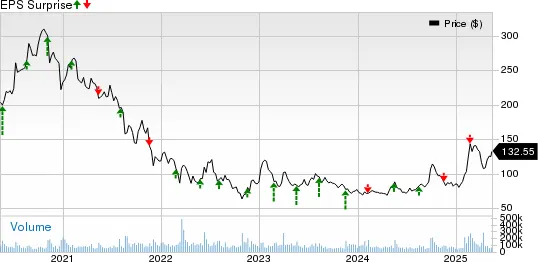

Alibaba Group Holding Ltd. (NYSE: BABA), once considered China’s answer to Amazon, is set to report Q4 FY2025 earnings on Thursday, May 15, 2025. Following years of regulatory headwinds, slowed domestic growth, and global trade concerns, investors are watching this report for signs of a turnaround — powered by AI, cloud, and international expansion.

Here’s everything you need to know.

Wall Street Expectations: What Analysts Forecast

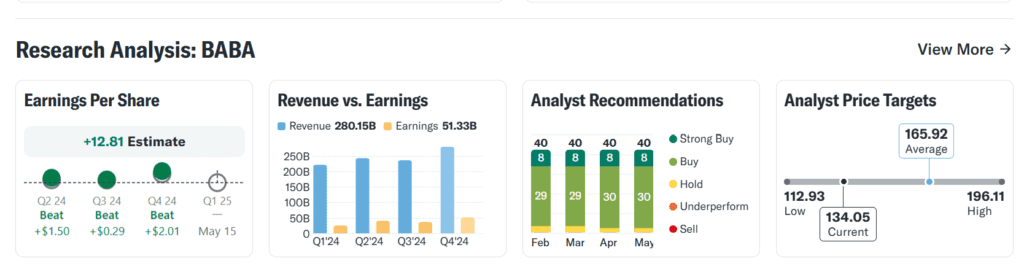

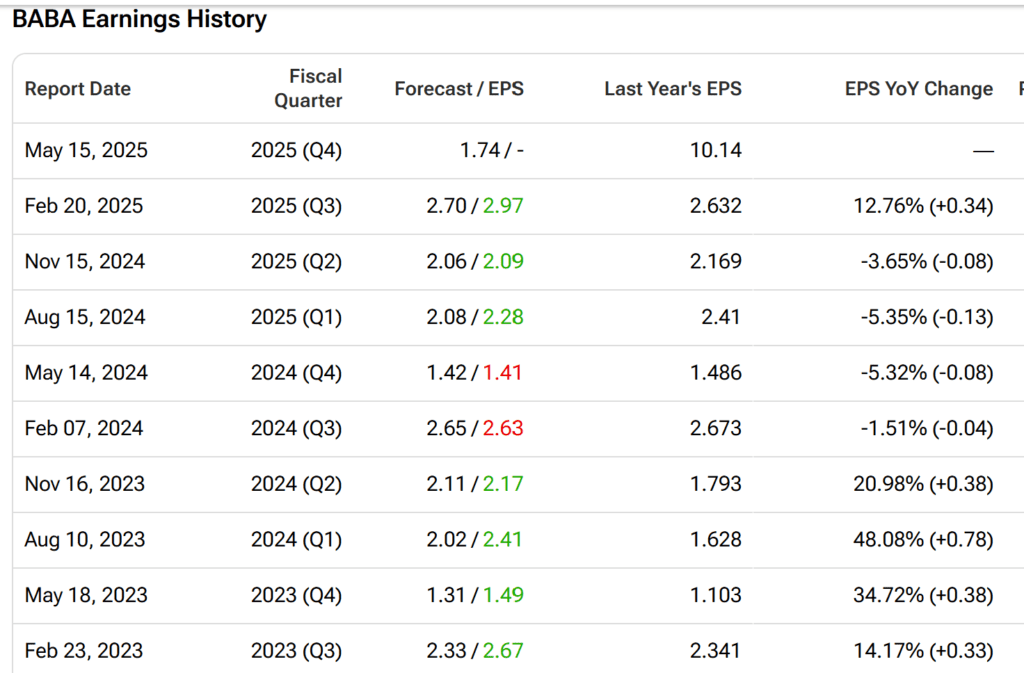

According to Barchart, Nasdaq, and AlphaStreet, analysts expect:

- Revenue: $31.2–32B USD

→ Up ~5–7% YoY, but flat QoQ - EPS (Adjusted): ~$1.45–1.50 USD

→ Up ~6–9% YoY, driven by margin improvements - Gross Margin: Expected to improve slightly, due to cost control and high-margin cloud & logistics

While these numbers reflect modest growth, analysts say Alibaba is beginning to stabilize — with more optimism around profitability than revenue acceleration.

