At a tense summit in Beijing on Thursday, China and the European Union reached narrow agreements on climate cooperation and emergency rare earth exports, but made little to no progress on the most pressing issues dividing them: Russia’s war in Ukraine, electric vehicle tariffs, and deepening trade imbalances.

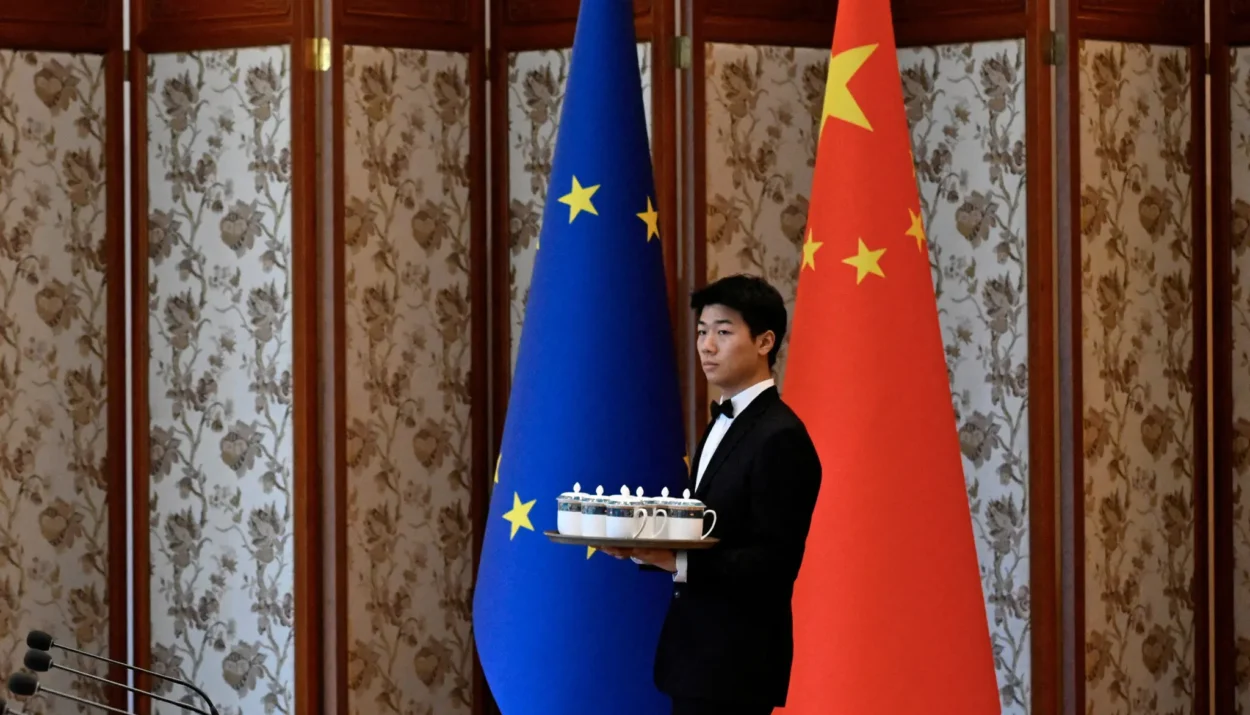

The meeting between President Xi Jinping and EU Commission President Ursula von der Leyen was billed as a last-minute effort to ease growing economic and geopolitical friction ahead of key August tariff deadlines set by the United States. But the event, largely held behind closed doors, highlighted the widening rift between Europe and China — with only a thin layer of common ground.

“In the fluid and turbulent international situation today, it is crucial that all countries, notably the major economies, maintain policy continuity and stability and step up efforts to address climate change,” the two sides said in a joint statement.

Climate & Rare Earths: Small Wins

Despite the broader tensions, China and the EU reaffirmed their commitment to the Paris climate agreement, which the US under President Trump has begun to exit. Both sides called for stronger global efforts to address environmental threats, marking the summit’s only clear area of consensus.

The EU also secured a procedural breakthrough on rare earth supplies — a new mechanism that allows for emergency shipments of critical materials to European factories on the brink of shutdown. However, the concession fell far short of European demands that China reverse its sweeping export controls, imposed in April.

“We all witnessed the cost and consequences of China’s coercion through export restrictions,” von der Leyen warned, highlighting Europe’s frustration that the shipments were just enough to keep plants open but not enough to build buffers.

China controls up to 99% of global refining capacity for some rare earth elements and has used its dominance to exert leverage over the West — including both the EU and the US — as broader trade negotiations drag on.

Trade Disputes: No Breakthrough

Despite growing alarm in Brussels over a $350 billion trade deficit with China and mounting complaints about state subsidies fueling Chinese overcapacity, the summit yielded no meaningful progress on structural trade reform.

“The subsidized production does not match domestic demand in China,” von der Leyen said. “All the capacity produced here goes to other markets.”

European leaders have recently imposed tariffs on Chinese electric vehicles, accusing Beijing of dumping cheap, government-backed EVs into the European market. China has demanded those tariffs be dropped and proposed a compromise similar to a 2013 solar panel deal — but EU leaders remain wary, citing how the last deal decimated Europe’s solar industry.

“Beijing wants Europe to repeat 2013,” one senior EU official said. “That’s not happening again.”

Ukraine: Total Stalemate

There was no movement on Ukraine, as China maintained its close alliance with Russia despite European appeals. Xi’s government has sharply increased purchases of Russian oil and gas, and has supplied trucks, drones, and key dual-use technologies to Moscow since the invasion.

Estonia’s former prime minister and now EU foreign minister, Kaja Kallas, took a firm line during the meetings. Having long warned about Russian expansionism, she reinforced the EU’s stance that China cannot expect closer ties with Europe while backing Putin’s war.

“As long as China continues to extend vital material and diplomatic support for Russia’s war in Ukraine, European leaders will resist any significant improvement in their ties with Beijing,” said former U.S. Ambassador to China Nicholas Burns.

Ticking Clock: Trump’s August Tariff Threats

The summit occurred under the shadow of looming U.S. trade deadlines, with Trump threatening a 30% baseline tariff on European goods starting August 1, and possible increases on Chinese exports after August 12. Both China and the EU are separately racing to reach last-minute deals with the US.

Treasury Secretary Scott Bessent is expected to meet Chinese officials in Stockholm on Monday and Tuesday for further negotiations.

China is pushing for reciprocal access to European markets, particularly for EVs and semiconductors, while the EU insists on stronger trade balance and IP protections before lowering barriers.

China’s frustration was clear in a recent Global Times editorial, which slammed Europe’s dual position on trade:

“Isn’t it contradictory for the European side to complain about China buying less while at the same time holding back and preventing sales?”

Outlook: Strategic Stalemate Continues

While Thursday’s summit prevented a total collapse in EU–China relations, it left nearly all core tensions unresolved. Leaders managed to paper over differences with shared language on climate and supply chains, but the broader standoff remains firmly in place.

With Trump’s tariffs approaching, Europe caught between Washington and Beijing, and Ukraine still a flashpoint, the path forward looks increasingly rocky — with trade and diplomacy now dictated more by deadlines than dialogue.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump’s Tariffs Are Hitting US Companies Hard — and Consumers Is Next

BYD Global EV Price War Reshapes Auto Markets, but at a Cost

Wall Street Is Stubbornly Bullish on Downtrodden Energy Stocks

As the Dollar Slides, the Euro Is Picking Up Speed

Indian Bank Stocks Surge as Earnings Beat Estimates

The 60/40 Portfolio Under the Microscope: 150 Years of Market Stress‑Testing