Wall Street paused for breath Tuesday, ending a six-day S&P 500 record streak, as global trade negotiations faltered and investors braced for the Federal Reserve’s rate decision. All eyes are now on Trump’s multi-front diplomacy — from China to Gaza — and today’s high-stakes earnings slate.

S&P 500 ends record run

US markets closed lower on Tuesday after a volatile day dominated by earnings, weak hiring data, and geopolitical drama. The S&P 500 fell 0.30%, breaking a six-day record streak. The Nasdaq lost 0.38%, while the Dow slipped 0.46% or over 200 points.

- The decline followed disappointing results from Merck (MRK), UnitedHealth (UNH -7.46%), and Spotify (SPOT).

- Boeing (BA) offered a rare bright spot, beating expectations.

- June JOLTS data showed falling job openings and hiring, adding to caution ahead of Friday’s nonfarm payrolls report.

“Investors were simply looking for a reason to take profits after the rally,” said one strategist, citing a “perfect storm of policy risk and earnings fatigue.”

Trump’s Trade Tour Rattles Markets

Global trade concerns returned to the spotlight as US-China talks in Stockholm concluded without an agreement. Treasury Secretary Scott Bessent said he recommended a 90-day extension of the tariff truce, but emphasized that President Trump would make the final decision. The

House later confirmed that a decision is pending and a blanket tariff increase could still go into effect by August 12 if no deal is reached.

President Trump, meanwhile, continued a high-profile diplomatic and business tour in Scotland. At a joint press conference with UK Prime Minister Keir Starmer, Trump made headlines by threatening secondary sanctions on Russian oil within 10 days and restated that he would not drop tariffs on Scotch whisky, disappointing UK officials.

He also confirmed that:

- Russia: Trump threatened new tariffs and secondary oil sanctions in 10 days if no ceasefire is reached in Ukraine.

- EU: A 15% tariff deal was confirmed, with $750B in EU energy purchases headed to the US.

- India: Trade deal “not finalized,” per Trump.

- Canada: US Ambassador teased a bilateral deal is “hopefully very soon.”

Meanwhile, Trump ignored calls to lift Scotch whisky tariffs, saying he’s “not a big whiskey drinker.”

Trump & Starmer Talk Gaza, Golf, and Global Trade

In a chaotic joint presser with UK PM Keir Starmer, Trump:

- Condemned Gaza starvation images: “You can’t fake it. That’s real starvation stuff.”

- Urged Israel to ensure food aid reaches civilians.

- Confirmed plans to build a third golf course in Scotland.

- Talked steel trade, whisky tariffs, and hinted at pushing Netanyahu to allow more aid.

Starmer replied, “People in Britain are revolted at what they see on their screens.”

During a press conference in Scotland, Trump mocked UK Prime Minister Starmer’s friend, London Mayor Sadiq Khan, calling him a “nasty person” and saying he’s done a “terrible job,” while Starmer awkwardly defended him as “a friend.”

Fed Meeting in Focus

The market’s main focus today will be the Federal Reserve’s rate decision at 2:00 PM ET, followed by Chair Jerome Powell’s press conference at 2:30 PM. According to the CME FedWatch Tool, there is a 97% probability that rates will remain unchanged.

Investors, however, will be parsing Powell’s language closely for any signals regarding the timing and conditions of a future rate cut. With inflation proving sticky and growth indicators cooling, a September rate cut remains the market’s base case, but any hint of delay could weigh further on risk assets.

