Alphabet (GOOG) is moving fast, rolling out new Gemini features, custom AI chips, and even launching ‘AI Mode’ in Search.

But as the product engine revs up, the legal pressure is piling on. US regulators are pushing for a historic breakup of Search. Chrome could be spun off. The default deals with Apple may be banned. And a recent court ruling labelled its ad business a monopoly.

It’s a tale of two narratives:

- The innovator racing to scale AI across everything it touches.

- The incumbent defending a business model that powers most of its profits.

Can Alphabet keep the momentum with regulators closing in? Let’s visualize the quarter and dive into the latest report.

1. Alphabet Q1 FY25

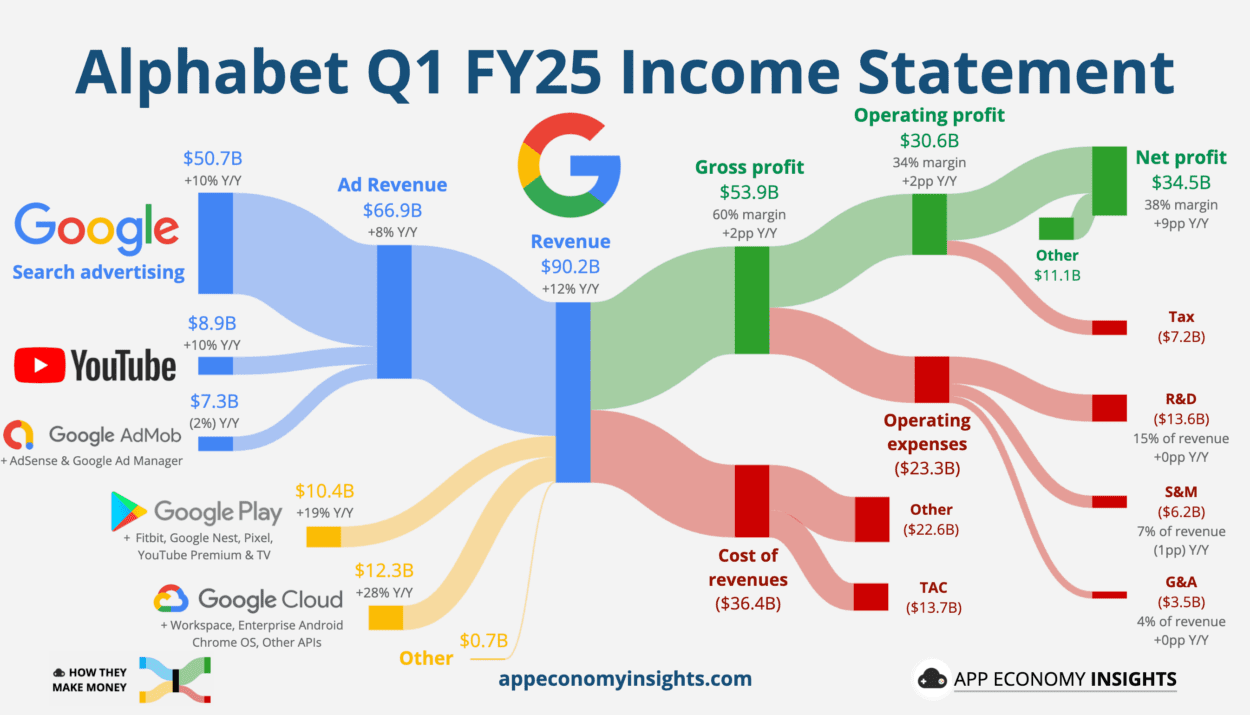

Income statement:

Revenue grew +12% Y/Y to $90.2 billion ($1.1 billion beat).

- Advertising: $66.9 billion (+8%).

- Search: $50.7 billion (+10%).

- YouTube ads: $8.9 billion (+10%).

- Network: $7.3 billion (-2%).

- Subscriptions, platforms, and devices: $10.4 billion (+19%).

