Airbnb (NASDAQ: ABNB) is set to report its Q1 2025 earnings on Thursday, May 2, after market close, and both Wall Street and travellers are watching closely. After an explosive post-pandemic recovery, Airbnb now faces a world of cooling travel demand, tough year-over-year comps, foreign exchange (FX) headwinds, and rising competition — all while trying to prove it can deliver sustainable profits.

Here’s a deep dive into what to expect, what’s driving results, where the risks lie, and how analysts are positioned.

Expected Q1 2025 Results

What’s at stake: Analysts expect Airbnb to post moderate revenue and booking growth, with investors focused on margins and forward guidance.

- Revenue estimate: ~$2.1B (Yahoo Finance, MarketBeat, Nasdaq)

- EPS estimate: $0.41 (Yahoo Finance, MarketBeat, Nasdaq)

- Previous Year Revenue: $1.82B

- Previous Year EPS: $0.18

Why it matters: Airbnb has moved from hyper-growth to profitability — investors now want to see margin stability and healthy demand as travel trends normalize.

Key Focus Areas

Let’s break down what will drive the stock’s post-earnings reaction.

✅ Nights and Experiences Booked

- Bookings are expected to grow high single to low double digits YoY (~11–13%), with demand cooling vs. post-pandemic peaks (Yahoo Finance, MSN, Nasdaq).

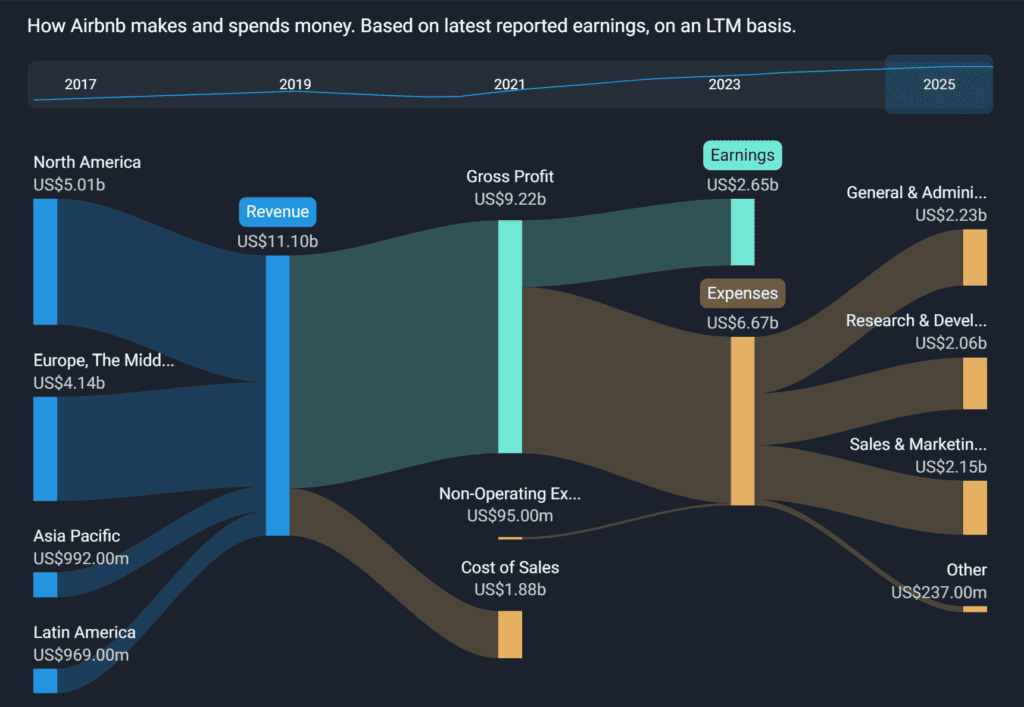

- Analysts are watching growth in North America and Europe, which have matured, vs. Asia-Pacific and Latin America, which offer faster expansion.

Why it matters: Booking growth is Airbnb’s core volume metric — a slowdown here will pressure the stock.

✅ Average Daily Rate (ADR)

- ADRs are under moderate downward pressure as customers shift to cheaper stays and international FX headwinds bite (GuruFocus, AInvest).

- Airbnb has acknowledged a shift toward more “affordable” listings.

Why it matters:

Even if bookings rise, falling ADRs can drag total revenue growth.

✅ Revenue and Profitability

- Revenue expected ~$2.1B → ~15% YoY growth

- Operating margins expected around 20% — a key focus for bulls

Why it matters: Airbnb has become one of the few profitable gig-economy companies — maintaining that while investing in growth will be critical.

✅ FX and Macro Pressures

- Foreign exchange is a meaningful drag as the dollar strengthens against the euro and other currencies (AInvest, GuruFocus).

- Macro uncertainty in Europe and APAC also weighs on demand.

Why it matters: Investors want to see Airbnb navigating global risks while protecting profitability.

✅ Strategic Investments

- Airbnb is increasing spending on product upgrades, AI tools, and host experience improvements.

- Expansion into long-term stays and new verticals remains a key part of the growth story.

Why it matters: The Street wants to see a balance between investing for growth and maintaining profitability.

Past Earnings Performance

| Quarter | EPS Estimate | EPS Actual | Price Change % Next Day |

|---|---|---|---|

| Q4 2024 | $0.29 | $0.34 | +4.5% |

| Q3 2024 | $2.11 | $2.25 | +7.2% |

| Q2 2024 | $0.98 | $1.02 | +5.3% |

| Q1 2024 | $0.25 | $0.18 | -10.8% |

Key takeaway: Strong beats have driven double-digit gains, but last year’s Q1 miss shows the stock is highly sensitive to forward guidance.

