China’s decision to freeze exports of rare earth magnets and heavy rare earth elements comes as the sharpest blow yet in the intensifying U.S.–China trade conflict. These materials — used in everything from Teslas to Tomahawk missiles — are suddenly trapped behind China’s new export wall.

Starting April 4, China introduced strict export licensing for six rare earth metals and nearly all magnets containing them. The catch? The licensing system isn’t functional yet. Multiple ports across China have stopped clearing shipments entirely, leaving raw material containers stranded.

Rare earth magnets power:

- Electric car motors (Tesla, BYD)

- Drones and robotic arms

- Jet engines and guided missiles

- Capacitors in AI servers and smartphones

Michael Silver, CEO of American Elements, said his firm was told it may take at least 45 days before any licenses are issued — if at all. For many U.S. companies, that’s too long.

Why It Matters: These Metals Drive the Tech Economy

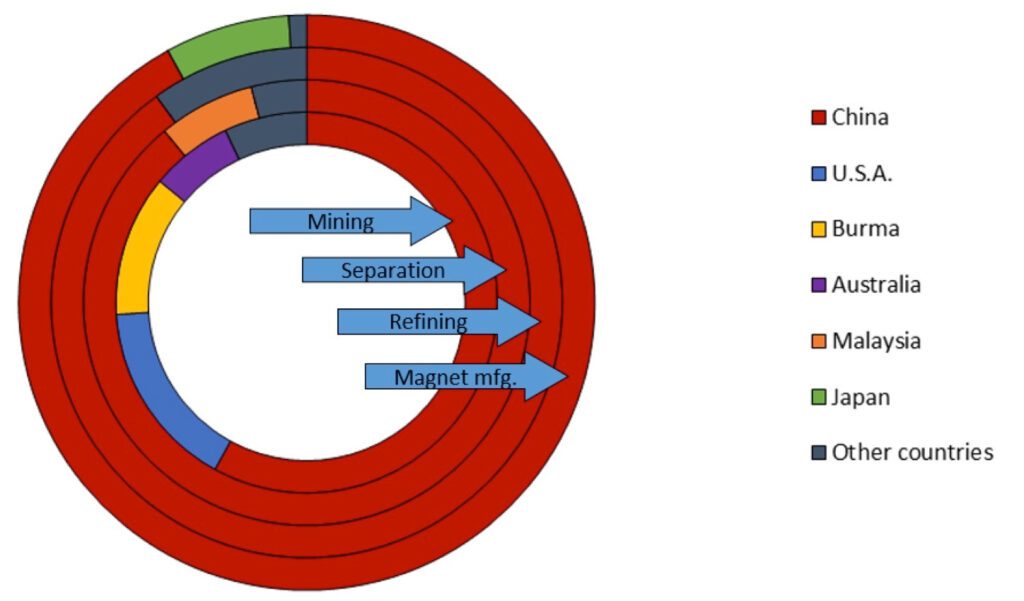

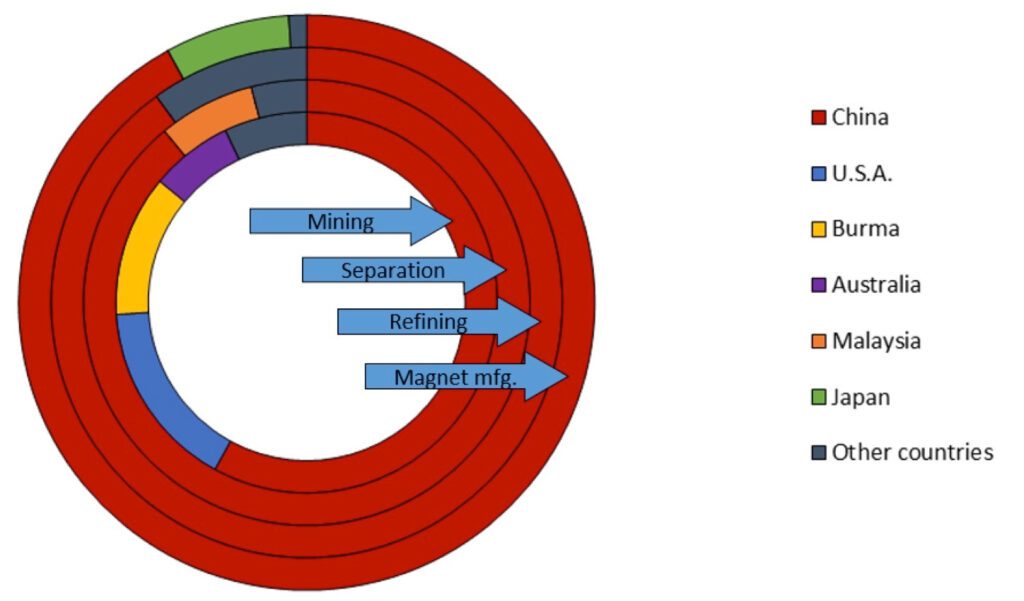

Most Americans don’t realize it, but China supplies 90% of the world’s rare earth magnets and nearly 100% of the heavy rare earth elements that prevent magnets from degrading under high temperatures. Without them, electric motors stall, AI chips lose capacity, and defense systems falter.

Dysprosium oxide, one of the most critical materials affected, trades at over $200/kg in Shanghai — much more in the U.S. It is vital for producing magnets that don’t demagnetize in heat or electromagnetic fields — a must for modern aerospace and military systems.

Daniel Pickard, chair of the U.S. Critical Minerals Advisory Committee, confirmed the stakes:

“Does the export control or ban potentially have severe effects in the U.S.? Yes.”

Factories Running on Fumes

Many Japanese firms have stockpiles lasting a year — a hard-earned lesson from China’s 2010 rare earth embargo. But most U.S. companies carry little to no inventory due to cost pressures. Now, that decision could shut down production lines.

One bright spot: MP Materials’ Mountain Pass mine in California — the U.S.’s only rare earth mine — is racing to begin magnet production in Texas by year-end, supplying clients like GM. But current capacity is limited, and full independence from China remains years away.

