The Federal Reserve (the Fed) is often called the most powerful institution in the world economy. It influences everything from your mortgage rates to global stock markets, the price of Bitcoin, and even whether the US economy slips into a recession. But many new investors don’t really understand what the Fed does, why interest rates matter, or how Powell’s speeches can move the S&P 500 in minutes. Let’s break it down clearly.

What Is the Federal Reserve and Why Was It Created?

The Federal Reserve was created in 1913 after a series of banking crises shook public trust in the US financial system. Before the Fed, banks often failed during panics, leaving ordinary people without savings and businesses without credit. The Fed’s main mission was to create stability in the banking system and prevent collapses like the 1907 Panic, when stock markets plunged and banks ran out of money.

Over time, the Fed’s role expanded far beyond banking. Today, its main goals are:

- Keep inflation stable (avoid prices rising too fast).

- Support maximum employment (make sure jobs are plentiful).

- Ensure financial stability (stop crises from spreading).

This is why the Fed is called the “central bank of the United States.” It doesn’t just serve banks—it indirectly shapes the lives of all households, companies, and investors.

The Fed isn’t just one building in Washington. It’s a system:

- Board of Governors in Washington, D.C. — 7 members appointed by the President.

- 12 Regional Federal Reserve Banks — from New York to San Francisco.

- FOMC (Federal Open Market Committee) — the Fed’s core policy-making team (12 voting members, including Chair Jerome Powell).

When you hear “Powell speaks” or “FOMC decision,” this is the group deciding whether to raise, cut, or hold interest rates.

How the Fed Affects the Economy

The Fed’s most powerful tool is setting the federal funds rate, which is the interest rate banks charge each other for overnight loans. Even though this sounds technical, it influences the entire economy—credit cards, mortgages, business loans, and even global capital flows.

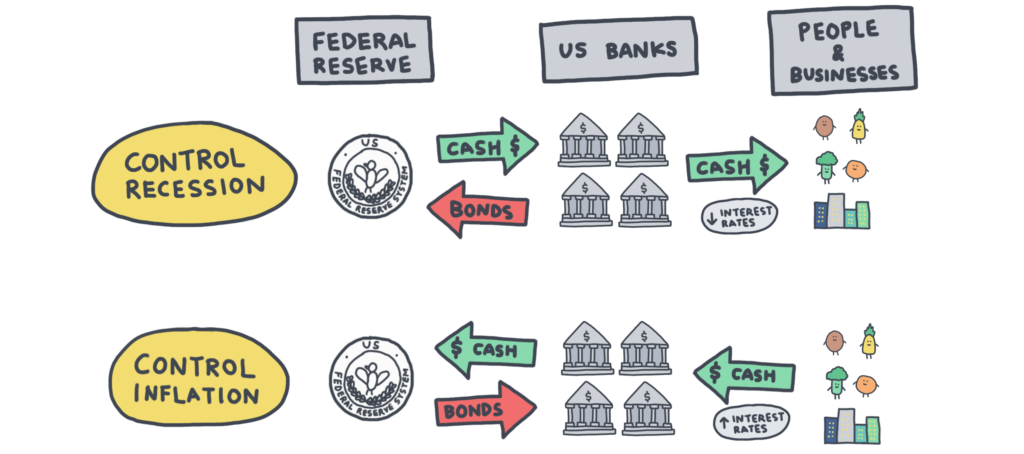

The Fed doesn’t directly “print money” or “control stocks.” Instead, it influences the economy through three main tools:

- Interest Rates (Federal Funds Rate)

- This is the interest banks pay to borrow from each other overnight.

