Don’t jump off the Nvidia bandwagon just yet.

China’s AI startup DeepSeek sent shockwaves through the stock market as investors reacted to fears of a cheaper open-source large language model (LLM), raising concerns about U.S. dominance in AI. The sell-off led to a sharp decline in tech stocks, particularly Nvidia (NASDAQ: NVDA), which suffered a staggering 16.9% drop, erasing $589 billion from its market cap in a single day.

Tech Stocks Plunge as Nasdaq Declines 3%

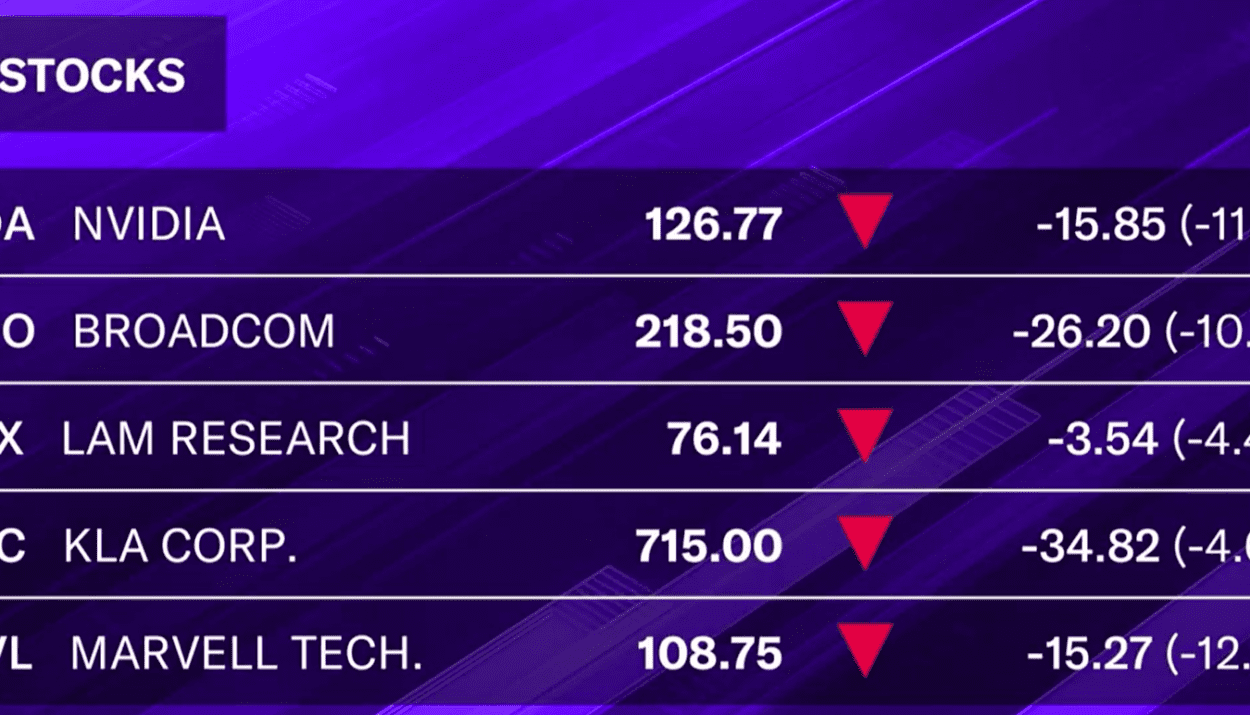

The Nasdaq Composite Index (^IXIC) closed down 3%, while the S&P 500 (^GSPC) dropped 1.5%. Other major tech stocks followed Nvidia’s decline:

- Microsoft (MSFT) fell 2%

- Alphabet (GOOGL) dropped 4%

- Broadcom (AVGO), Lam Research (LRCX), KLA (KLAC), and Marvell (MRVL) all posted losses

The sell-off added pressure to Big Tech ahead of their Q4 earnings reports, as Wall Street expects slowing profit growth—down to 22%, its slowest pace in nearly two years, due to rising capital expenditures (capex) concerns.

Panic Selling May Be Overblown, Analysts Say

Despite the market turmoil, analysts argue that the sell-off is exaggerated. Bernstein’s Stacy Rasgon dismissed fears that DeepSeek could spell “doomsday for AI infrastructure.” He emphasized that the demand for AI computing power is far from hitting its peak:

“I am not of the belief that we’re anywhere close to the cap on compute needs for artificial intelligence. If you’re freeing up compute capacity, it likely gets absorbed. We’re going to need innovations like this to keep AI going.”

Futurum’s Chief Strategist Daniel Newman echoed this view, citing the Jevons Paradox—which suggests that increased efficiency in AI computing will drive even greater AI adoption.

“The market is completely missing this one. If we can use compute more efficiently, AI companies will build models cheaper, reduce overhead costs, and ultimately increase earnings per share (EPS).”

Even Microsoft CEO Satya Nadella weighed in, tweeting that as AI efficiency improves, its use will skyrocket, further boosting demand for AI infrastructure and chips.

Market Recovery and Broader Economic Outlook

As investor sentiment stabilized, Microsoft pared losses, and Amazon (AMZN) and Meta (META) closed positive, up 0.3% and 1.9%, respectively.

Seema Shah, Principal Asset Management’s Chief Global Strategist, downplayed concerns about a major market correction, emphasizing that macroeconomic conditions remain strong:

“The economic environment is still very constructive for earnings across most sectors. If DeepSeek is everything they’re saying, it’s ultimately positive for global productivity—this certainly isn’t the end of U.S. exceptionalism.”

While the Nasdaq finished the day down 3%, the Dow Jones Industrial Average (^DJI) reversed early losses, closing up 0.65%, signaling resilience in the broader market.

Conclusion

The DeepSeek-fueled sell-off highlights market fears over AI disruption but also underscores the potential for more efficient AI technologies to drive long-term growth. While Nvidia and other chipmakers face near-term pressure, analysts believe that AI demand will continue to expand, making this downturn more of a temporary reaction than a fundamental shift in the market.

With upcoming earnings reports and continued AI advancements, investors will be watching closely to see how tech giants navigate this evolving landscape.

Related articles:

What Is DeepSeek and Why Is It Crashing AI Stocks?