Global Supply Jam — Not Just the US at Risk

Chinese customs are blocking exports of rare earths and magnets to all countries, not just the U.S. Some ports allow minimal exceptions — magnets with trace amounts of heavy rare earths, bound for non-U.S. destinations — but enforcement is wildly inconsistent.

Meanwhile, Japan and Germany, the only other producers of these powerful magnets, still rely on China for raw materials, meaning China’s chokehold reaches global scale.

Inside China’s Magnet Empire: Pollution and Power

The world’s rare earth monopoly is centered in Jiangxi province, where mining methods involve injecting toxic chemicals into red clay hillsides, leaching rare metals into collection basins. After years of pollution concerns, some mines near Longnan resumed quietly this month — diesel pumps now hum as chemicals gurgle through plastic tubes.

TheseGanzhou — home to JL Mag, China’s top rare earth magnet factory — remains the beating heart of the global supply chain. The company supplies both Tesla and BYD, and its magnets deliver 15x the strength of standard iron magnets. In 2019, Xi Jinping visited the plant, sending an unmistakable signal: these materials are a strategic weapon.

Finblog Takeaway:

China has played its most powerful card yet — and it hits at the core of modern tech and defense.

This isn’t about raw materials alone. It’s a geopolitical reset as Beijing wields control over the metals that make the modern world run.

Expect ripple effects:

- Supply chain disruptions in EVs, AI chips, and aerospace

- Rising costs for defense and tech firms

- Accelerated Western push to decouple from China’s mineral monopoly

But in the short term, the U.S. is vulnerable. And China knows it.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Tariffs on Phones and Microchips Will Return — Electronics Exemption Only Temporary

90 Deals in 90 Days?: Experts say good luck with that

China strikes back with 125% tariffs on U.S. goods, starting April 12

Tesla stops taking new orders in China

145% Tariffs and a Global Showdown: China Rejects US “Arrogance”

EU to impose retaliatory 25% tariffs on US goods from almonds to yachts

Trump Raises Tariffs On China To 125% After Beijing’s 84% Move