After another record‑setting session on Wall Street, global equities are trying to keep the party going. Solid US macro prints, blockbuster chip earnings and a softer dollar powered Thursday’s rally, but politics in Japan and a light data calendar inject a hint of caution as we head into the weekend. Here’s what happened, what’s moving markets now, and what to watch over the next few hours.

Yesterday in context: why the records kept coming

The S&P 500 closed above 6,300 for the first time and the Nasdaq notched yet another all‑time high. Three forces drove the advance:

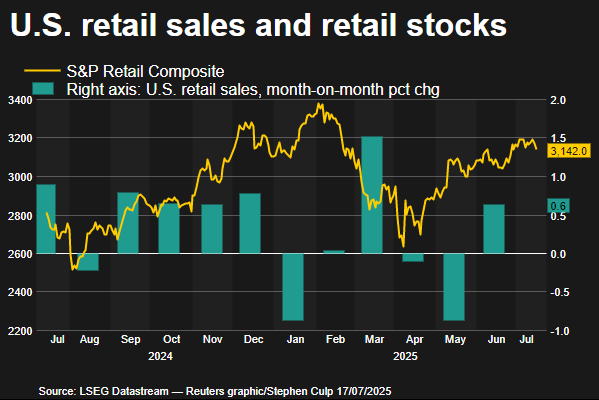

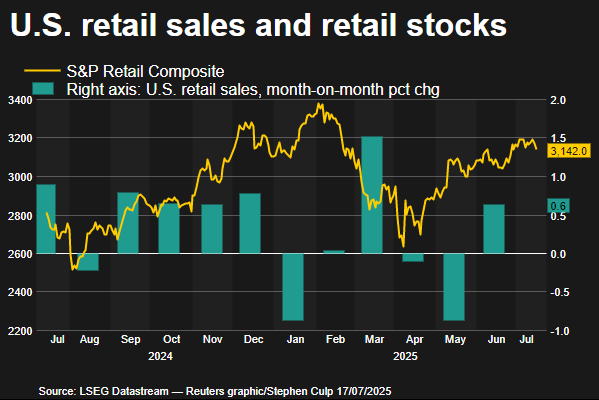

- Macro resilience – June retail sales surprised to the upside and jobless claims fell for a fifth straight week, reinforcing the “soft‑landing‑plus‑AI” narrative. (June’s jump in US retail sales beat economists’ forecasts and showed Americans are opening their wallets despite worsening sentiment. Analysts cautioned, though, that the sales figures aren’t adjusted for inflation, and some of the rebound may reflect rising prices rather than increased consumer demand. June’s inflation report showed notable price increases in tariff-exposed categories like furnishings, appliances, toys, and sporting goods. Still, Thursday’s numbers offer a moment of relief amid swelling concern over consumer health: Sales at restaurants and bars — often seen as a barometer for discretionary spending, and usually the first to fall when wallets tighten — also rose in June).

- Earnings support – TSMC’s record profit and upbeat outlook sparked a broad semiconductor rally.

- Rates relief – Treasury yields edged lower intraday on dovish Fed commentary, keeping equity valuations supported.

After the bell, Netflix beat on revenue, EPS and cash flow but guided to a lower full‑year FCF range. The stock eased ~1 % in late trade as investors debated whether margin guidance (29.5 % for FY‑25) justifies the recent all‑time high.

More about: Netflix Tops Q2 Estimates but Shares Slip After Hours: Here is Why

Nine of 11 S&P sectors finished in the green, led by financials, while health‑care names lagged. After the bell, Netflix delivered a clean beat on revenue, profit and free cash flow, but guided FCF below Wall Street’s lofty hopes; the stock slipped about 1 % in late trade.

Setting the tone this morning

Overnight, Asian markets mostly tracked the U.S. gains, but Tokyo wobbled as investors weighed Sunday’s upper‑house election, which could threaten Prime Minister Ishiba’s coalition majority. European futures are firm, and U.S. index futures are pointing slightly higher, suggesting the path of least resistance is still up—provided rates stay contained and no negative surprises hit the tape.

Global market snapshot

| Region / Asset | Level* | Δ % (day) | Context |

|---|---|---|---|

| S&P 500 futs | 6,310 | +0.2 % | Hovering near Thursday’s record cash close |

| Nasdaq 100 futs | 23,125 | +0.2 % | Tech bid intact on AI optimism |

| Euro Stoxx 50 futs | 5,170 | +0.3 % | Set for another positive open |

| MSCI Asia ex‑JP | 662 | +0.4 % | Highest since late 2021 |

| Nikkei 225 | 41,365 | –0.3 % | Election jitters offset weaker yen |

| Dollar Index (DXY) | 98.30 | –0.1 % | Pullback from three‑week high |

| 10‑yr UST | 4.47 % | –2 bp | Yields ease after Waller’s dovish tone |

| Gold | $3,335 /oz | +0.2 % | Firmer with the softer dollar |

| Brent crude | $68.95 | +0.1 % | Range‑bound near $69 |

Bitcoin is holding just above $120 K, stabilizing after its mid‑week dip as traders weigh the GENIUS stablecoin bill and a softer dollar backdrop.

Key themes heading into the U.S. session

Fed expectations

Governor Christopher Waller reiterated he’d back a July cut, yet futures see virtually no chance. September remains a coin flip (~60 %). Today’s U.S. data—housing starts and University of Michigan sentiment—will either confirm or dent the “resilient consumer” picture that boosted stocks this week.