- When the Fed raises rates, borrowing becomes expensive → businesses invest less, consumers borrow less → economy slows ( and stock markets usually fall)

- When the Fed cuts rates, money is cheap → businesses expand, consumers spend more → economy grows (and stock markets usually rise)

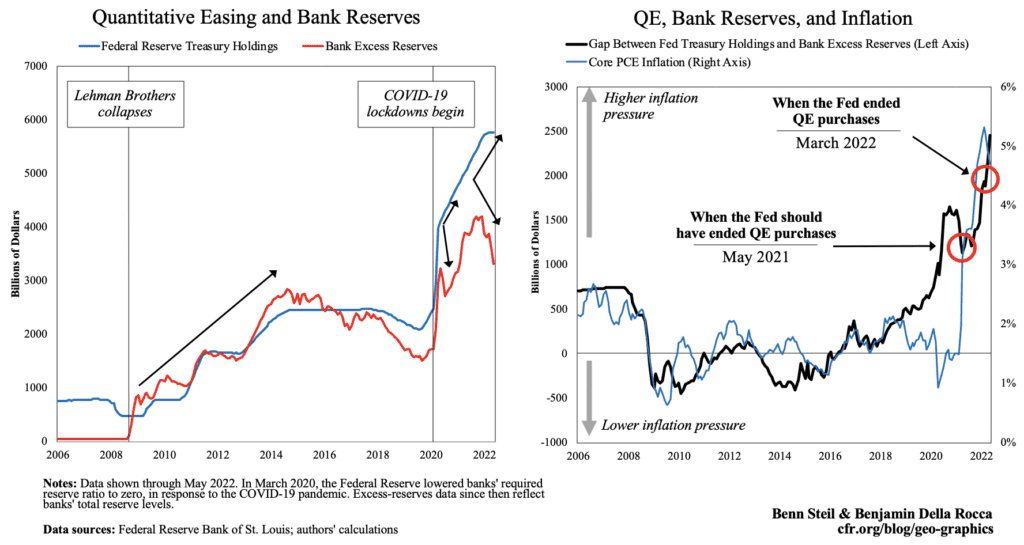

- Quantitative Easing (QE) and Tightening (QT)

- QE = Fed buys bonds and injects money into the system → stimulates growth.

- QT = Fed sells bonds or lets them expire → pulls money out → slows economy.

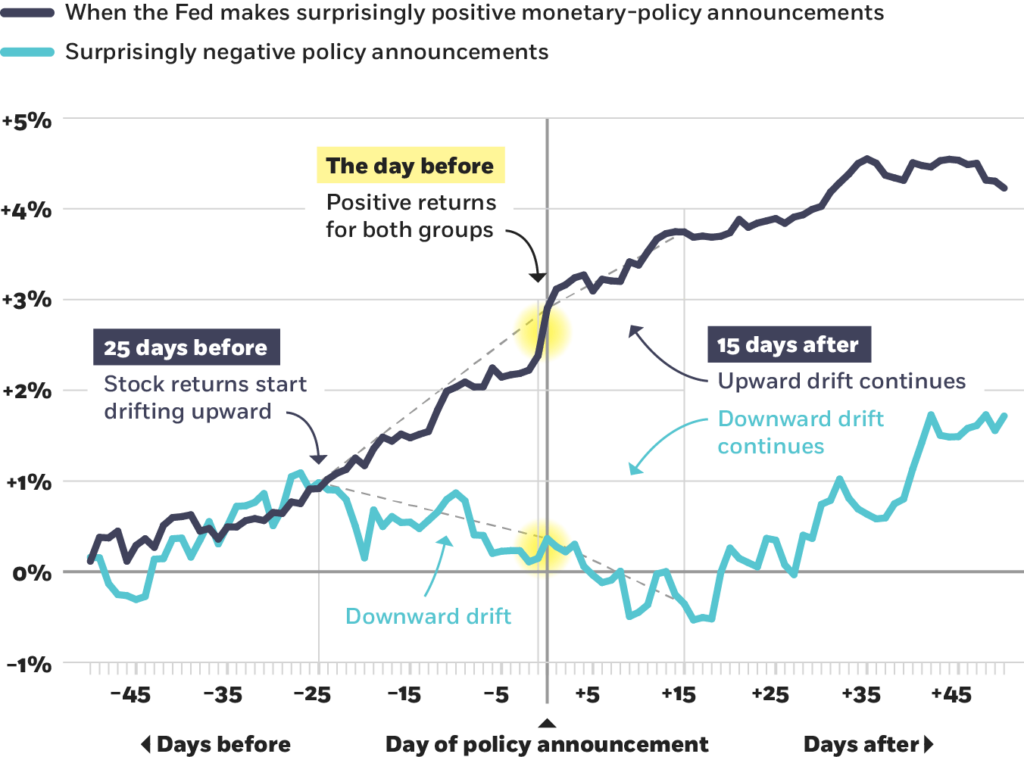

- Forward Guidance (Communication)

- Markets don’t just react to what the Fed does, but also to what it says.

