 boom-bust, when a surge in leveraged trading drove shares skyward before collapsing. China’s margin debt now stands at 2.1 trillion yuan ($293B) — not far off the 2015 peak.

“The abundant liquidity and the revival of animal spirits remind us of the crazy times a decade ago,” said Hao Hong, CIO at Lotus Asset Management.

Policy Dilemma

Beijing faces a bind: more stimulus could inflate the market further, while staying cautious risks worsening the slowdown. So far, officials have favored measured support, avoiding the kind of massive stimulus seen in past downturns.

For now, investors keep piling in, especially into chipmakers and tech shares, but strategists warn that if sentiment breaks, the outflows could be just as fast as the inflows.

As Vantage Markets’ Hebe Chen put it: “China’s bull market is more of a mystery box than a conventional growth story. Once sentiment fades, investors will flee in no time.”

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

ETF Boom or Bubble? US Now Has More ETFs Than Stocks as Retail Piles In

Federal Reserve Explained: How It Shapes Stock Market and Economy

Jerome Powell signals Fed may cut rates soon even as inflation risks remain

EU Speeds Up Digital Euro Plans After US Stablecoin Law, Considers Ethereum and Solana