- Cloud: $12.3 billion (+28%, decelerating from +30% in Q4).

Margins:

- Gross margin: 60% (+2pp Y/Y).

- Operating margin: 34% (+2pp Y/Y).

- Services (Advertising & Other): 42% (+3pp Y/Y).

- Cloud: 18% (+8pp Y/Y).

- Earnings per share (EPS) grew 49% Y/Y to $2.81 ($0.80 beat).

- The dividend was raised by 5% to $0.21/share.

Cash flow:

- Operating cash flow was $36.2 billion (+25% Y/Y).

- Free cash flow was $19.0 billion (+13% Y/Y).

Balance sheet:

- Cash, cash equivalents, and marketable securities: $95 billion.

- Long-term debt: $11 billion.

So, what to make of all this?

- Revenue grew+14% Y/Y in constant currency, implying an acceleration from +13% Y/Y in Q4 and well ahead of consensus.

- Search maintained a double-digit growth and came in $0.4 billion ahead of expectations, seeing traction from insurance, retail, and travel. The volume of commercial queries has increased thanks to AI Overviews.

- YouTube ads slightly missed consensus. Engaged views on Shorts grew 20% and are closing the monetization gap with long-form videos.

- Network ads (which have a lower margin profile) declined (-2% Y/Y), reflecting ongoing competition and a tougher macro backdrop.

- Subscriptions, platforms & devices rose +19% Y/Y. Paid subscriptions surpassed 270 million, driven by YouTube, followed by Google One.

- Cloud remained Alphabet’s fastest-growing segment at +28% Y/Y, mostly in line with expectations. More on this in a minute.

- Profitability gets another boost: Gross margin jumped to 60%, defying concerns that AI would hit the company’s margin.

- What is that $11 billion gain under “Other income”? It comes primarily from an unrealized gain tied to the revaluation of a private company investment—possibly Anthropic, though management didn’t name the company.

- Capex surged +43% Y/Y to $17.2 billion: It was just above the outlook. Management maintained its massive capex ramp to $75 billion in FY25 to expand AI capacity.

- More cash returned to shareholders: The board approved a $70 billion buyback program, and the company bought back $15.7 billion in Q1 (+4% Y/Y). If we add the $2.4 billion in dividend payments, Alphabet has returned to shareholders nearly all the cash not reinvested in Capex.

2. Antitrust, Cloud, and YouTube

Antitrust pressure intensifies

Alphabet’s legal headaches keep growing:

- Search Monopoly Remedies Trial Begins: After a 2024 ruling that Alphabet violated antitrust laws in Search, the DOJ has launched a remedies trial. Proposed outcomes include divesting Chrome, ending default search deals, and mandating access to search data for rivals. Regulators also aim to restrict the use of Gemini to maintain dominance. A decision is expected by August. Alphabet already said it would appeal the decision.

- Ad Tech Monopoly Ruling: In April, a federal judge ruled that the company holds illegal monopolies in the publisher ad server and ad exchange markets. The court found anticompetitive tying practices that harmed publishers. Remedies—including potential divestitures—will be addressed in a separate hearing. An appeal is planned.

- Play Store Antitrust Appeal: The firm is appealing a 2023 jury verdict that deemed its Play Store an illegal monopoly. The ruling requires support for alternative app stores and third-party payments on Android. A final decision is pending.

- EU Digital Markets Act (DMA) Scrutiny: The European Commission issued preliminary findings in March that Alphabet may be breaching DMA rules. Concerns include self-preferencing in Search and restricting app developers from promoting external offers. Penalties could reach 10% of global revenue if violations are confirmed.

- International Scrutiny: In India, a settlement with regulators addresses Android TV dominance by unbundling Play Store and Play Services. In China authorities have opened an antitrust investigation focused on mobile OS practices and potential harm to local smartphone makers.

These legal challenges could lead to significant structural changes in business operations, affecting core products and services.

