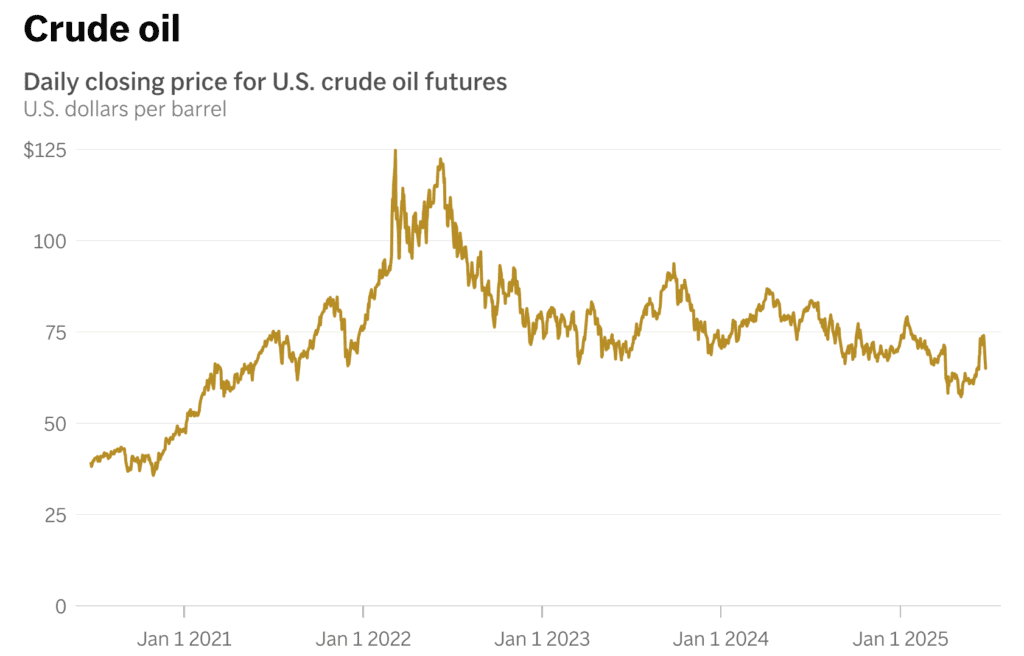

Crude oil prices have tumbled despite last week’s Iranian missile strike on a US military base in Qatar — an act that, in the past, would have triggered a full-blown global energy crisis. But with the ceasefire now holding between Iran and Israel, markets have remained calm. US benchmark crude is down more than 7%, and Brent has dropped over 5%, surprising many who expected greater volatility.

The reasons are surprisingly structural: a new global oil order, a shift in demand, and the world’s growing immunity to geopolitical shocks.

Oil Abundance, Not Scarcity

- The world is oversupplied with oil, thanks to record production levels from the US, Canada, Brazil, and non-OPEC countries.

- The US is now the largest oil producer, surpassing Saudi Arabia in 2018. Domestic output has remained strong even amid price fluctuations.

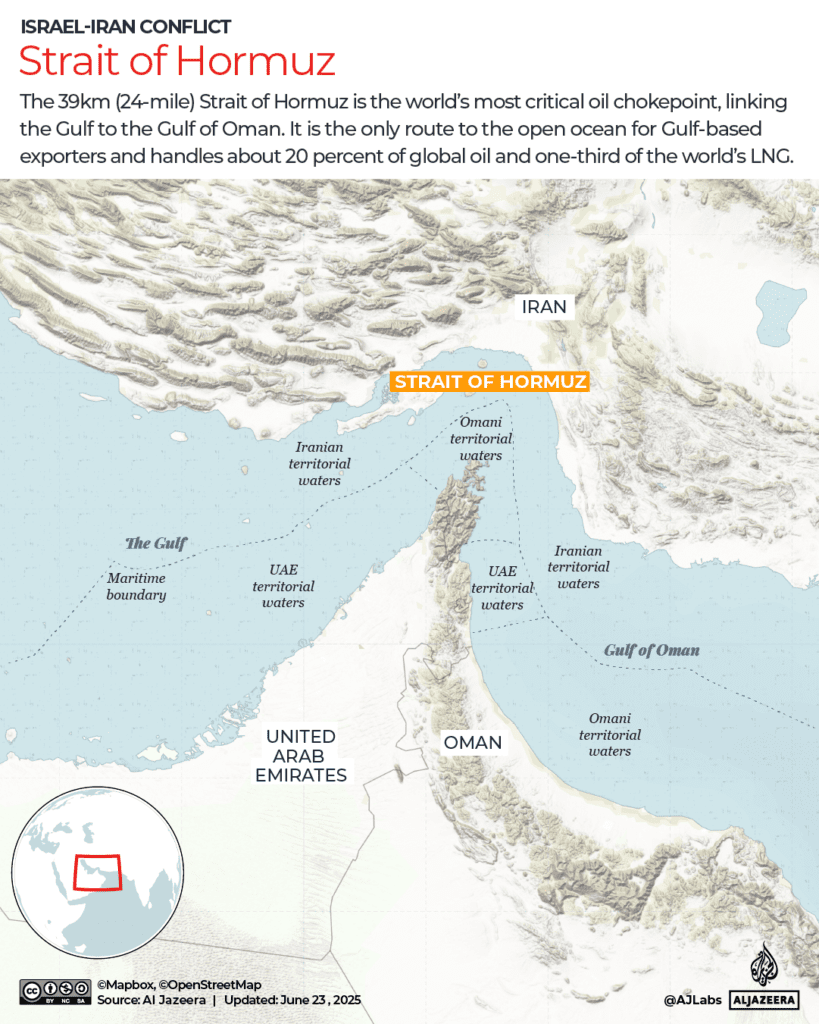

- Iran’s missile attack didn’t disrupt actual oil flows. The Strait of Hormuz — the critical route for 20% of global oil — remains open.