Segment Breakdown: Where Growth Is Coming From

- Core Commerce (Taobao, Tmall): Still ~70% of total revenue, but domestic e-commerce growth remains muted.

- Macro softness in China and cautious consumer spending continue to pressure GMV.

- However, analysts expect a slight QoQ improvement due to Lunar New Year promotions and reduced discounting.

- Taobao app MAUs are expected to remain stable at ~900M, per Nasdaq and Yahoo.

2. International Commerce (AliExpress, Lazada, Trendyol): One of the fastest-growing segments, driven by Southeast Asia and European cross-border demand.

- Revenue expected to grow ~15–18% YoY , especially from Trendyol (Turkey) and Cainiao’s overseas services.

- The U.S. market remains tricky due to tariffs, but localized promotions helped offset some drag.

3. Alibaba Cloud: All eyes are on this division, especially after Alibaba scrapped its spin-off in 2024 due to U.S. chip export restrictions.

- Despite those concerns, revenue is expected to grow ~10–12% YoY, up from just 3% in Q3.

- Seeking Alpha reports increased demand for AI-driven compute, data analytics, and enterprise digitalization, particularly from Chinese banks and logistics firms.

- Profit margins in cloud are improving, thanks to operational scale and reduced capex.

4. Cainiao (Logistics & Smart Supply Chain): Poised to be Alibaba’s next big value unlock.

- Revenue is expected to rise ~20% YoY, per AlphaStreet and Nasdaq, driven by international fulfillment growth.

- Cainiao’s IPO plans in Hong Kong were postponed, but analysts still view it as a hidden asset with strong margin upside.

5. Digital Media & Entertainment (Youku, Alibaba Pictures): Still a minor contributor (~5% of revenue), but losses are narrowing.

- Youku has reduced cash burn via content consolidation, and viewership surged during Chinese holidays.

Geopolitical Context: U.S.–China Trade & Tariff Pressures

- New U.S. tariffs on Chinese goods (including tech-related categories) and the collapse of earlier decoupling optimism have weighed on Alibaba’s U.S. expansion strategy.

- Nasdaq reports some institutional investors have trimmed exposure to Chinese tech stocks, including BABA, amid rising geopolitical risk.

Still, domestic strength and diversification into ASEAN markets have helped buffer revenue exposure.

AI Investments & Strategic Bets

Alibaba has been investing heavily in its AI model “Tongyi Qianwen”, integrating it into:

- Alibaba Cloud services (for business intelligence and automation)

- Tmall/Taobao (for personalized product recommendations)

- DingTalk (workplace productivity)

Barchart and Yahoo Finance highlight that Alibaba is accelerating AI infrastructure, forming joint initiatives with top Chinese universities and chipmakers. While these efforts won’t spike short-term earnings, analysts believe they lay the groundwork for FY2026+ monetization.

Bullish Case

Valuation Reset

- Alibaba trades at just ~8x forward earnings and ~1.1x sales, per Yahoo Finance — far below historical levels and U.S. mega-cap tech peers.

- Seeking Alpha and Nasdaq both note upside potential if earnings stabilize and macro risk fades.

Cloud & Cainiao Margin Expansion: Alibaba Cloud expected to grow double digits, and Cainiao’s high-margin logistics business is gaining international contracts.

Cost Discipline & Profit Focus: Alibaba has been trimming unprofitable business units, restructuring into six independent business groups, and emphasizing profitability > GMV.

AI Flywheel Beginning to Turn: Integration of Tongyi Qianwen across all platforms could unlock productivity and personalisation benefits in 2025–26.

Bearish Case

China Macro Risk

- Consumer spending in China remains fragile, especially in real estate-sensitive provinces.

- Youth unemployment remains high; this impacts discretionary commerce spending.

US Trade & Regulatory Tensions: Biden’s May 2025 tariffs and further export controls on AI chips could impact Alibaba’s cloud strategy and cross-border expansion.

Execution Risk on Restructuring: Splitting into six units creates complexity. Investors remain concerned about management bandwidth and synergies across divisions.

Investor Sentiment Still Cautious: Despite value metrics, institutional ownership remains low. Nasdaq reported hedge funds like Bridgewater and Tiger Global trimmed BABA positions in Q1.

Prediction and Market Implications

- EPS Beat Likely: Cost controls and profit focus point to a solid bottom-line surprise.

