Markets opened on a cautious note Tuesday, as investors weighed Powell’s upcoming speech, new Fed scrutiny from Summers and Bessent, and mounting tariff pressure.

US stock indexes opened mixed after Monday’s record highs, with tech stocks pulling back and investors bracing for a wave of earnings and geopolitical risk. The Nasdaq and S&P 500 edged lower as Nvidia extended its slide and concerns grew over a possible AI bubble retracement. Meanwhile, General Motors’ profit warning due to tariffs rattled sentiment around trade.

The Dow Jones managed to stay slightly green, supported by strong defense names like Northrop Grumman, which surged over 8% on a guidance upgrade and new demand linked to global conflict zones.

Markets are now waiting for:

- Fed Chair Powell’s speech (expected to focus on regulatory framework, not rates)

- Tesla and Alphabet earnings tomorrow

- Tariff deadline talks, with Bessent confirming August 1 is a “hard line”

- New trade deals expected with China and EU, as hinted by Bessent

Investor caution is rising not just over earnings surprises, but also over the Fed’s growing political entanglement, as top names call for institutional course-correction.

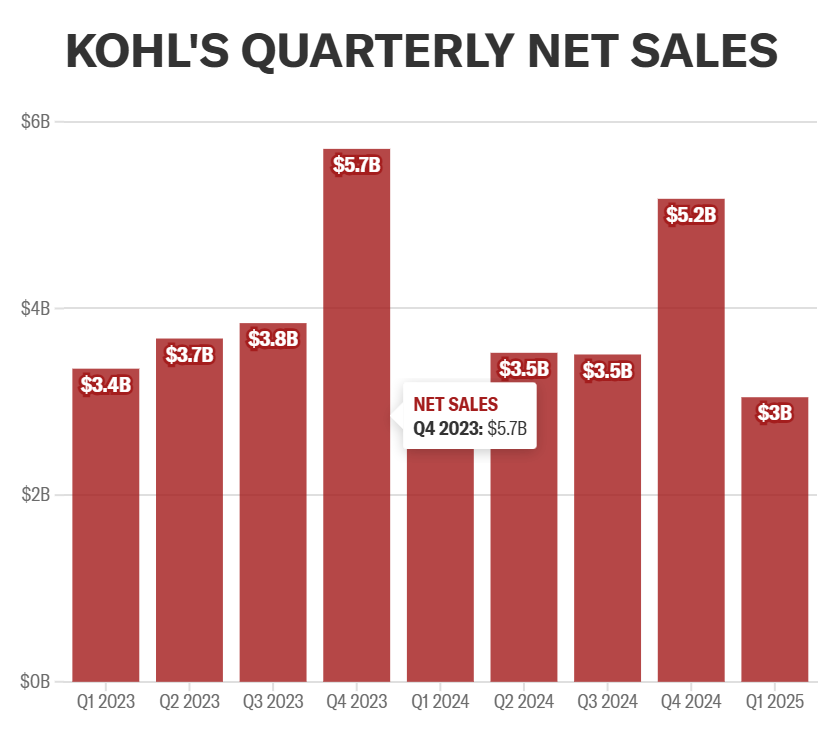

Kohl’s Joins Meme Stock Frenzy as Retail Traders Pounce

Kohl’s (KSS) stock surged over 35% Tuesday, triggering a trading halt after retail traders on WallStreetBets piled in, echoing Opendoor’s meme-fueled rally.

- Shares jumped from $10.70 to $21.39 in premarket before NYSE stepped in.

- Kohl’s short interest is at 49%, fueling the squeeze.

- The retailer has struggled, with same-store sales down 4.1% in Q1 and forecasts showing another 4%-6% drop in 2025.

- Leadership turmoil also continues: CEO Ashley Buchanan was ousted in May over ethical issues.

Kohl’s joins Opendoor as the latest meme target, despite weak fundamentals.

Bessent Eyes Trade Wins, Not Powell Exit

In contrast to Trump’s public calls for Powell to step down, Bessent adopted a more pragmatic tone in a Fox Business interview:

“There’s nothing that tells me that he should step down right now. His term ends in May. If he wants to see that through, I think he should.”

Still, Bessent doubled down on the need for transparency and oversight, especially amid expanding Fed regulatory authority and its costly HQ renovation.

Meanwhile, Bessent confirmed that the August 1 tariff deadline is “pretty hard” and revealed a flurry of upcoming trade deals, including meetings with Chinese counterparts in Stockholm next week.

He also forecast US GDP growth above 3% by Q1 2026, citing momentum from recent policy moves and anticipated trade breakthroughs.

Global Market Snapshot — July 22, 2025 (6:30 PM GMT+3)

| Asset / Index | Last Price | Move Today |

|---|---|---|

| S&P 500 | 6,291.34 | ↓ -0.12% |

| Nasdaq Composite | 21,140.88 | ↓ -0.41% |

| Dow Jones | 44,330.55 | ↑ +0.02% |

| 10Y US Yield | 4.15% | ↓ -2 bps |

| WTI Crude Oil | $78.42 | ↓ -0.8% |

| Gold | $2,417 | ↑ +0.4% |

| Bitcoin | $119,041 | ↑ +0.3% |

| Nvidia (NVDA) | $168.13 | ↓ -1.9% |

| Kohl’s (KSS) | $14.14 | ↑ +35.7% |

| Northrop (NOC) | $557.79 | ↑ +8.2% |

| GM (GM) | $35.12 | ↓ -6.9% |

| Philip Morris (PM) | $89.51 | ↓ -7.97% |

| RTX | $91.44 | ↓ -3.2% |

| Lockheed (LMT) | $450.26 | ↓ -2.7% |

| Circle (CRCL) | $198.70 | ↓ -8.05% |

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Markets Brace for Tech Earnings and Trump Tariff Deadline

Indian Bank Stocks Surge as Earnings Beat Estimates

The 60/40 Portfolio Under the Microscope: 150 Years of Market Stress‑Testing

Trump To Open 401k Market To Crypto, Gold, And Private Equity

93.5 % Battery Material Tariff by US: 5 Stocks Poised to Benefit Most From It

How Nvidia Jensen Huang Persuaded Trump to Sell AI Chips to China

Stocks Inch Up as Trump Softens Tariff Talk; CPI and Bank Earnings Ahead