Solar stocks have had a tough year, facing headwinds from policy shifts under the Trump administration. However, it’s worth remembering that solar equities performed well during Trump’s first term, and some analysts believe that long-term tailwinds remain strong.

Since taking office, President Trump has prioritized fossil fuels, nuclear, and geothermal energy, freezing federal grants and loans for renewable projects, pausing offshore wind leasing, and withdrawing from the Paris Climate Agreement. Despite these challenges, solar energy still contributes 7% of the U.S. electric grid, and industry growth projections remain positive.

The Solar Energy Industries Association (SEIA) reports that solar accounted for 64% of all new electricity-generating capacity in the U.S. through Q3 2024, with total capacity now reaching 220 GW, enough to power over 37 million homes. Moreover, Fortune Business Insights predicts that the global solar market will expand at a CAGR of 6% through 2032, with the U.S. holding a dominant 41% market share.

With long-term growth intact but short-term volatility high, which solar stocks are best positioned for future gains?

Daqo New Energy Corp ($DQ) – A High-Risk, High-Reward Play in Polysilicon

📉 Stock Performance: +8.2% in the past year

💰 Current Price: $20.63

📊 Price Target: $25.76 (WSJ average)

💰 Net Cash: $853.4M vs. Total Liabilities: $724.3M

Daqo New Energy ($DQ) is a leading supplier of high-purity polysilicon, a key material for solar panel efficiency. China dominates the polysilicon market, supplying 92% of global production as of 2023.

However, Daqo has faced pricing pressure, reporting a $60 million net loss in Q3 2024 as polysilicon prices remained below production costs. The industry is in a balancing phase, exiting an oversupply cycle, which could present a buying opportunity before a turnaround.

Despite recent losses, Daqo maintains strong cash reserves, with total equity worth $6.3 billion and a low debt-to-equity ratio. If polysilicon demand rebounds, DQ stock could benefit significantly.

First Solar ($FSLR) – The Leading U.S. Solar Player

📉 Stock Performance: +4.2% in the past year

💰 Current Price: $150.70

📊 Price Target: $272.79 (WSJ average, 81% upside)

💰 Net Income (Q3 2024): $312.9M

💰 Net Cash: $1B vs. Liabilities: $265.3M

First Solar ($FSLR) stands out for its Cadmium Telluride (CadTel) thin-film solar modules, which offer lower costs and higher efficiency than traditional silicon-based panels. The company’s scaling strategy is similar to the lithium battery industry, focusing on cost reductions through efficiency improvements.

In Q3 2024, First Solar reported $887.6M in sales and a net income of $312.9M. Its cash reserves of $1 billion far outweigh its short-term liabilities, positioning the company for continued expansion.

Upcoming Catalyst: First Solar reports FY2024 earnings on February 25. A strong report could reignite investor confidence.

At its current price near multi-year lows, FSLR presents a compelling long-term opportunity, with 81% upside potential based on WSJ forecasts.

NextEra Energy ($NEE) – A Diversified Renewable Giant with Dividend Growth

📉 Stock Performance: +30% in the past year

💰 Current Price: $71.41

📊 Price Target: $85.83 (WSJ average)

⚡ Total Power Capacity: 67 GW

💰 Dividend Yield: 2.91% (Annual Payout: $2.06 per share)

Unlike pure solar plays, NextEra Energy ($NEE) is a diversified energy company spanning solar, wind, and nuclear power. The company’s Florida Power & Light (FPL) subsidiary is a dominant player, adding 2.2 GW of new solar capacity in 2024.

NextEra’s business model is built on stability, with long-term power purchase agreements (PPAs) securing predictable cash flow. The company plans to increase its annual dividend per share payout by 10% through 2026, making it an attractive option for income-focused investors.

In 2024, NextEra added 12 GW of renewables, and it forecasts 8% annual earnings growth through 2027, ensuring steady expansion despite shifting policy landscapes.

Conclusion: Will Solar Stocks Rebound?

In conclusion,

🔹 Daqo ($DQ) offers high-risk, high-reward exposure to the polysilicon market.

🔹 First Solar ($FSLR) is the top U.S. solar manufacturer, with 81% upside potential based on analyst forecasts.

🔹 NextEra ($NEE) provides diversified renewable exposure, with stable dividends and consistent earnings growth.

Solar stocks are at a crossroads. On one hand, shifting U.S. energy policies favor fossil fuels, nuclear, and geothermal energy, creating short-term headwinds for the sector. On the other hand, solar power continues to grow globally, with projections showing long-term expansion driven by cost reductions, technological advancements, and increasing energy independence initiatives.

For investors, this presents both risks and opportunities.

🔹 Policy uncertainty and market volatility may weigh on solar stocks in the near term.

🔹 However, long-term demand for solar remains strong, and companies with efficient scaling strategies and solid financials could thrive.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source: Tokenist

Related:

Here Are All the Reasons Why Bitcoin Fall From a Record

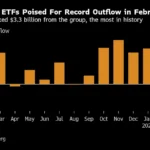

ETF Inflows at Record Highs – A Bullish Signal or a Bubble?

Which Stocks Super Investors Bought Recently?

How long can NVIDIA stay untouchable?

Trump Organization Files Trademark for Metaverse & NFT Trading Platform

Trade war is back: After new tariffs S&P 500 erased $500+ BILLION of market cap, Bitcoin dropped

Trump vows March 4 tariffs for Mexico, Canada, extra 10% for China over fentanyl

How Trump’s 25% EU Tariffs Could Impact the Stock Market & Key Sectors

How Will Tesla Be Affected by 25% EU Tariffs?

Trump vows to slap 25% tariffs on EU and claims bloc was ‘formed to screw US