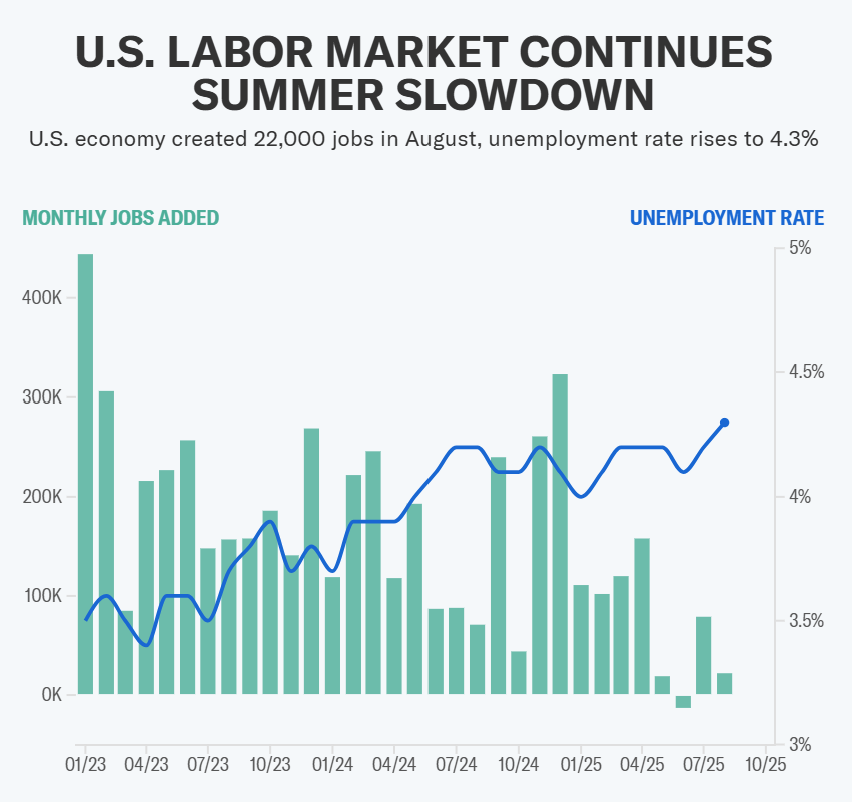

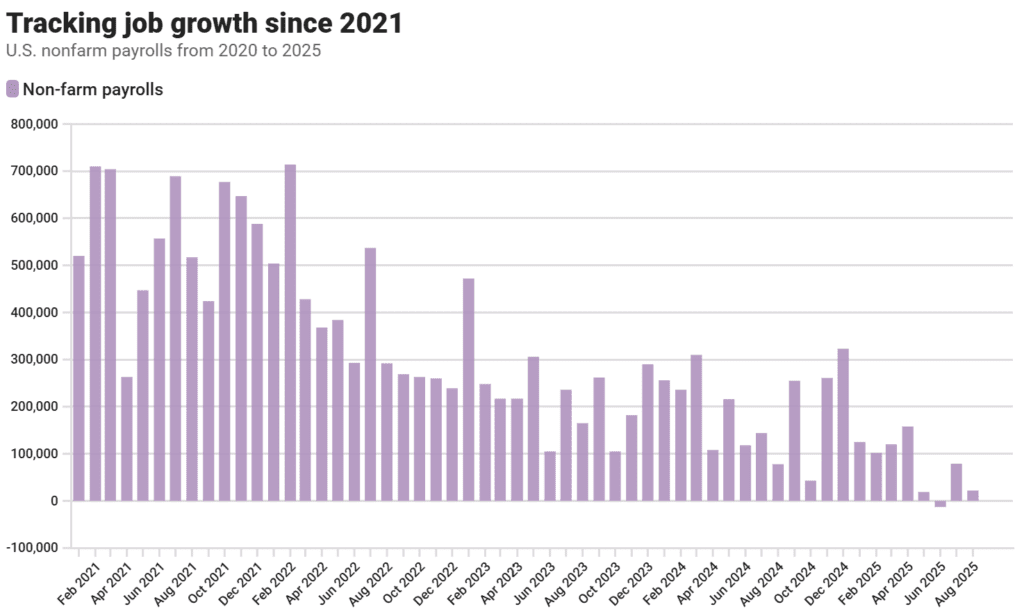

The August nonfarm payrolls report showed the US economy added just 22,000 jobs — far below economists’ forecast of 75,000. Even worse, revisions revealed that June actually lost 13,000 jobs (the first monthly decline since 2020) and July was modestly better at 79,000. Taken together, the past three months show an average of under 30,000 jobs created per month, a dramatic slowdown compared to earlier in the year.

The unemployment rate rose to 4.3%, up from 4.2% in July, matching expectations but marking the highest level in nearly four years. Meanwhile, wage growth held steady at 0.3% month-on-month and 3.7% year-on-year, in line with forecasts.

This confirms that while wages aren’t spiraling, hiring momentum has cooled sharply. Key sectors told the story:

- Education & health services: +46,000 jobs

- Durable goods manufacturing: –19,000

- Business services: –17,000

- Government: –16,000

The manufacturing sector overall lost 12,000 jobs, while healthcare showed softer-than-usual growth.

Market Reaction: Traders Bet on Fed Relief

The immediate reaction was classic “bad news is good news.” Markets saw the weak jobs print as giving the Federal Reserve cover to start cutting interest rates at the September 17 FOMC meeting.