- Example: If Powell hints that “inflation is under control,” stocks may rally even if rates don’t change.

The Fed uses these rate changes to cool the economy when inflation is too high, or to stimulate growth when the economy is weak.

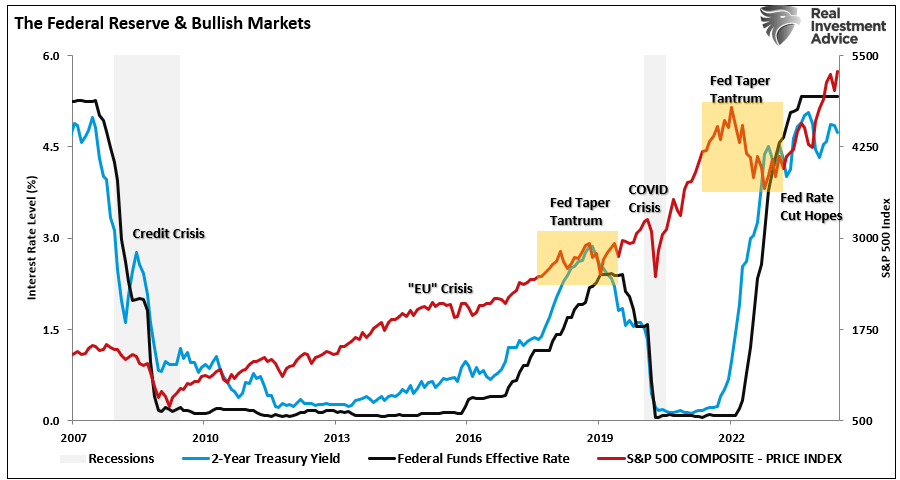

Historical Fed Moves and the Stock Market

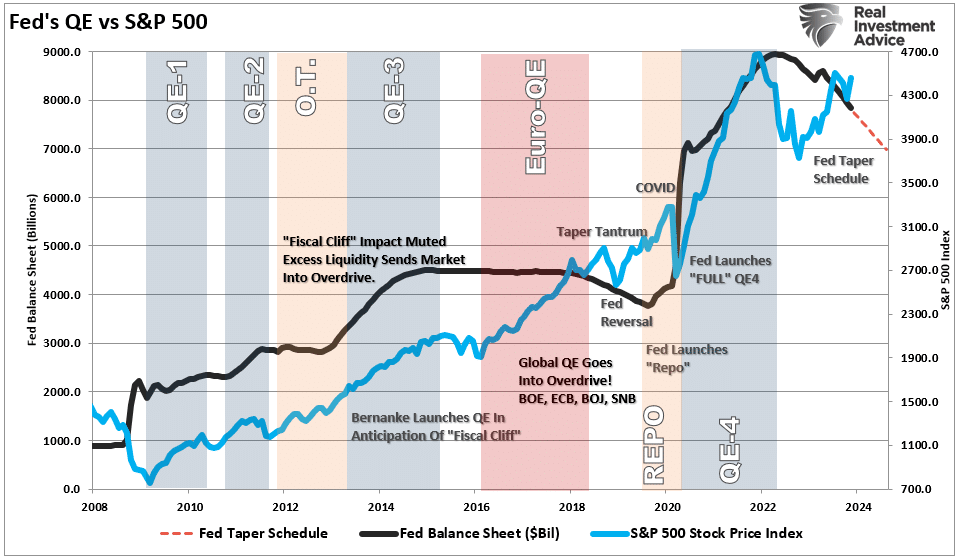

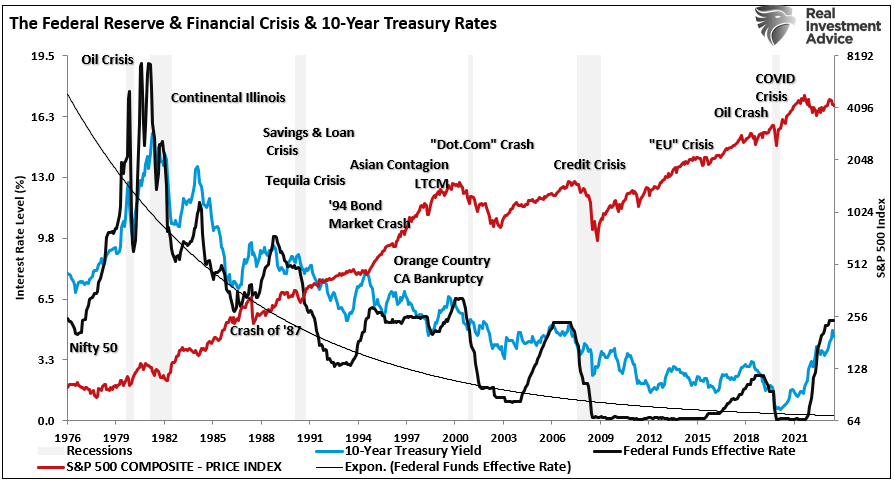

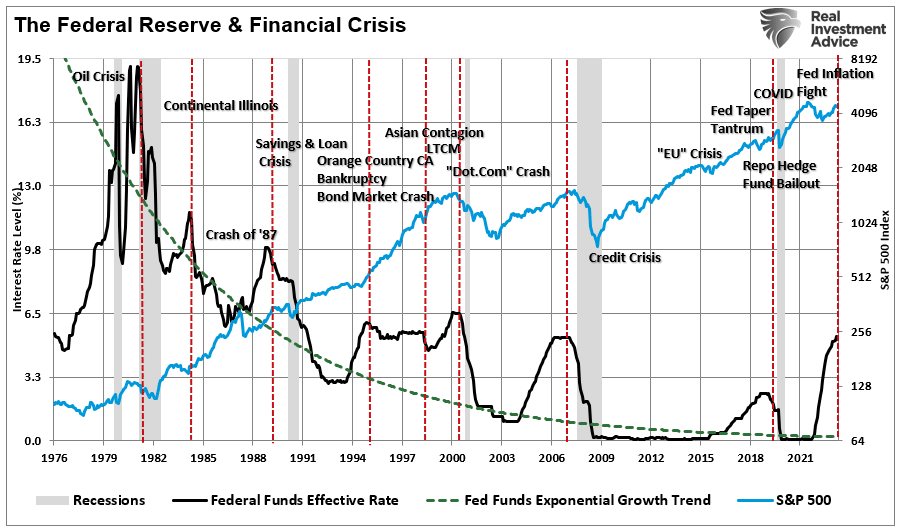

The stock market has always been highly sensitive to the Fed’s decisions. History shows clear patterns of how markets react:

- Rate Hikes (raising rates): Often lead to falling stock prices, especially in growth sectors like tech, since higher rates reduce the value of future earnings.

- Rate Cuts (lowering rates): Usually boost stocks, especially cyclicals like retail, autos, and housing, as consumers borrow and spend more.

Here are some key moments:

- 1980s Volcker Era: Fed hiked rates above 15% to crush inflation. Stocks struggled in the short term but later boomed once inflation was controlled.

- 2008 Financial Crisis: Fed cut rates to near zero, launched QE (quantitative easing), and the S&P 500 began one of the longest bull markets in history.

- 2020 Pandemic: Fed slashed rates to zero again, providing massive liquidity. The S&P 500 rebounded 70% in less than a year.

- 2022–2023 Inflation Fight: Powell raised rates aggressively, leading to sharp corrections in the S&P 500 and Nasdaq.

