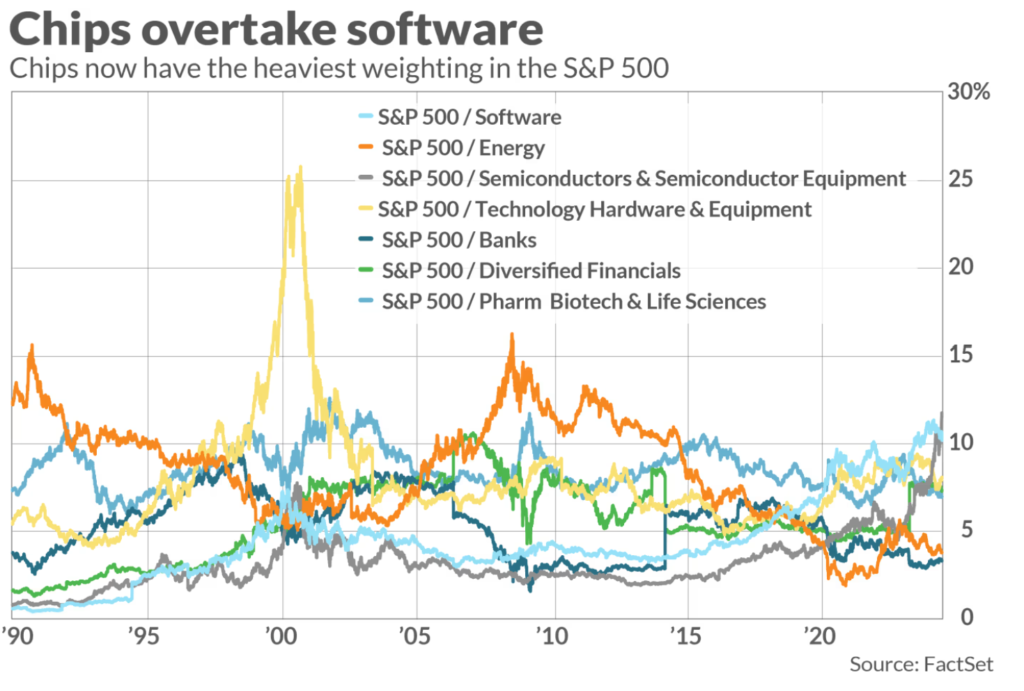

Chip stocks now outweigh software stocks in the S&P 500 and have the largest overall sector weighting.

Chip stocks have become the largest weighting in the S&P 500, surpassing the software sector. This shift highlights Wall Street’s optimism about the semiconductor sector’s potential financial gains from artificial intelligence (AI) and concerns over budget pressures in the software industry.

Strategist Todd Sohn noted that chip stocks now hold an 11% weight in the S&P 500, a significant rise from 2% in early 2014. Meanwhile, software stocks are struggling, with Mizuho analyst Jordan Klein describing the sector as “uninvestable” due to the macroeconomic climate causing delays and cautious spending among customers.

Salesforce exemplifies these struggles, recently lowering its forecast and discussing deal delays and budget scrutiny. Other software companies like MongoDB, UiPath, and Nutanix have also issued cautious signals.

The software sector’s ETF is down 4% this year, while the PHLX Semiconductor Index has surged 23% in 2024, driven by Nvidia’s financial growth and AI potential. LPL Financial’s Jeff Buchbinder warns that high valuations across tech could pose risks, despite the promising investments in AI.

In summary, the chip sector’s rise reflects a strategic shift among investors, prioritizing semiconductors over software amidst growing AI opportunities.