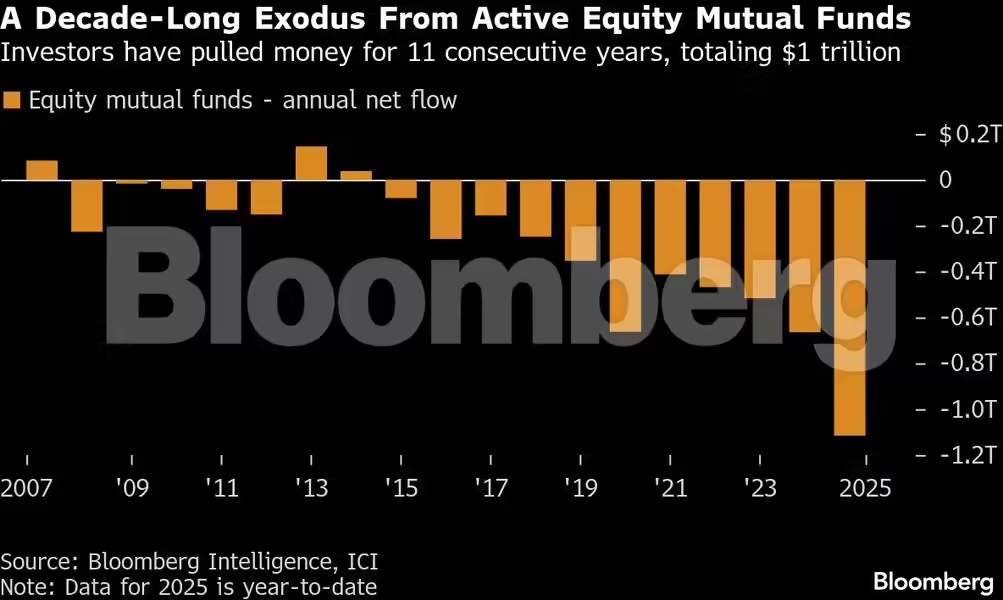

Investors pulled roughly $1 trillion from actively managed stock funds in 2025 as a handful of mega-cap tech companies dominated market returns making it harder for fund managers to outperform benchmarks and boosting passive investing.

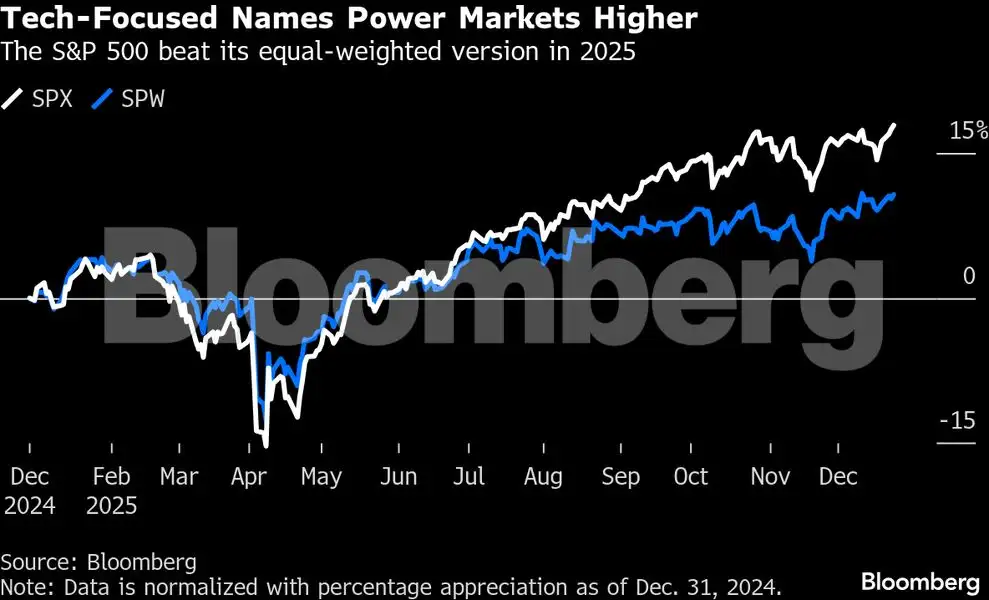

As the S&P 500 climbed to record territory late in the year, markets revealed a stark reality for active equity managers: most gains came from a tiny group of stocks, especially large U.S. tech names. That trend squeezed diversified stock pickers who struggled to beat broad indexes without heavy exposure to those few winners.

Active Management Loses Its Edge

For many investors, stock picking, the strategy of choosing individual stocks to outperform the market — simply didn’t work out in 2025. Even though the overall market posted strong gains, active equity funds saw about $1 trillion in outflows over the year, according to data compiled by Bloomberg Intelligence and the Investment Company Institute. In contrast, passive index funds and ETFs attracted more than $600 billion in new money as investors shifted to strategies that track major benchmarks.

This marks the 11th consecutive year of net outflows from actively managed funds, and by some measures, the steepest of the cycle. Managers who deviated from benchmark-heavy stocks often underperformed, highlighting the challenge of beating index returns in a market where tech leaders carried most of the gains.

Narrow Market Leadership

A small set of tech megacaps contributed a large share of the S&P 500’s gains in 2025. When only a handful of stocks are driving the market, traditional active managers face a tough choice: either overweight those same names and risk losing their distinct strategy, or underweight them and fall behind the benchmark.

In fact, 73% of equity funds lagged their benchmarks this year, one of the highest proportions in nearly two decades of data. That makes the case for passive investing stronger, especially for plain exposure to the U.S. market.

Where Some Active Strategies Still Worked

Not all active strategies struggled. A few more diversified or thematic portfolios outperformed by stepping outside the narrow U.S. large-cap tech trend. For example, certain international small-cap value funds delivered strong returns by leaning into financials, industrials, and materials, sectors that weren’t leading the U.S. index but offered broader diversification.

Some fund managers also found success by sticking to specific themes or sectors, though doing so required conviction and tolerance for volatility.

What This Means for Investors

The big takeaway for investors is clear: index-heavy passive strategies gained popularity as active managers struggled to justify the extra cost of stock picking in such a concentrated market. While active management isn’t dead, its recent performance underscores the difficulty of outperforming in markets where returns cluster around a small number of dominant stocks.

Looking ahead, some market watchers believe active managers can still add value through global diversification and sector rotation, but investors may increasingly weigh that potential against the lower fees and broad exposure offered by passive funds.

2025 was a tough year for stock pickers. With a few giants dominating returns, investors shifted billions toward passive funds that mirror market performance rather than rely on individual stock selection. The trend highlights how market structure and concentrated gains can reshape investment flows and strategy choices.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: How Big Tech Created the 2025 AI Boom on Debt

What’s Ahead for Stocks and Gold in 2026? What Markets and Experts Are Watching

Stocks Look Bullish Entering 2026 — But What Could Go Wrong?

FOMO vs. Bubble Angst Signals More Stock Volatility in 2026

Gold Breaks $4,400 as Silver, Copper and Platinum Hit Record Highs: What Comes Next

Markets Enter Final Stretch of 2025 With Santa Rally Hopes: What to watch

Trade, Tariffs, and Treasuries: The Hidden Cost of Trump’s Protectionism

Want to Know Where the Market Is Going? Don’t Trust This, or Any, Forecast.