Jackson Hole Effect: Powell’s Speeches Move Markets

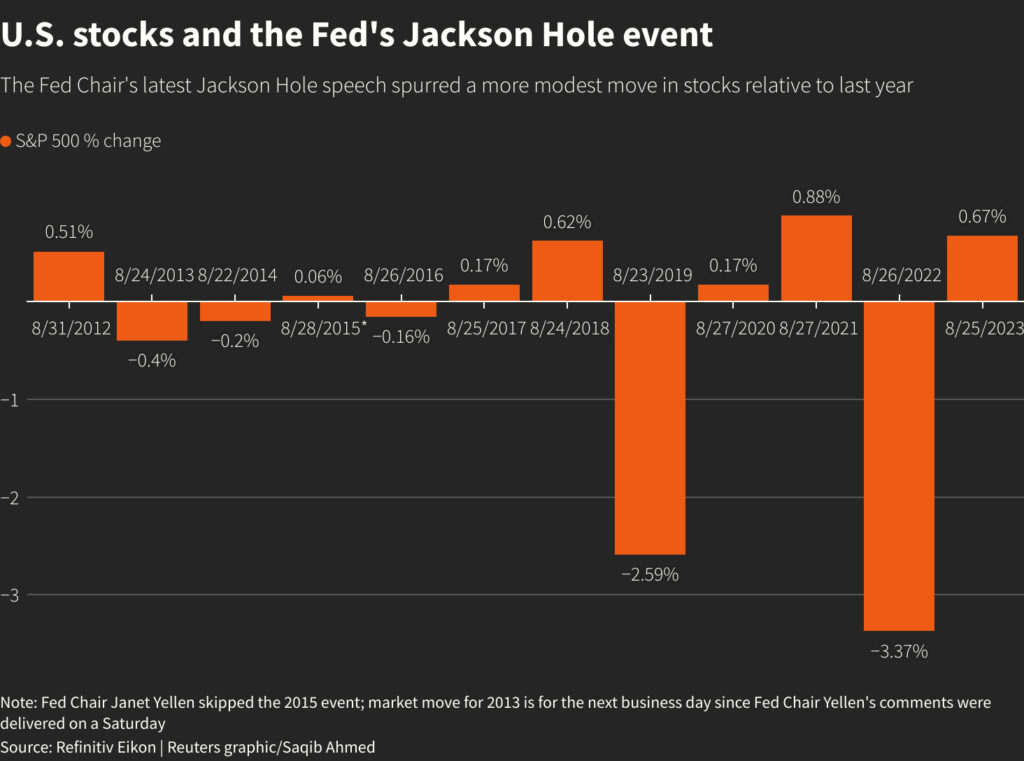

Powell’s yearly Jackson Hole speeches are famous for triggering big stock moves because investors look for hints on future Fed policy.

- 2020: Sparked an initial rally with dovish comments, but reversed later.

- 2021: Dovish tone boosted stocks +0.9% the same day.

- 2022: Hawkish warning led to a -7.9% drop in the S&P 500 within five days.

- 2023: Slightly negative, -1.4% slide.

- 2024: Flat at first, but then -4.1% within a week.

This shows how even words from the Fed Chair can change global markets instantly.

Interest Rates and the Stock Market

Interest rates are the bridge between Fed policy and investor portfolios. Understanding this link is essential:

Lower Rates → Stocks Up

- Borrowing becomes cheaper, helping companies expand, boost earnings, and take more risks.

- Investors leave low-yielding bonds and move into stocks, raising demand.

- Growth stocks (like tech) usually outperform, as future profits look more attractive when discounted at lower rates.

Higher Rates → Stocks Down

- Companies face higher borrowing costs, reducing profits and cutting back on expansion.

- Bonds become more attractive versus risky stocks, pulling money out of equities.

- Dividend stocks and defensive sectors (utilities, healthcare) often outperform.

This push-and-pull explains why markets obsess over every Fed move.

How the Fed Responds to Stock Market Moves

The Fed doesn’t officially target stock prices—but it watches them closely. If a stock crash threatens the economy (like in 2008 or 2020), the Fed steps in with cuts or liquidity injections.

But when stocks are booming too much, fueling bubbles, the Fed may tighten to prevent overheating. This “dance” between Wall Street and the Fed is sometimes called the Fed Put—the idea that the Fed won’t let markets fall too far.