Cookie Reversal: After years of promising to kill third-party cookies in Chrome, the company announced it will no longer roll out a prompt to disable cookies and will maintain the current setup, effectively abandoning the Privacy Sandbox’s original mission. Legal scrutiny, industry pushback, and scalability issues plagued alternatives like the Topics API, which failed to gain traction. While Alphabet will continue investing in privacy features like IP protection in Incognito Mode, the broader shift away from cookie-based targeting is on indefinite hold. For now, the ad ecosystem’s most entrenched tracking tool lives on.

Cloud Next ‘25: The 1-minute version

At its annual Cloud conference, Alphabet showcased how it’s turning AI into a platform, not just a feature.

- Gemini goes enterprise: Gemini 1.5 models, including 1.5 Flash (optimized for fast, low-cost tasks), are now embedded across Workspace (Docs, Gmail, Sheets) and developer tools. This deepens the company’s moat in enterprise AI, competing directly with Microsoft Copilot.

- AI infrastructure as a service: The company unveiled Axion, the first custom Arm-based CPU for data centers, and spotlighted TPU v5p chips. These additions reduce reliance on NVIDIA and strengthen vertical integration in AI infrastructure—boosting long-term Cloud margins.

- Growing ecosystem, stickier Cloud: They announced new partnerships with SAP and Salesforce, along with AI agents for security, customer support, and code generation. These moves enhance retention and upsell opportunities in a highly competitive market.

- Focused on enterprise, not hype: Cloud CEO Thomas Kurian emphasized scalable, real-world use cases over flashy demos—especially in healthcare, retail, and finance. The focus on ROI-driven agents signals maturity and alignment with enterprise demand.

Let’s unpack Cloud’s performance in Q1 FY25:

- GCP + Workspace: Remember, Cloud includes GCP and Workspace. Management says GCP is growing ‘much faster’ than the broader 28% Y/Y for the Cloud segment, though it doesn’t break out numbers.

- Capacity still catching up: Cloud has been capacity-constrained, so the segment could face variability due to capacity deployment. Higher capacity is expected by year-end.

- Margin expansion: Cloud operating margin reached a new high at 18%. CFO Anat Ashkenazi attributed the gains to continued operational efficiencies, offsetting an increase in depreciation coming from new AI investments.

YouTube: Eating the competition’s lunch

As a reminder, YouTube contributes to two segments:

- YouTube ads: Advertising revenue generated on YouTube properties.

- Subscriptions: YouTube TV, Music, Premium, NFL Sunday Ticket, and data storage. Subscription revenue is mixed with the Play store and Pixel sales.

YouTube Music and Premium reached over 125 million subscribers (including trials). Together, ads and subscriptions put YouTube at a ~$62 billion run rate by the end of 2024—about 1.5x Netflix. Management is testing Premium Lite in the US, giving users a new way to enjoy most videos on YouTube ad-free at $7.99/month.

Viewership growth: According to Nielsen, YouTube’s share of US TV time hit an all-time high of 12% in March 2025 (excluding YouTube TV), up from 10% a year ago. YouTube has been the most-watched streaming platform on US TVs for 26 consecutive months, widening its lead as more viewers shift from linear TV to streaming. But it’s also running away from the rest of the streaming pack.

For perspective, The Walt Disney Company comes in second with 10.5% of US TV Time across streaming (Disney+, Hulu, ESPN+) and linear TV (ABC, National Geographic, The Disney Channel).

3. Key quotes from the earnings call

CEO Sundar Pichai

On AI progress:

Pichai touched on Alphabet’s full stack approach to AI tech:

- AI infrastructure: Alphabet unveiled TPU v7 (Ironwood) for large-scale inference and reinforced its early access to NVIDIA’s latest GPUs, signaling continued leadership in custom and third-party AI compute.

- Models and tooling: Pichai praised the progress of Gemini 2.5 Pro and 2.5 Flash, with usage surging across developer tools. Open-source models like Gemma are gaining traction, and new efforts are emerging in robotics and biotech.

