Palantir Technologies (NYSE: PLTR) has been a standout performer in 2024, with shares soaring 262% year-to-date. However, analysts, including Jefferies’ Brent Thill, are cautioning investors about the stock’s unsustainable valuation, rising insider sales, and reduced retail ownership following its S&P 500 inclusion.

- Skyrocketing Stock Performance:

- Palantir shares are up 262% in 2024, driven by optimism over its AI positioning.

- Overvaluation Concerns:

- Currently trades at a 43x EV/NTM revenue multiple, far exceeding most software peers.

- Comparable multiples were last seen during the COVID-19 bubble for high-growth stocks.

- Insider Selling Activity:

- CEO Alex Karp has sold nearly 40 million shares ($1.9 billion) in the past three months.

- Karp plans to sell an additional 9 million shares by May 2025, which could pressure the stock.

- Total insider sales valued at $11.1 million in the last three months.

- Ownership Shifts:

- Retail ownership dropped 7% to 42% after S&P 500 inclusion.

- Institutional ownership increased to 25% for index funds and 27% for active funds.

- Analysts predict limited upside from institutional demand as much of it is already priced in.

- Analysts’ Views:

- Brent Thill (Jefferies): Rates Palantir as Sell with a price target of $28, implying a 55% downside.

- Among other analysts:

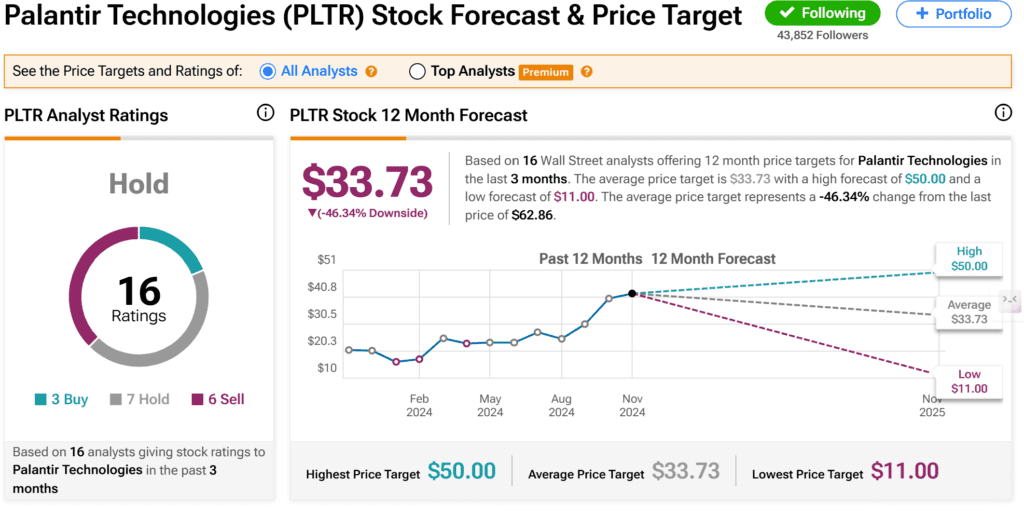

- 5 Sell ratings, 7 Hold ratings, and 3 Buy ratings.

- Average price target of $33.73, suggesting a 46% pullback.

- Historical Context:

- Palantir’s multiple expansion outpaces peers like Oracle, which saw a modest 48% increase in NTM revenue multiple.

While Palantir has captivated investors with its massive rally in 2024, analysts warn of its steep valuation and insider selling as significant risks. Most experts recommend caution, with consensus leaning towards holding or selling the stock at current levels.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.