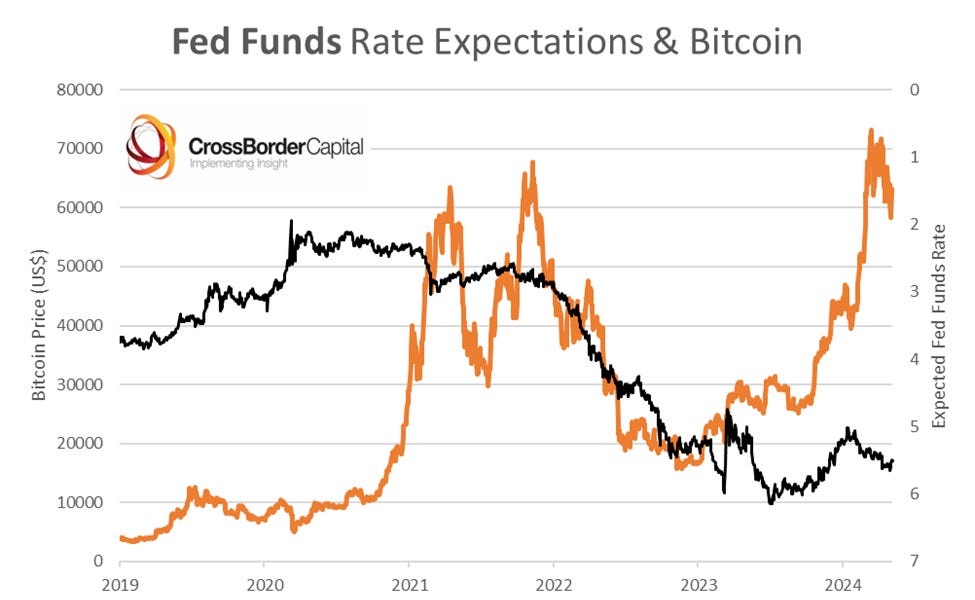

The Fed and Crypto

Cryptocurrencies like Bitcoin are also deeply influenced by the Fed.

- When rates are low: cheap money fuels risk-taking, and investors pile into speculative assets like crypto. The 2020–2021 crypto boom was fueled by ultra-low rates and stimulus checks.

- When rates rise: liquidity dries up, and crypto often suffers as investors flee to safer assets. This happened in 2022, when Bitcoin fell from nearly $69,000 to $16,000 during the Fed’s tightening cycle.

So while Bitcoin is called “digital gold,” it often moves like a high-risk tech stock when Fed policy shifts.

What Drives Fed Decisions?

The Fed doesn’t act randomly. Its choices are guided by data:

- Inflation (CPI, PCE, core inflation) – If prices rise too fast, the Fed hikes.

- Employment data (jobs reports, unemployment rate) – Weak jobs = cuts, strong jobs = hikes.

- GDP growth – Too hot = hikes, too weak = cuts.

- Global risks – Wars, financial crises, pandemics can force unexpected moves.

- Market conditions – Sharp selloffs may influence emergency interventions.

This is why investors track economic calendars so closely—every jobs report, inflation release, and Powell speech can shift Fed policy expectations.

Why Inflation Is Central to Fed Policy

The Fed has a “dual mandate”:

- Keep inflation around 2%.

- Maximize employment.

When inflation rises too fast, the Fed hikes rates. When jobs are at risk, it cuts rates. Striking that balance is tricky, and markets constantly try to guess which way the Fed will lean.

Key Takeaways

- The Fed was created in 1913 to stabilize the US banking system but now shapes the entire global economy.

- Its main tool—interest rates—directly impacts stock prices, crypto markets, and economic growth.

- Rate cuts usually boost risk assets, while hikes slow them down.

- History shows that Fed decisions have repeatedly sparked both bull and bear markets.

- Powell’s speeches, especially at Jackson Hole, often trigger immediate market swings.

- Understanding the Fed isn’t optional—it’s essential for anyone investing in stocks, bonds, or crypto.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

LIVE: Fed Chair Jerome Powell’s Keynote Address at Jackson Hole Economic Policy Symposium 2025

Related:

Jerome Powell at Jackson Hole: A Defining Moment, Markets Brace for Impact

Markets Brace for Jackson Hole as Fed Faces Trump Pressure and Policy Uncertainty

Morning Bid: Jackson Hole Opens Under Trump’s Shadow