- Products and platforms: Gemini now powers all major consumer products. Android and Pixel lead the charge, with AI upgrades rolling out to phones, tablets, wearables, and cars later this year.

On Search:

“We see [AI] growing the number and types of questions we can answer. […] AI Overviews is going very well with over 1.5 billion users per month, and we’re excited by the early positive reaction to AI Mode. […] We are getting really positive feedback from early users about its design, fast response time, and ability to understand complex, nuanced questions.”

Pichai also touted significant growth in multi-modal queries, with Circle to Search usage growing 40%. In short, Search is alive and well.

On Gemini:

“We rolled out Gemini 2.5, our most intelligent AI model, which is achieving breakthroughs in performance, and it’s widely recognized as the best model in the industry. […] Active users in AI Studio and Gemini API have grown over 200% since the beginning of the year.”

Leadership can be fleeting in the competitive world of LLMs. Gemini has consistently performed well with new releases, positioning Alphabet toe to toe or ahead of other leading models. But if distribution is the moat, Alphabet’s in pole position—with 15 products reaching over half a billion users.

On Waymo:

“Waymo is now safely serving over a quarter of a million paid passenger trips each week. That’s up 5X from a year ago.”

The paid service is live in Silicon Valley and has expanded in Austin via Uber. Next is Atlanta this Summer (also via Uber).

Chief Business Officer Philipp Schindler

On macro trends:

“The changes to the de minimis exemption will obviously cause slight headwind to our Ads business in 2025, primarily from APAC-based retailers.”

There are many moving pieces impacting advertising revenue in 2025, notably the tough comps from the financial service vertical throughout 2024, and advertisers impacted by the more recent US tariffs. That aid, they will be hard to pinpoint without additional commentary in the coming quarters.

4. What to watch looking forward

Streamlining to refocus

Alphabet is tightening operations—even as it invests aggressively in AI.

- Layoffs hit Platforms & Devices: Hundreds of roles were cut across teams tied to Android, Pixel, and Chrome, part of a broader effort to reduce duplication and streamline execution. The impacted division has historically struggled to gain meaningful hardware traction outside of Android’s dominance. This move signals a sharper focus on high-margin, scalable products—especially cloud and AI services.

- Chorus spun out of X: The company also spun off Chorus, a supply chain optimization startup born out of the X moonshot lab. Now operating independently, Chorus aims to use AI for real-time supply chain visibility and logistics efficiency. This reflects Alphabet’s continued willingness to incubate and externalize moonshots that show commercial promise, without weighing down the core business.

Search Gets Smarter

Search is no longer just about links—it’s becoming conversational.

- “AI Mode” launched in March: Rolled out as an experimental feature, it lets users enter multi-step, complex queries and receive AI-generated responses powered by Gemini 2.0. It’s a deeper step into generative AI integration across core services. Queries people are typing in AI Mode are 2x longer.

- Premium-only (for now): Access is currently limited to Google One AI Premium subscribers in the US, offering a new potential lever for subscription monetization. The move edges Search closer to a chat-like assistant—reshaping how information is accessed and monetized.

But rivals are circling.

- ChatGPT now sees an estimated 123 million daily users, processing over 1 billion queries, boosted by its integration into iPhones.

- Perplexity AI, while smaller, has reached 15 million active users, with strong traction among students and professionals.

Still, the scale gap is massive. Google processes over 5 trillion searches annually, and AI Overviews already reach 1.5 billion users—and counting

During the recent antitrust trial, an executive testified that ChatGPT has siphoned off some search traffic—but not the high-value, commercial queries that power revenue.

It might only be a matter of time. But for now, reports of Search’s death have been greatly exaggerated, with revenue still chugging along.

Regulators, however, might not see it that way.

Source: App Economy Insights

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Alphabet Q1 2025 Earnings Preview and Prediction: What to Expect