Performance and Sentiment Snapshot

- Current price (Apr 29): ~$155

- 52-week return: +82% (!!)

- Market cap: ~$100B

- P/E ratio: ~40x forward

- Wall Street sentiment:

- Consensus: Moderate Buy (MarketBeat, Yahoo Finance)

- Average 1-year price target: ~$170–180 → ~10–15% upside

- Notable buyers: Cathie Wood’s ARK Invest added ABNB ahead of earnings (Globe and Mail)

Analyst Ratings and Opinions

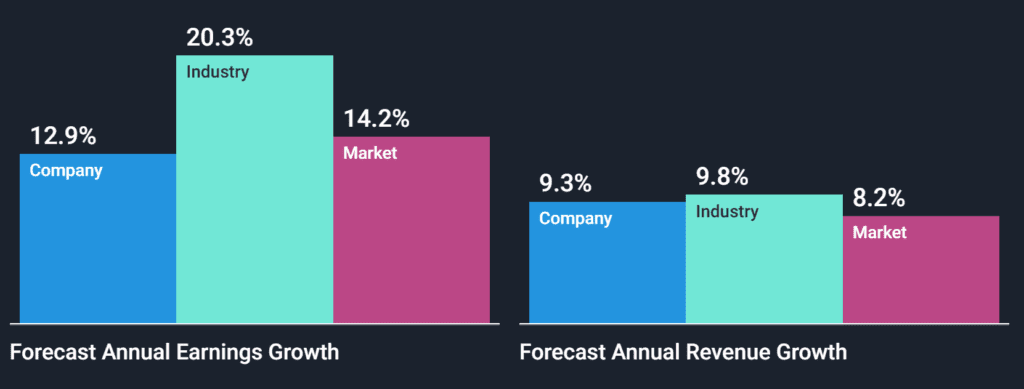

- Analysts are generally bullish on ABNB, citing:

- Strong brand loyalty

- Attractive margins vs. hotel peers

- Long runway for international growth

- Key concerns:

- Slowing growth rates

- FX drag

- Rising competition (Vrbo, Booking, hotels)

Challenges and Headwinds

- Travel normalization: Post-pandemic tailwinds are fading

- FX headwinds: Strong USD impacting revenue growth

- ADR compression: Shift to lower-cost stays

- Host churn + supply issues: Maintaining host satisfaction and supply density is crucial

- Competition: Booking.com, Vrbo, Marriott Homes & Villas ramping up

Bullish Drivers

✅ Strong bookings growth despite normalization: Expected ~11–13% YoY bookings growth in Q1, even as post-pandemic tailwinds fade (Yahoo Finance, Nasdaq). Strength especially in North America and APAC.

✅ High-margin, asset-light business model

- Airbnb’s platform model avoids hotel-level costs — operating margins ~20% expected (AInvest, Yahoo Finance).

- Profitable unlike many other gig-economy peers.

✅ Expansion into new categories: Growth in long-term stays, corporate travel, and Experiences diversifies revenue.

✅ Strategic reinvestment in tech and AI: Spending on AI-powered tools and host improvements is seen as a smart long-term play (AInvest).

✅ Strong brand and user loyalty: Airbnb has become a default brand for global travelers, especially among younger demographics.

✅ Cathie Wood’s ARK Invest buying shares: High-profile investors like ARK have added to positions ahead of earnings (Globe and Mail) — signaling institutional confidence.

Bearish Case (Why bears are cautious)

❌ Moderating growth rates:

- Booking growth slowing compared to post-pandemic boom; tough YoY comps.

- Revenue expected to grow ~15% — solid, but no longer hypergrowth (Yahoo Finance, GuruFocus).

❌ Pressure on average daily rates (ADR): Customers shifting to cheaper listings, plus FX drag → ADR softening (GuruFocus, AInvest).

❌ Macro and FX headwinds

- Strong U.S. dollar hurting international revenues.

- Economic uncertainty in Europe and APAC weighing on demand.

❌ Rising competition: Vrbo, Booking.com, and hotels are stepping up discounting and advertising.

❌ Regulatory risks: Ongoing challenges in cities tightening short-term rental rules.

❌ High valuation: Trading at ~40x forward earnings — leaves little room for disappointment.

Earnings Surprise History

- Last 4 quarters: 3 beats, 1 miss

- Average post-earnings move: ~6–10%

- Current setup: Analysts cautiously optimistic, but forward guidance on summer demand will be key

Why it matters: Q1 is historically the slowest quarter — all eyes will be on Q2 and summer travel guidance.

Conclusion

Airbnb’s Q1 2025 earnings will show wheth

er the company can balance growth, profitability, and global expansion.

With booking growth moderating, ADR pressure, and FX drag, the Street wants evidence that Airbnb can defend margins and maintain leadership. But with a beloved brand, strong tech investments, and new growth levers, Airbnb remains one of the most compelling plays in the travel sector.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

What Analysts Think of MicroStrategy Stock Ahead of Earnings?

What Analysts Think of BigBear.ai Stock Ahead of Earnings?

What Analysts Think of Amazon Stock Ahead of Earnings?

Apple Q2 2025 Earnings Preview and Prediction: What to Expect

Eli Lilly Q1 2025 Earnings Preview and Prediction: What to Expect

UK-US trade talks ‘moving in a very positive way’, says White House

Trump Eases Auto Tariffs to Avoid Industry Meltdown

Trump Administration Lays Out Roadmap to Streamline Tariff Talks

Trump Pushes Plan to Replace Income Taxes with Tariffs: “A Bonanza for America!”

California Overtakes Japan to Become Fourth Largest Economy in World

“Made in USA”? It’s More Complicated Than You Think

Conflicting US-China talks statements add to global trade confusion