The European Union is accelerating its long-debated digital euro project after the United States passed the GENIUS Act, a landmark law easing the issuance of dollar-backed stablecoins. Policymakers in Brussels now fear that America’s lead in the stablecoin sector could cement the dollar’s dominance in global payments at the expense of Europe’s monetary sovereignty.

US Shock Spurs European Urgency

The GENIUS Act, approved by Congress in July, provides a clear framework for the $288 billion stablecoin industry — dominated by Tether’s USDT and Circle’s USDC. Supporters in Washington argue the law will bolster the dollar’s role in cross-border finance by legitimizing private-sector stablecoins.

In Europe, the move set off alarm bells. One EU official told the Financial Times the U.S. law “rattled a lot of people,” forcing policymakers to revisit timelines and technology choices for the digital euro.

Pierre Gramegna, head of the European Stability Mechanism, had already warned earlier this year that dollar-backed stablecoins could erode the euro’s global influence:

“If this were to be successful, it could affect the euro area’s monetary sovereignty and financial stability.”

From Private to Public: A Technology Pivot

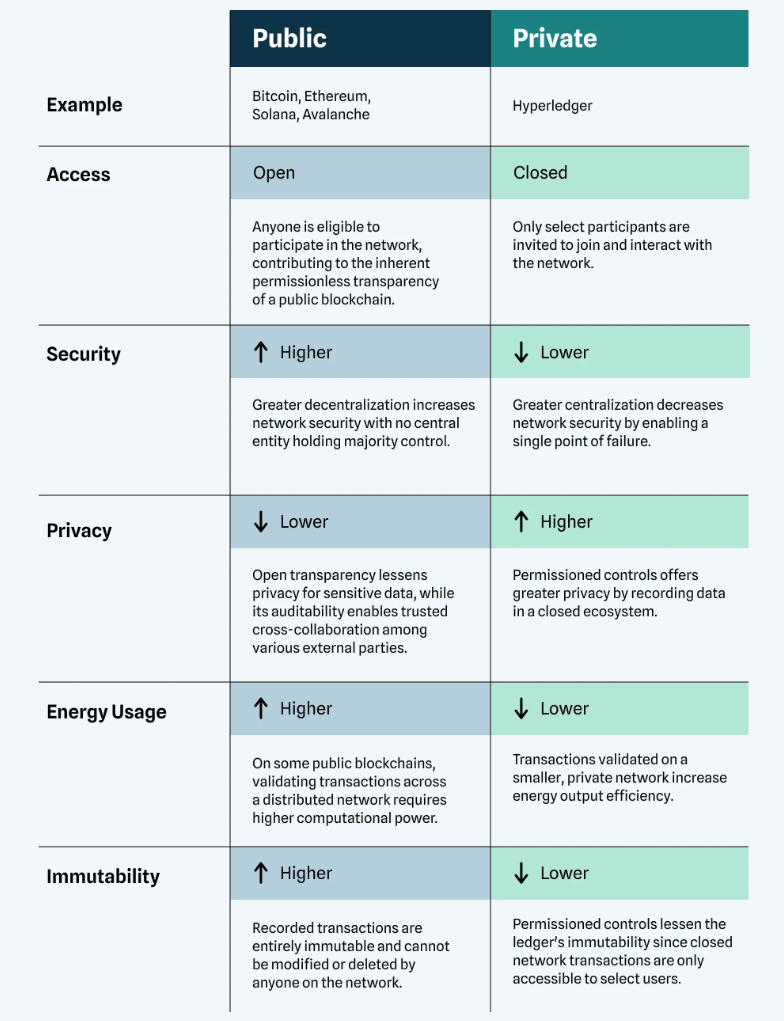

Until recently, the European Central Bank (ECB) had leaned toward a private, centrally controlled ledger for the digital euro, citing privacy and security concerns. That approach mirrored China’s digital yuan pilot, where state-controlled infrastructure dominates.

But the U.S. regulatory push has shifted the debate. Officials are now openly considering public blockchains such as Ethereum and Solana as potential hosts for the euro token.

One policymaker told the FT:

“The use of a public blockchain is definitely something that we are taking more seriously now.”

Public blockchains would allow the digital euro to interoperate with existing crypto infrastructure, potentially boosting adoption. However, they also raise thorny issues of data transparency, governance, and state influence over open networks

Balancing Privacy and Control

The ECB has long faced criticism that a digital euro could become a “Big Brother tool,” enabling authorities to track individual transactions. In response, the bank has pledged that personal data would remain with commercial banks, not the ECB itself.

Still, a public blockchain design could heighten concerns about surveillance and government influence on blockchain governance. “On the positive side, it would plug directly into existing infrastructure. On the negative, it could introduce stronger state control over blockchain protocols,” said Juan Ignacio Ibañez, general secretary of the MiCA Crypto Alliance.

Global Pressure and Competitive Stakes

The US isn’t Europe’s only worry.

- China is advancing its digital yuan, already used in pilot programs for domestic payments.

- The U.K. is considering a digital pound.

- Euro-backed stablecoins like Circle’s EURC already exist, but lack the weight of an official central bank-issued token.

Without a competitive offering, EU policymakers fear that European deposits and transactions could increasingly migrate to dollar-denominated digital assets, undermining the bloc’s financial autonomy.

What’s Next for the Digital Euro

The ECB confirmed to the FT that it is still evaluating both centralized and decentralized designs, leaving the door open to Ethereum, Solana, or other distributed ledger technologies.

A final decision has not been made, but the pace of deliberations has quickened. With cash use declining, U.S. stablecoins surging, and China pressing ahead, Europe may have little choice but to launch a digital euro sooner than expected — and potentially on a blockchain platform once deemed too risky.

Key Takeaways

- US GENIUS Act accelerates stablecoin adoption, boosting dollar dominance.

- EU officials now exploring Ethereum and Solana for digital euro design.

- Digital euro initially envisioned on private infrastructure, but debate has shifted.

- ECB promises no direct access to personal data, aiming to ease privacy fears.

- Global race: US, China, UK all moving faster on digital currencies, adding pressure on Europe.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Federal Reserve Explained: How It Shapes Stock Market and Economy

Jerome Powell signals Fed may cut rates soon even as inflation risks remain