- Stocks: The S&P 500 hit a fresh intraday record before giving back gains to finish flat. The Nasdaq rose 0.2%, helped by tech, while the Dow slipped 0.1%. For the week, the S&P was still up 1%, the Nasdaq 1.8%, and the Dow 0.4%. Broadcom’s blowout earnings (+10%) helped buoy sentiment.

- Bonds: Yields dropped across the curve. The 10-year Treasury fell to 4.07%, its lowest since April, while the 30-year dipped under 4.8% after brushing 5% earlier this week.

- Currencies: The dollar weakened modestly, especially against the euro and pound, as rate-cut bets firmed.

- Commodities: Gold held near record highs at $3,550, while oil eased to $67 a barrel.

Traders using the CME FedWatch tool priced in a 100% chance of a September rate cut:

- 25 bps cut: ~84% probability

- 50 bps cut: ~16% probability (up from 0% just a day earlier)

What It Means for the Fed

The report puts the Fed in a tough but clearer position. Chair Jerome Powell recently said the “balance of risks is shifting” toward easing policy, and this jobs data reinforces that message.

- The Fed doesn’t want to risk a recession by holding rates too high while hiring slows.

- At the same time, tariffs are still fueling sticky inflation, complicating how aggressive policymakers can be.

Most Fed officials lean toward a quarter-point cut in September, though some, like Governor Chris Waller, have said they’d consider a half-point cut if data worsens. The weak payrolls number makes that debate more live than before.

The White House is also applying pressure: Trump and his Labor Secretary openly criticized Powell for “waiting too long” to cut, arguing that tariffs and business investment need monetary relief.

The Bigger Picture

This marks a pivotal moment for US markets:

- The labor market is no longer bulletproof. Job growth is slowing sharply, revisions are ugly, and the unemployment rate is climbing.

- The Fed is cornered. A September rate cut now looks certain, but the size and pace of future cuts will shape the market outlook for 2025.

- Stocks are caught between hope and fear. Rate relief supports valuations, but weak hiring raises questions about the underlying strength of the economy.

The August nonfarm payrolls report showed the US economy added just 22,000 jobs — far below economists’ forecast of 75,000. Even worse, revisions revealed that June actually lost 13,000 jobs (the first monthly decline since 2020) and July was modestly better at 79,000. Taken together, the past three months show an average of under 30,000 jobs created per month, a dramatic slowdown compared to earlier in the year.

The unemployment rate rose to 4.3%, up from 4.2% in July, matching expectations but marking the highest level in nearly four years. Meanwhile, wage growth held steady at 0.3% month-on-month and 3.7% year-on-year, in line with forecasts.

This confirms that while wages aren’t spiraling, hiring momentum has cooled sharply. Key sectors told the story:

- Education & health services: +46,000 jobs

- Durable goods manufacturing: –19,000

- Business services: –17,000

- Government: –16,000

The manufacturing sector overall lost 12,000 jobs, while healthcare showed softer-than-usual growth.

Market Reaction: Traders Bet on Fed Relief

The immediate reaction was classic “bad news is good news.” Markets saw the weak jobs print as giving the Federal Reserve cover to start cutting interest rates at the September 17 FOMC meeting.

- Stocks: The S&P 500 hit a fresh intraday record before giving back gains to finish flat. The Nasdaq rose 0.2%, helped by tech, while the Dow slipped 0.1%. For the week, the S&P was still up 1%, the Nasdaq 1.8%, and the Dow 0.4%. Broadcom’s blowout earnings (+10%) helped buoy sentiment.

- Bonds: Yields dropped across the curve. The 10-year Treasury fell to 4.07%, its lowest since April, while the 30-year dipped under 4.8% after brushing 5% earlier this week.

- Currencies: The dollar weakened modestly, especially against the euro and pound, as rate-cut bets firmed.

- Commodities: Gold held near record highs at $3,550, while oil eased to $67 a barrel.

Traders using the CME FedWatch tool priced in a 100% chance of a September rate cut:

- 25 bps cut: ~84% probability

- 50 bps cut: ~16% probability (up from 0% just a day earlier)

What It Means for the Fed

The report puts the Fed in a tough but clearer position. Chair Jerome Powell recently said the “balance of risks is shifting” toward easing policy, and this jobs data reinforces that message.

- The Fed doesn’t want to risk a recession by holding rates too high while hiring slows.

- At the same time, tariffs are still fueling sticky inflation, complicating how aggressive policymakers can be.

Most Fed officials lean toward a quarter-point cut in September, though some, like Governor Chris Waller, have said they’d consider a half-point cut if data worsens. The weak payrolls number makes that debate more live than before.

The White House is also applying pressure: Trump and his Labor Secretary openly criticized Powell for “waiting too long” to cut, arguing that tariffs and business investment need monetary relief.

The Bigger Picture

This marks a pivotal moment for US markets:

- The labor market is no longer bulletproof. Job growth is slowing sharply, revisions are ugly, and the unemployment rate is climbing.

- The Fed is cornered. A September rate cut now looks certain, but the size and pace of future cuts will shape the market outlook for 2025.

- Stocks are caught between hope and fear. Rate relief supports valuations, but weak hiring raises questions about the underlying strength of the economy.

For now, the market prefers to cheer lower rates rather than panic about the risk of a recession. But as one strategist put it: “Bad news is good news, until it’s just bad news.”

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.