Stocks are entering a critical week with Wall Street’s attention split between Nvidia earnings, the Federal Reserve’s policy signals, and fresh inflation data. With indexes near record highs and AI enthusiasm still a dominant driver, investors face a packed calendar that could set the tone for the rest of the summer rally.

Powell Opens the Door to Rate Cuts

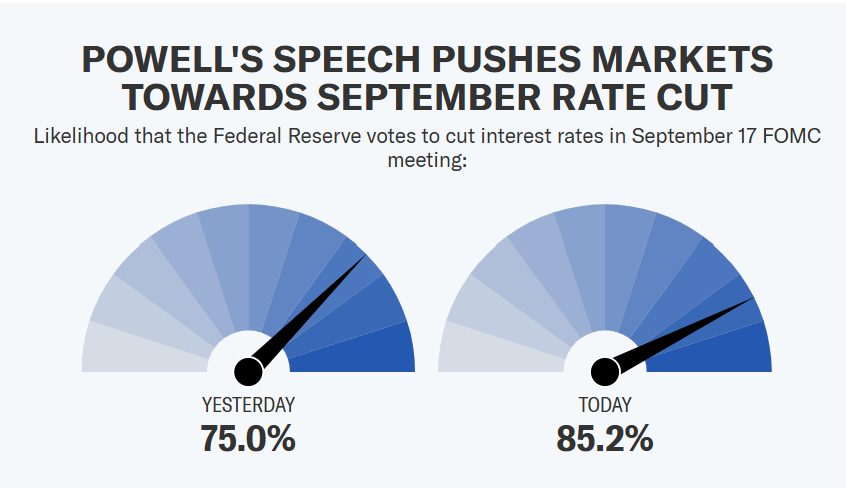

Markets ended last week on a strong note after Fed Chair Jerome Powell’s Jackson Hole speech reignited hopes for a September rate cut. Powell said the “shifting balance of risks may warrant adjusting our policy stance,” highlighting rising downside risks to employment while playing down tariff-driven inflation spikes as “likely short-lived.”

Traders seized on those remarks, pushing the Dow Jones to record highs while the S&P 500 gained 0.3% and the Nasdaq slipped 0.5%. According to the CME FedWatch Tool, investors are now pricing an 85% chance of a 25bps cut at the Fed’s September meeting.

This week’s PCE inflation report on Friday will be decisive. Economists expect core PCE to rise 0.3% MoM and 2.9% YoY, the highest since February, raising the risk that tariff pressures are broadening across goods and services. Wells Fargo economists warned that “core PCE inflation may peak slightly above 3% by year-end,” complicating the Fed’s calculus.

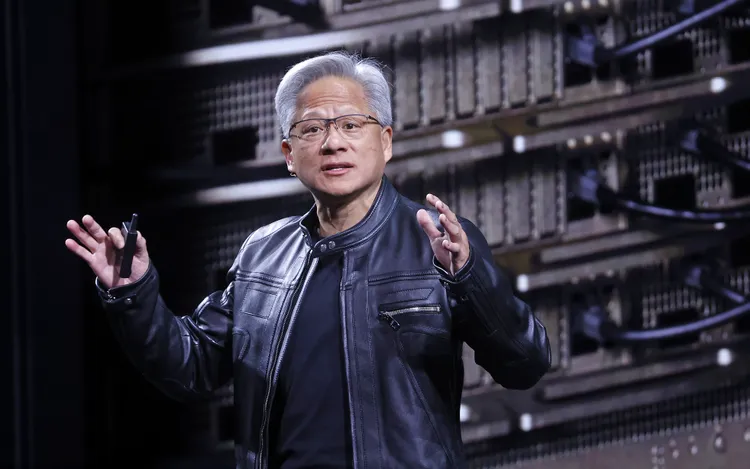

Nvidia: The Market’s Hinge Point

The week’s main event arrives Wednesday when Nvidia ($NVDA) reports Q2 earnings. As the world’s largest company and the face of the AI trade, Nvidia’s numbers will test whether the summer rally has more fuel.

- Wall Street consensus: EPS $1.01 on revenue of $46.1B.

- Keybanc expects strong results but warned Q3 guidance could fall short, as Nvidia’s outlook may exclude China revenue pending export license approvals.

- Analyst sentiment: Price targets continue to rise, with many calling for long-term strength. Nvidia stock is up 32% YTD and has nearly doubled since the April bottom.

Yet expectations are sky-high. Citi strategist Stuart Kaiser said unless Nvidia “posts a large disappointment,” sentiment selling in tech could clear quickly, reigniting the AI trade.

Broader Earnings Landscape

While Nvidia dominates headlines, other corporate reports will also test consumer resilience and sector rotations:

- Retail & Consumer: Abercrombie & Fitch ($ANF), Dick’s Sporting Goods ($DKS), Best Buy ($BBY), Dollar General ($DG), Gap ($GPS), and Ulta Beauty ($ULTA).

- Tech & AI: Dell ($DELL), Snowflake ($SNOW), CrowdStrike ($CRWD), Pure Storage ($PSTG), HP ($HPQ), and Marvell ($MRVL).

- Others: Alibaba ($BABA), Williams-Sonoma ($WSM), The J.M. Smucker Company ($SJM), TD Bank ($TD), and Affirm ($AFRM).

Investors will be watching Dell and Marvell in particular for secondary confirmation of AI spending trends beyond Nvidia.

Sector Rotation and Market Dynamics

The AI trade has cooled in August, with the IT sector (XLK) the worst performer in the S&P 500. Meanwhile, rate-sensitive sectors are rallying:

- Russell 2000 small caps gained 5% in a month.

- Homebuilders ETF (XHB) surged 10%.

- S&P 500 climbed a modest 2.6%.

Interactive Brokers strategist Steve Sosnick noted: “We’ve changed back to a market condition that is more about rotation than outright risk aversion.”

This Week’s Key Calendar

| Day | Economic Data | Earnings Highlights |

|---|---|---|

| Mon, Aug 25 | • New Home Sales (July) • Dallas Fed Manufacturing | $PDD, $HEI |

| Tue, Aug 26 | • FHFA House Price Index (Jun) • Case-Shiller 20-City (YoY) • Consumer Confidence (Aug) • Richmond Fed Manufacturing | $MDB, $OKTA, $PVH, $BMO |

| Wed, Aug 27 | • MBA Mortgage Applications (w/e Aug 22) | $NVDA, $ANF, $CRWD, $FIVE, $HPQ, $KSS, $PSTG, $SNOW, $SJM, $WSM, $URBN |

| Thu, Aug 28 | • GDP Q2 (second estimate) • Personal Consumption Q2 (second est.) • Initial Jobless Claims (Aug 23) • Pending Home Sales (July) | $DELL, $BBY, $DG, $DKS, $GPS, $ULTA, $MRVL, $AFRM, $TD |

| Fri, Aug 29 | • PCE Inflation (July) • Core PCE MoM & YoY (July) • Michigan Sentiment Final (Aug) • Chicago PMI (Aug) • Wholesale Inventories (Jul prelim) | $BABA |

This week could determine whether markets ride Nvidia’s momentum and Powell’s dovish tilt to fresh records — or stumble if earnings disappoint and inflation creeps higher. With geopolitics, tariffs, and rotation all in play, the stakes are as high as they’ve been all summer.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Federal Reserve Explained: How It Shapes Stock Market and Economy

Jerome Powell signals Fed may cut rates soon even as inflation risks remain

EU Speeds Up Digital Euro Plans After US Stablecoin Law, Considers Ethereum and Solana