Gold has once again reclaimed its role as the ultimate safe-haven, surging past $3,500 per ounce in early September 2025 as investors react to President Donald Trump’s escalating trade war, record U.S. debt, and unprecedented political pressure on the Federal Reserve.

Gold’s Run: Driven by Uncertainty

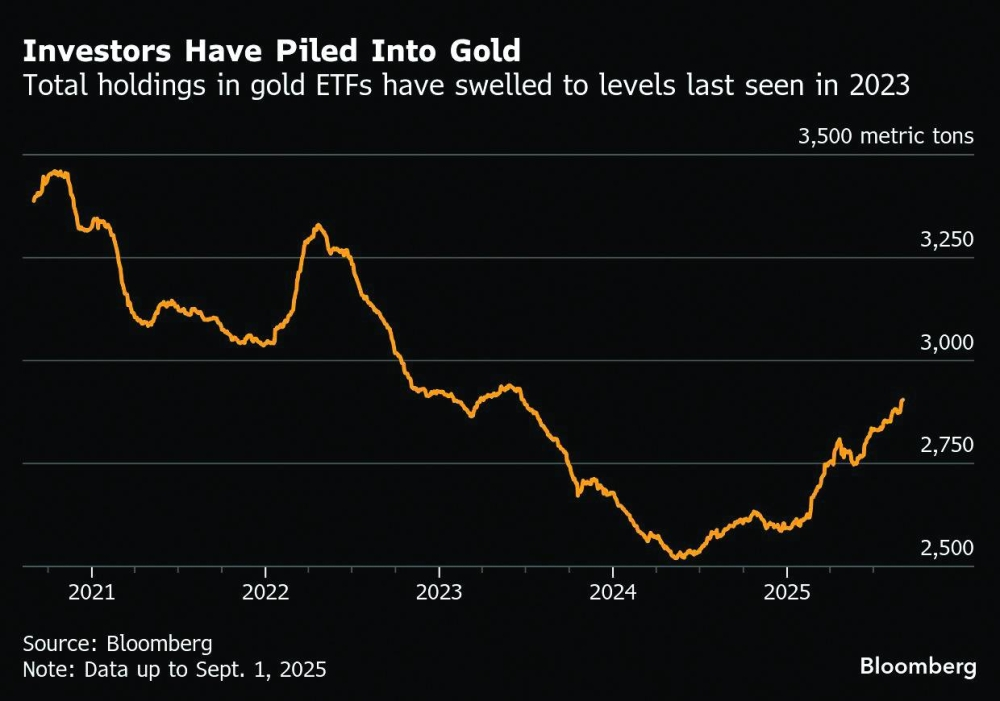

For centuries, gold has been the default asset in times of turmoil—and 2025 has proved no different. Investors are piling into bullion and gold-backed ETFs at the fastest pace since mid-2023, extending a rally that began in 2024.

Trump’s trade agenda, which has already faced setbacks in U.S. courts, has heightened inflation risks and rattled trust in the dollar and U.S. Treasuries—long considered safe havens. That shift in confidence is pushing capital toward gold instead.

Why Investors Choose Gold

- Safe-haven appeal: Gold retains value in crises and is globally liquid.

- Inflation hedge: Tariffs risk lifting consumer prices, while gold historically protects against currency erosion.

- Lower-rate environment: With the Fed expected to cut rates in September, gold’s lack of yield becomes less of a disadvantage versus bonds.

“Gold is thriving in an environment where both the U.S. dollar and Treasuries—the usual safe harbors—are under strain,” one strategist noted.

Central Banks Still Buying

Another powerful tailwind: central banks. Since Russia’s reserves were frozen in 2022, emerging markets have doubled down on gold to diversify away from the dollar. In 2024 alone, central banks bought over 1,000 tonnes of bullion for the third straight year.

India and China also remain strong pillars of demand. Indian households alone hold roughly 25,000 tonnes of gold—five times what is stored in Fort Knox.

Challenges for Gold’s Rally

Still, risks exist:

- Profit-taking: After nearly 18 months of relentless gains, some consolidation may come as traders lock in profits.

- Policy shocks: A peace deal in Ukraine or a major rollback of Trump’s tariffs could dampen gold’s safe-haven bid.

- Central banks: If major holders slowed or reversed purchases, momentum could weaken, though no such moves are on the horizon.

The Market Impact

The surge in bullion has global implications:

- For investors: Gold ETFs are attracting flows not seen since the pandemic era.

- For currencies: The dollar, at a three-year low, is amplifying the metal’s run.

- For geopolitics: Gold’s role as an alternative to dollar reserves underscores shifting trust in U.S. financial leadership.

Gold above $3,500 is more than just a price milestone—it’s a message. Investors no longer see the U.S. dollar and Treasuries as untouchable safe havens. With Trump’s tariff battles, swelling U.S. debt, and a Fed under political attack, gold has reclaimed its crown as the global shelter of choice. Unless there is a major political de-escalation, the rally looks set to stay alive through 2025.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Nvidia Q2 2026 Earnings Preview and Prediction: What to expect

Why Warren Buffett and Hedge Funds Are Betting on UnitedHealth Stock (UNH)