- Revenue in Line: Modest growth expected, but any miss in cloud or commerce may rattle markets.

- Key Catalyst: Commentary on AI monetization, Cainiao IPO timing, and cloud rebound will guide stock movement.

Market reaction: Expect +6 to -8% swing based on guidance tone and macro commentary.

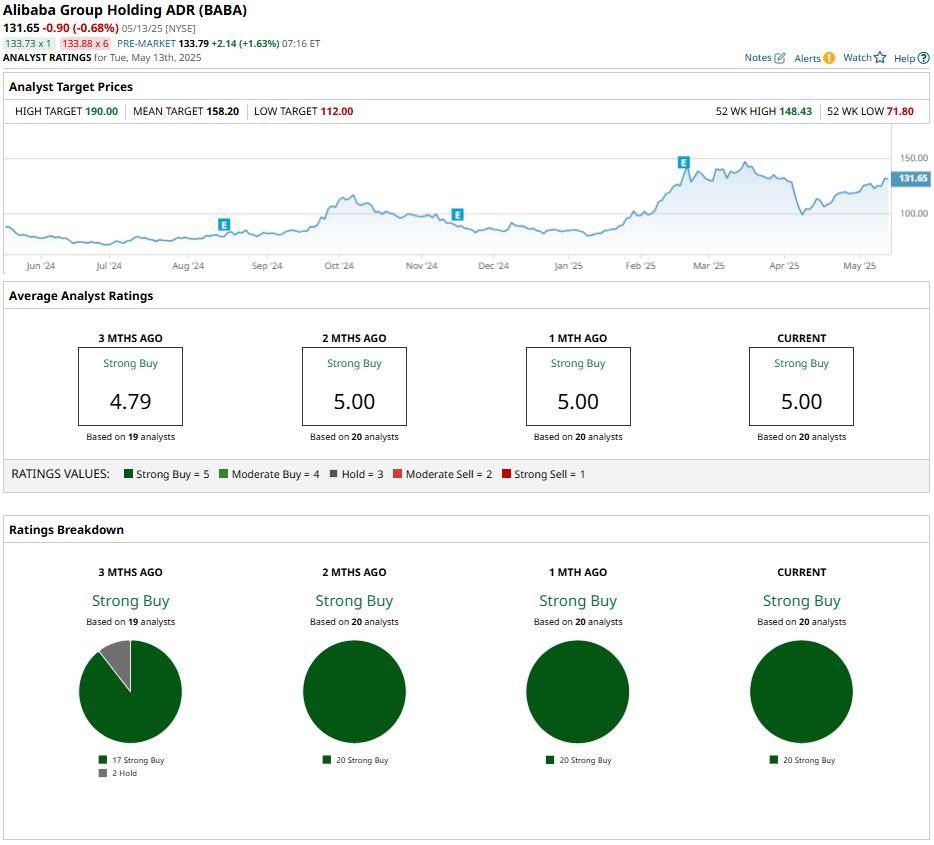

Valuation & Analyst Sentiment

- P/E: ~8.5x

- Price-to-Sales: ~1.1x

- Dividend: None (Alibaba reinvests cash)

- Buy Ratings: 26 out of 30 analysts (Yahoo Finance, Nasdaq)

- Avg. PT: $102 (vs ~$84 current) → ~21% upside

Final Takeaway

For long-term investors: Alibaba looks undervalued compared to U.S. tech giants, and if you believe in China’s economic recovery and AI/cloud monetization, it offers significant upside. However, geopolitical risk and structural complexity must be considered.

For traders: Earnings will likely show strong EPS, but price will move based on management tone around cloud, Cainiao, and macro guidance. Watch closely for commentary on U.S.-China headwinds.

For beginners: Alibaba is a leader in Chinese tech with businesses like Amazon + AWS + FedEx rolled into one. But investing in BABA also means exposure to China’s politics, trade policy, and currency swings. Start small and stay informed.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Qatar Buys 160 Boeing Jets as Trump Accepts $400M Gift Jet

Elon Musk, Robotaxis, and Starlink: Inside Multi-Billion Dollar US–Saudi Tech Power Play

Nvidia’s Partnership With Saudi Arabia Opens a New Frontier in Global AI

Trump Secures $600 Billion Saudi Investment in US Tech, Energy, and AI

US Drug Price Revolution Begins: Trump Targets 30–80% Cuts

US and China announce deal to cut reciprocal tariffs for 90 days

Zelensky Tells Putin to Show Up in Turkey for Talks After Trump Pushes for Meeting