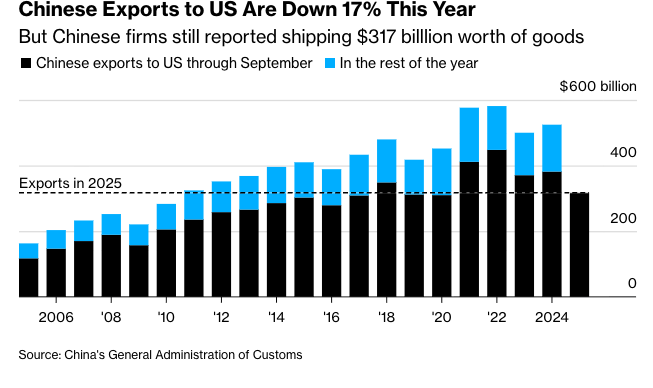

Six months into Donald Trump’s second-term trade offensive against China, with tariffs reaching as high as 55% on many imports, Chinese exports to the U.S. remain surprisingly robust — about $1 billion worth of goods are still shipped daily.

Key Facts

- China’s goods exports to the U.S. continue at roughly the $1 billion per-day pace, according to Bloomberg’s analysis of Chinese customs data.

- While exports to the U.S. are down about 17% this year, that decline is offset by the sheer volume — the flow remains close to pre-pandemic levels for selected goods.

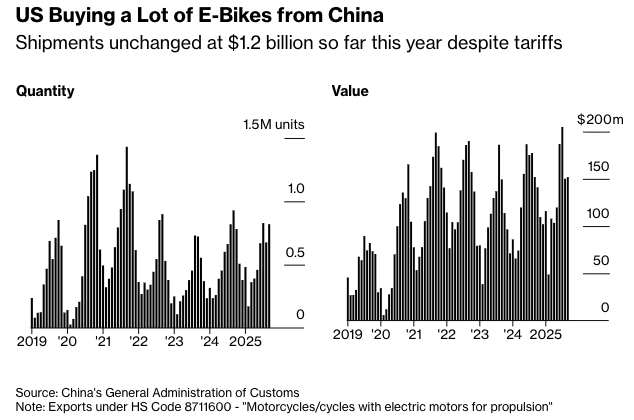

- Certain product categories, such as e-bikes and electronics, continue to post year-on-year growth in exports to the U.S., showing selective resilience.

- Analysts say this durability stems from China’s deeply integrated role in global supply chains — many U.S. companies remain reliant on Chinese-made inputs and finished goods.

What It Means

The data suggest that the U.S. tariff strategy may be less immediately effective than intended in curbing Chinese exports. Despite steep duties, the consistent flow of Chinese goods to the U.S. underlines how entrenched Chinese manufacturing and global supply-chain links are in the American economy.

For American policymakers, this raises questions:

- How much leverage the U.S. really has in forcing supply-chain shifts when dependent on Chinese production?

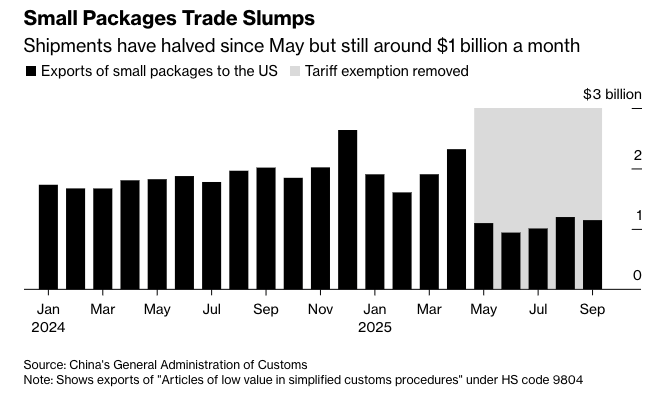

- Whether American importers are absorbing tariff costs, passing them onto consumers, or finding ways to circumvent duties.

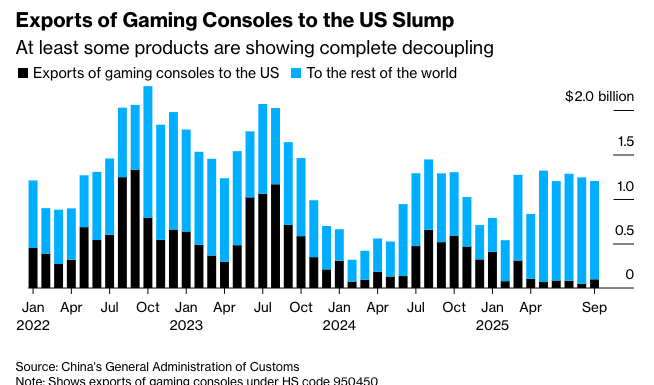

- If the trade war is driving structural shifts (like relocated production) or simply reshuffling flows without reducing total volumes materially.

For China, the resilience bolsters its position — offering Beijing strategic bargaining power even as trade tensions mount. As one economist noted: “China’s strong position in global supply chains gives it some bargaining power with U.S. importers in the near term.”

Risks & Watchpoints

- If China chooses to adjust supply or redirect exports away from the U.S., the current flow could suddenly drop — which would increase pressure on both sides.

- On the U.S. side, consumers and businesses could face higher input costs or disruptions if continued flow becomes constrained.

- The article also flags that while overall exports to the U.S. are down, China is ramping up shipments to other markets, such as Southeast Asia and Latin America — reinforcing its diversification strategy.

Six months into the renewed U.S.–China trade war, China’s exports to the U.S. are far from collapsing. The fact that around $1 billion in daily shipments continue despite tariffs of up to 55% highlights the complexity of decoupling from Chinese manufacturing — and suggests the trade battle may be protracted rather than quick.

Related: Trump Calls Upcoming Tariffs Case ‘The Most Important’ in Supreme Court History