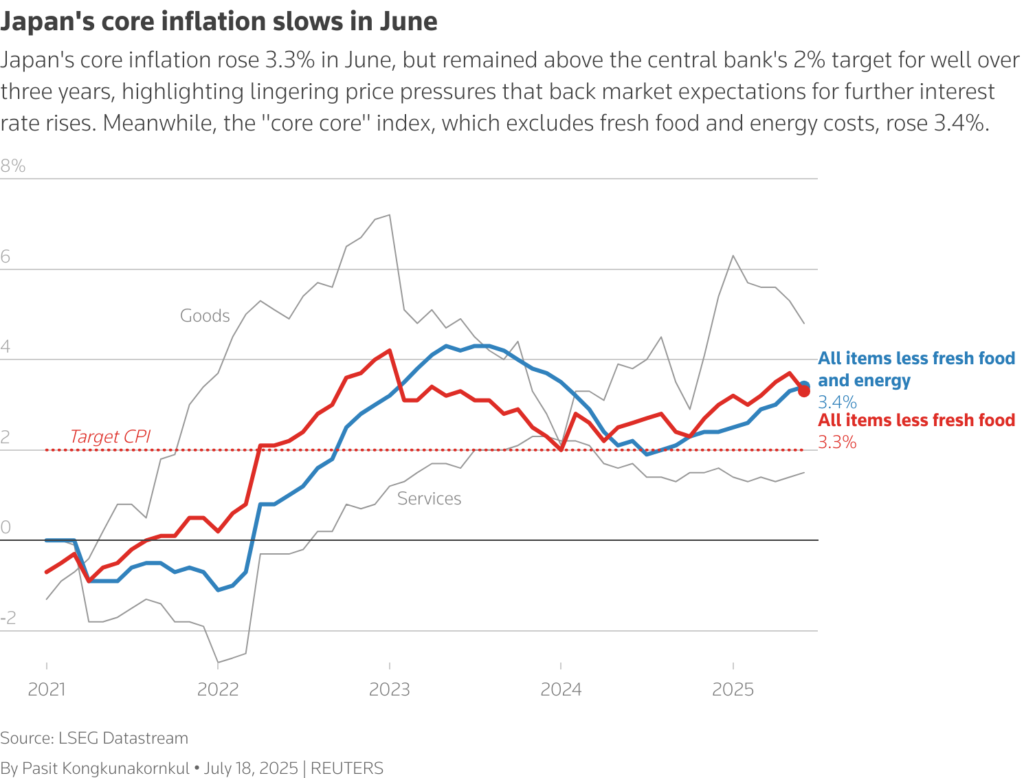

Japan’s weekend vote

Sunday’s upper‑house election could threaten PM Ishiba’s coalition majority. A weaker showing may complicate fiscal plans and yen policy; risk‑off flows already pushed USD/JPY to 148.45, near a two‑month low for the yen.

US data pulse

- 08:30 ET Building Permits & Housing Starts (June)

- 10:00 ET Michigan Consumer Sentiment & Expectations (July prelim)

- 11:30 ET Atlanta Fed GDPNow update

Surprisingly strong retail sales and falling claims lifted growth estimates this week; the GDPNow tracker sits above 2 % for Q3—today’s revision will test that optimism.

Pre‑market earnings

3M ($MMM), American Express ($AXP), SLB ($SLB), Charles Schwab ($SCHW) and Ally Financial ($ALLY) report before the bell. Watch AmEx for high‑end consumer trends and Schwab for rate‑sensitive net‑interest income.

Sentiment gauge

The CNN Fear & Greed Index remains in “Extreme Greed” territory; call‑volume skew and tight IG credit spreads underline confidence, but positioning is extended, and any upside CPI or tariff shock could spark a late‑July shake‑out.

Market sentiment check

Greed gauges remain elevated, call‑skew is stretched and IG credit spreads are at YTD tights. Bulls argue the tape still has room as earnings beat rates drift sideways; bears note any upside inflation jolt or negative trade headline could trigger a quick fade from these lofty levels.

What to look for at the bell

Futures suggest a mild follow‑through to Thursday’s gains. If 10‑year yields stay below 4.50 %, another push toward S&P 6,350 is plausible. Watch AmEx guidance for high‑income spending clues and Schwab’s deposit trends for signs of funding pressure. On the macro front, any wobble in Michigan sentiment could briefly unsettle the tape, but a solid Atlanta Fed GDPNow print would reinforce the growth story investors are betting on.

Risk appetite remains strong, powered by sturdy U.S. data and AI earnings tailwinds. Friday’s light calendar means price action will hinge on earnings headlines and bond‑market tone, while Japan’s weekend election looms as the next potential curveball.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump To Open 401k Market To Crypto, Gold, And Private Equity

93.5 % Battery Material Tariff by US: 5 Stocks Poised to Benefit Most From It

How Nvidia Jensen Huang Persuaded Trump to Sell AI Chips to China

Stocks Inch Up as Trump Softens Tariff Talk; CPI and Bank Earnings Ahead

JPMorgan Targets KOSPI 5,000; Short Bets Hit Record

Tariff Shock, or Just a Ripple? June CPI Faces Market That No Longer Flinches

Week Ahead (July 14 – 18): Inflation Check, Big Bank Earnings, Tech Titans

Hegseth Orders Every US Squad Armed by 2026: Defense Stocks Up