Federal Reserve Governor Christopher Waller said Friday the central bank may be ready to cut interest rates as soon as July, thanks to signs that inflation is easing and economic data is softening.

In an interview with CNBC, Waller said:

“We’re in the position that we could do this as early as July. That would be my view.”

This marks a clear split from Fed Chair Jerome Powell, who just days earlier said the Fed would wait longer to see how inflation and new Trump-era tariffs affect the economy.

What the market did:

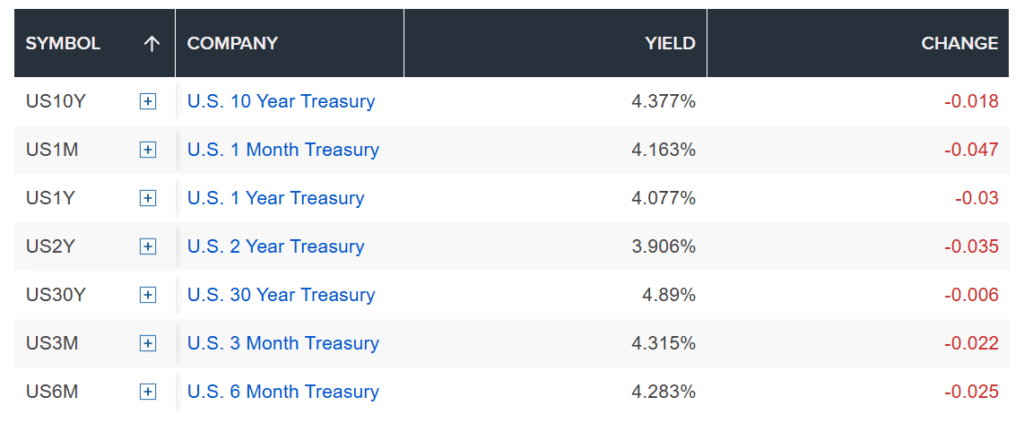

- 10-year Treasury yield dropped slightly to 4.377%

- 2-year yield fell to 3.908%

- S&P 500 opened a bit lower, but held steady

Why this matters:

Waller’s message is the strongest signal yet that the Fed may begin easing monetary policy sooner than expected — especially if inflation keeps trending lower. He also said the labor market is starting to cool, pointing to growing challenges for some job seekers.

While Powell has urged patience, Waller argued that tariff-driven inflation may not last and that the Fed has room to start cutting rates gradually.

“If prices rise again, we can just pause,” Waller said, suggesting a flexible approach.

Political pressure is rising:

President Donald Trump has been pushing hard for the Fed to slash rates. He wants cuts of up to 2.5 percentage points to reduce borrowing costs, especially as government debt grows under his administration. While Waller didn’t directly mention Trump, his comments clearly align more with the president’s view than Powell’s.

“I call [Powell] every name in the book,” Trump joked earlier this week, frustrated by the Fed’s caution.

What’s next:

Markets are now watching the July Fed meeting closely. Even though not all Fed officials agree with Waller, his stance increases the odds of at least one rate cut this summer — especially if inflation stays soft and economic growth slows further.

At the same time, global tensions — particularly Trump’s threats of military action against Iran — are adding uncertainty, which could further influence Fed decisions in the weeks ahead.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

IMF Warns: European Economy Faces Risk of Stagnation

Why Oil Prices Aren’t Surging Despite the Israel-Iran War

Trump Privately Approved Attack Plans for Iran but Has Withheld Final Order

Iran Refuses to Surrender as Trump Mulls Strike: Tensions Surge in Middle East Conflict

Trump Demands Iran’s ‘Unconditional Surrender,’ Escalates Pressure in Israel-Iran Conflict

US and UK Seal Trade Deal — but Steel Tariffs Unresolved

Trump Exits G7 Early as Leaders Urge Mideast Ceasefire: What the Summit Delivered

OpenAI considers antitrust action against Microsoft amid tensions

What Is Trump’s ‘Revenge Tax’ — and Why It’s Scaring Off Foreign Investors