In a fast-moving weekend of diplomacy, US and China officials have reached a trade deal during two days of talks in Geneva. Vice Premier He Lifeng, the sides made “substantive progress” and achieved “important consensus.”

The deal marks a dramatic shift in tone, with both parties describing the talks as “constructive” and “productive.” U.S. Trade Representative Jamieson Greer stated:

“This was a very constructive 2 days. The differences are not as great as previously thought.”

The White House confirmed Sunday that a deal has been reached, and more details will be shared in a joint statement on May 12.

Trump, Bessent, and Greer Signal Major Progress

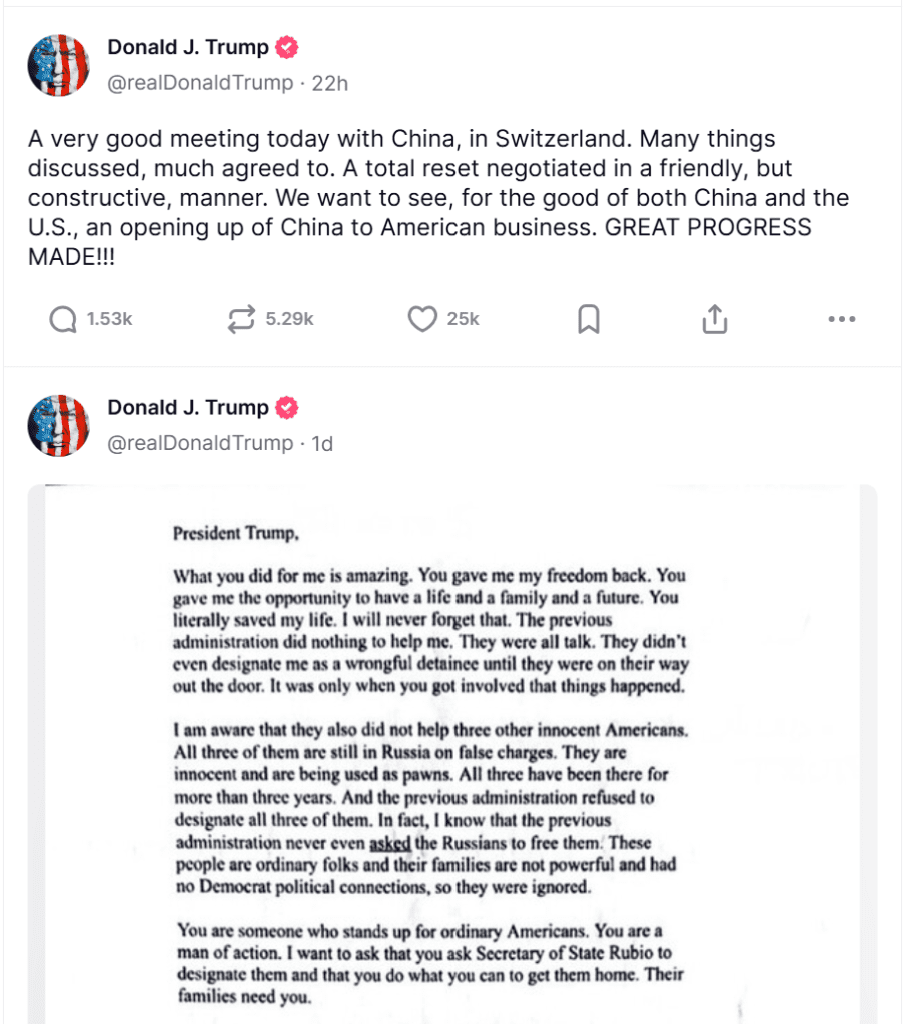

Former President Donald Trump, who attended part of the Geneva discussions, called the outcome a “very good” result, describing the agreement as a “total reset” reached in a “friendly but constructive way.”

Meanwhile, Treasury Secretary Scott Bessent praised the weekend’s progress:

“We have made substantial progress in trade talks with China.”

He added that a complete briefing would be held Monday morning, emphasising the speed and productivity of the negotiations.

Tariffs in Focus: Trump Hints at Major Cuts

Prior to the meetings, Trump posted on Truth Social suggesting:

“80% Tariff on China seems right! Up to Scott B.”

The comment hinted at a possible dramatic easing of tariffs — a move that could reshape global trade flows. Currently:

- China has 125% tariff rates on U.S. imports

- The U.S. under Trump had imposed 145% tariffs on Chinese goods

- China remains the third-largest exporter to the U.S., shipping $143.5 billion in goods last year

- However, China runs a $295 billion trade surplus with the U.S., the largest among all trading partners

What Comes Next

- May 12: U.S. and China to release a joint statement outlining the deal

- Monday morning: Bessent and Greer will give a complete briefing

- Expect new details on tariff adjustments, consultation mechanisms, and future negotiations

Why It Matters

This is the first high-level meeting between the U.S. and China since the trade war reignited earlier this year. Markets and multinationals will be watching closely to see if this “reset” leads to:

- Tariff relief

- Supply chain normalization

- Stronger global trade stability

If successful, it could mark the beginning of a new phase in U.S.-China economic diplomacy

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

BlackRock CEO Larry Fink Predicts Bitcoin to Hit $500K in 5–10 Years

Global Savings Glut: How Surplus Savings and Investment Imbalances Are Reshaping World Economy

China’s Billions in Military Tech Face First Major Test in India-Pakistan Conflict

Google Faces Crackdown and Stock Crash — But Is It a Long-Term Opportunity?

Tariff Trouble in Hollywood: Studios brace for new policy as box office struggles

US-UK Trade Deal: A Big Win or Just Political Theater?

What Jerome Powell said after Fed leaves key interest rate unchanged