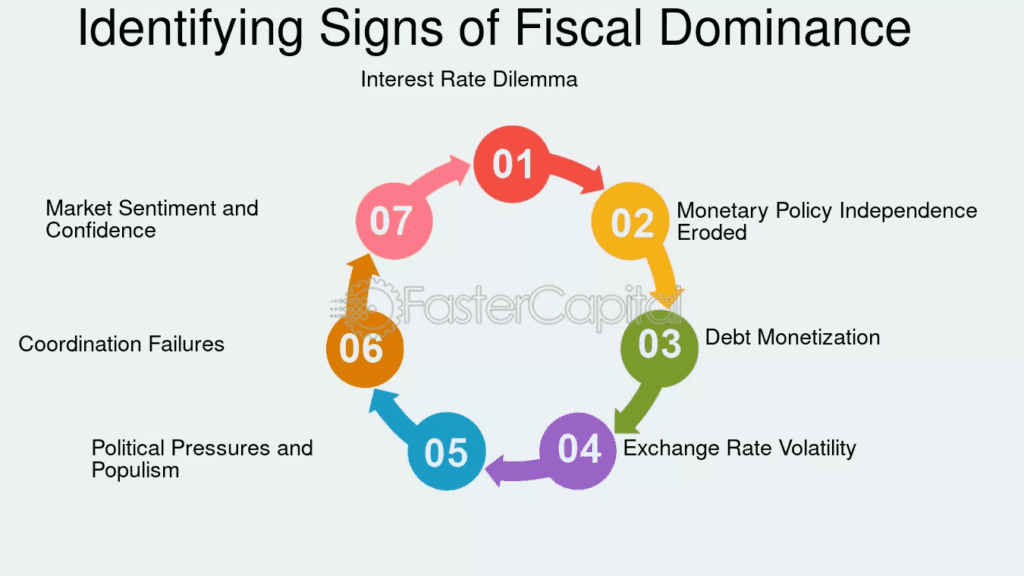

In today’s rapidly evolving macroeconomic landscape, few forces are as underappreciated—yet as influential—as fiscal dominance. As global debt levels skyrocket and inflationary pressures persist, this powerful dynamic is quietly constraining central banks around the world, transforming the way monetary policy is made.

What Is Fiscal Dominance?

At its core, fiscal dominance refers to a situation where a government’s fiscal policy—its decisions about spending and borrowing—begins to overpower the central bank’s ability to independently conduct monetary policy. In other words, when national debt becomes so large that raising interest rates would risk a fiscal crisis, central banks may be forced to keep rates low, even in the face of high inflation.

This creates a policy environment in which controlling inflation takes a backseat to managing debt burdens, making it harder for central banks to meet their mandates.

How Fiscal and Monetary Policy Are Supposed to Work

- Monetary policy is controlled by central banks. It includes adjusting interest rates and managing money supply to stabilize inflation and support employment.

- Fiscal policy is managed by governments and focuses on taxation and public spending to stimulate or cool down the economy.

Under normal circumstances, these two work independently but in coordination. However, in a fiscally dominant regime, the central bank becomes a de facto arm of fiscal authorities, often having to accommodate government debt levels instead of prioritizing inflation control.

Why Fiscal Dominance Is Gaining Ground Today

Global debt has soared to unprecedented levels:

- The U.S. debt-to-GDP ratio rose above 120% in 2023, up from just 60% in 2007.

- Japan’s debt exceeds 260% of GDP.

- The Eurozone averages around 90%, with Italy pushing past 140%.

This explosion of debt means that even modest interest rate hikes could lead to unsustainable debt servicing costs. For instance, if U.S. Treasury yields rose to 5%, annual interest payments could surpass $1 trillion, crowding out essential government functions.

Historical Precedents of Fiscal Dominance

- Post-World War II United States

- Debt-to-GDP: Over 120%

- Fed capped interest rates at around 2.5%

- Inflation averaged 6% annually, reducing real debt burdens by over 30% in a decade

- 1970s United Kingdom

- Heavy public spending limited the Bank of England’s ability to tighten

- Inflation surged past 20%

- Control only regained with aggressive 17% interest rates in 1979

- Japan (1990s-2000s)

- Debt exceeded 200% of GDP

- The Bank of Japan held rates near zero

- Result: decades of low growth and deflation

Modern-Day Consequences of Fiscal Dominance

1. Central Banks Are Cornered As governments rely more on deficit spending to manage crises (e.g., COVID-19, defense, infrastructure), central banks face mounting pressure to keep rates low. Raising rates to fight inflation could crash bond markets or trigger a fiscal crisis.

2. Inflation May Stay Higher for Longer Traditional 2% inflation targets may become politically unfeasible. Instead, central banks might accept 3-4% inflation over the long term to “inflate away” debt.

3. Financial Repression Returns In such regimes, governments often:

- Keep nominal interest rates below inflation

- Use regulatory tools to force financial institutions to hold government debt

This stealth strategy reduces the real value of debt over time, but at the cost of savers and fixed-income investors.

4. Market Volatility Rises Investors no longer have a clear sense of central bank priorities. Will they tighten policy to fight inflation? Or pivot to protect government finances? This uncertainty increases volatility across equities, bonds, and currencies.

5. Gold and Hard Assets Shine During periods of financial repression and persistent inflation, assets like gold historically outperform. In the 1970s, gold rose 1,600% over a decade.

What This Means for Investors

Navigating an era of fiscal dominance requires a strategic shift:

- Diversify globally: Reduce exposure to single-currency risks, particularly the U.S. dollar

- Emphasize real assets: Gold, commodities, infrastructure, and real estate can protect against inflation

- Prepare for volatility: Markets may swing more violently in response to shifting policy narratives

- Watch debt metrics: Keep an eye on debt-to-GDP ratios, budget deficits, and central bank balance sheets

Final Thoughts: A Paradigm Shift in the Making

We are entering a period where the old rules of monetary policy may no longer apply. As fiscal dominance takes root, inflation targeting, independent central banks, and predictable rate cycles may all become relics of the past.

For investors, the challenge is clear: understand the forces at play, adapt to a world of blurred fiscal and monetary lines, and position for a future shaped not just by economics, but by the political constraints of debt.

Fiscal dominance isn’t just a risk. It’s already here.

Based on insights from Macro Mornings by Alessandro and economic history. Original source: Macro Mornings – Fiscal Dominance Deep Dive

Dollar Role in Global Economy: Analyzing US dollar future’s reserve currency status

The Dot-com bubble burst: How irrational exuberance led to tech stock collapse

Energy Transition and Its Macro Impact

Collapse of Enron (2001) – How corporate fraud reshaped corporate governance