Mixed Economic Signals

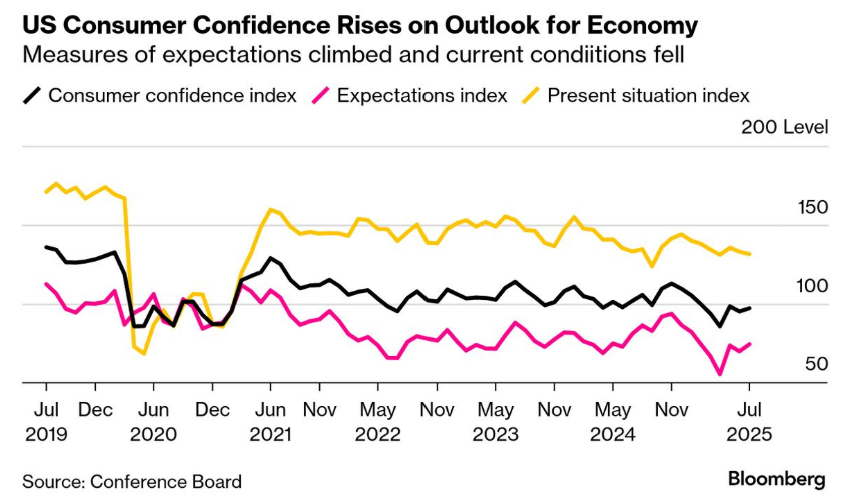

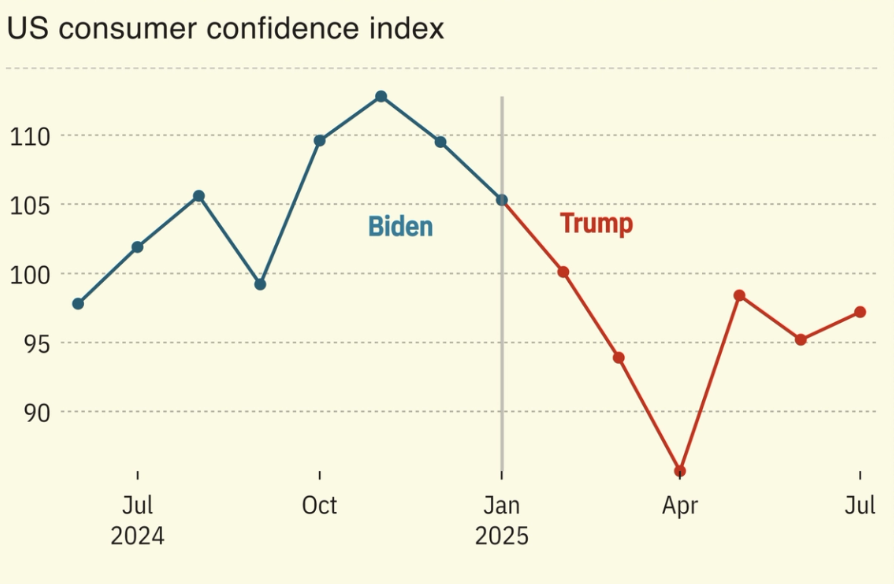

Tuesday’s data added to the cautious tone. The JOLTS report showed a decline in job openings and hires in June, reinforcing concerns that the labor market may be softening. However, consumer confidence improved, with The Conference Board’s index rising to 97.2 in July, up from 95.2.

The International Monetary Fund (IMF) also boosted its global GDP forecast for 2025 to 3%, up from 2.8%, citing reduced fears over US tariff damage and recent signs of stabilization in the US-China relationship.

Asia Opens Higher on Trade Truce Hopes

Despite Wall Street’s retreat, Asian equities edged higher Wednesday morning as traders welcomed signs that the US and China are still talking.

The MSCI Asia Pacific Index rose 0.4%, with gains led by technology shares. The South Korean won surged 0.8% after reports the US had asked for a stronger currency as part of trade negotiations. Meanwhile, the dollar weakened against all G10 currencies.

| Time (ET) | Event / Earnings | Details |

|---|---|---|

| 8:15 AM | ADP Employment Change | Estimated ~75K |

| 8:30 AM | Q2 GDP (Preliminary, Annualized) | Estimated 2.4% |

| 8:30 AM | GDP Price Index (Q2) | Estimated 2.3% |

| 10:00 AM | Pending Home Sales (June, MoM) | Estimated +0.3% |

| 10:30 AM | Crude Oil Inventories | Forecast –2.3M barrels |

| 2:00 PM | FOMC Rate Decision | Rates expected to remain unchanged |

| 2:30 PM | Fed Chair Jerome Powell Press Conference | Focus on tone and outlook |

| Pre-Market | Etsy, Teva, Altria, Amarin, Kraft Heinz, Fiverr | Earnings reports before market open |

| After-Hours | Meta, Microsoft, Qualcomm, Robinhood, Arm Holdings | Key tech earnings after market close |

| After-Hours | Carvana, MGM Resorts, eBay, Ford, Applied Digital | Additional post-market earnings |

With equities having surged from April lows, markets are entering a delicate phase. Investors appear increasingly sensitive to policy missteps, trade uncertainty, and earnings volatility. A dovish Fed press conference and positive tech results could be enough to resume the rally — but risks remain elevated.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump’s Trade War Reshaped: US–EU Deal Finalized, China Truce Extension Likely

Global Markets Kick Off Tuesday With Cautious Optimism: Market Wrap

Market Is Euphoric Again — and Everyone Knows It

Wall Street Keeps Breaking Records, But Big Tests Are Looming

Tariff Shock Incoming: Trump’s August 1 Deadline to Hike Prices on Food, Clothing, and Cars

Hottest Business Strategy This Summer Is Buying Crypto

Accidental King of Meme Stocks: How a Canadian Hedge Fund Manager Sparked 2025’s Retail Rebellion