“If Iran were serious about retaliation, it would sink an oil tanker,” said Robin Brooks of the Brookings Institution. “It isn’t doing that — it’s bending the knee.”

Markets Aren’t Panicking Like Before

- Traders have learned not to overreact. Past conflicts — including Hamas-Israel clashes and the Russia-Ukraine war — caused only temporary spikes.

- Energy strategist Rebecca Babin calls it the “boy who cried wolf” effect. Spikes fade quickly when real supply disruptions don’t follow.

Demand Is Slowing — and Changing

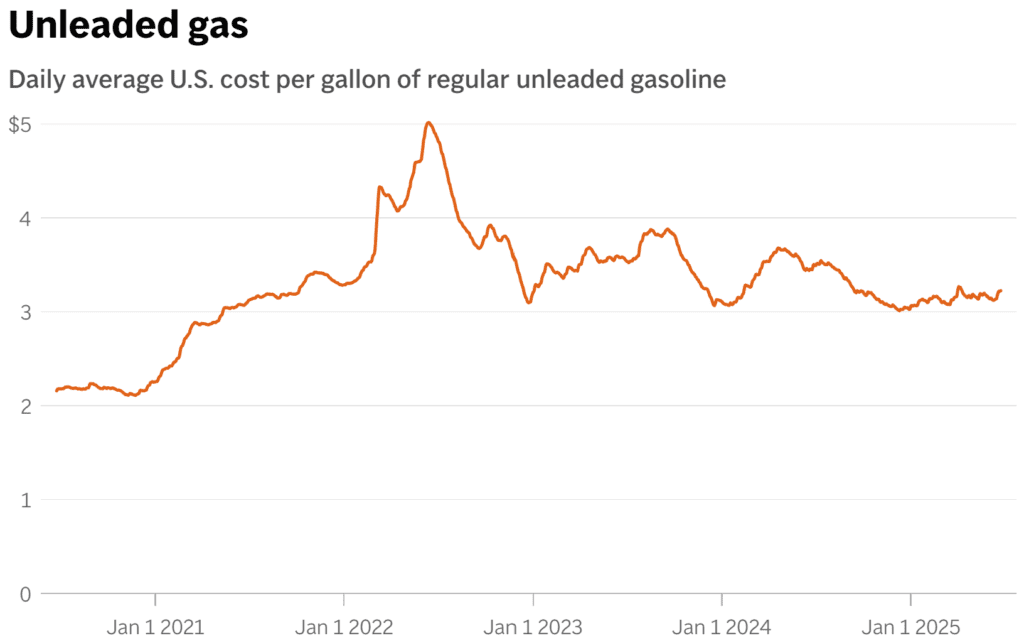

- Gasoline prices have fallen for three years straight. This week’s drop in crude will likely pull pump prices down starting this weekend.

- The rise of electric vehicles (EVs) and cleaner technologies is softening demand. 1 in 5 cars sold globally last year was electric.

- Meanwhile, fossil fuel engines are getting more efficient, and airlines have slashed travel projections amid economic unease.

“Oil’s share of global energy demand dropped below 30% in 2024 — a historic first,” reported the International Energy Agency.

Alternative Energy Is Catching Up

- 80% of electricity growth last year came from renewables like wind and solar, according to the IEA.

- Tech giants (Meta, Microsoft, Google, Amazon) are now investing in nuclear energy to power data centers and AI infrastructure.

- Demand for natural gas grew 2.7% last year, far outpacing crude oil’s 0.8% rise.

What Could Change the Equation?

- Analysts say if Iran closes the Strait of Hormuz, oil could shoot up to $110/barrel.

- But few believe that will happen — Iran relies on that same route to export its oil, mostly to China, which buys 90% of Iranian crude.

- Meanwhile, the US Strategic Petroleum Reserve and OPEC+ spare capacity act as buffers in case of serious disruption.

Trump’s Political Gamble

President Trump has demanded low oil prices while imposing tariffs that risk stoking inflation. Gas prices have fallen 12% year-over-year, but the White House is watching closely.

“EVERYONE, KEEP OIL PRICES DOWN, I’M WATCHING,” Trump posted Monday.

Yet, even Trump’s push to “drill, baby, drill” may fall flat. US producers aren’t ramping up despite the pressure — not due to politics, but because the market is telling them not to.

So, the oil market today is more resilient, more diversified, and more cautious than at any point in recent history. Unless the Strait of Hormuz is shut or a real supply crisis erupts, prices may stay subdued — even with missiles flying in the Middle East.

Sources:

- https://www.apnews.com/article/oil-supply-demand-middle-east-1d4c15bf394235396e755c74bef4b458

- https://www.aljazeera.com/economy/2025/6/24/fragile-iran-israel-ceasefire-calms-oil-markets

- https://www.npr.org/2025/06/25/nx-s1-5444030/oil-prices-iran-israel

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

S&P 500 Nears All-Time High After Stunning Rebound from April Lows

Trump rebukes Israel and Iran hours after ceasefire: Latest Updates

Ceasefire “Now in Effect” as Israel and Iran End 12 Days of War — But Deadly Strikes Continue

Trump Announces Ceasefire Between Israel and Iran

Why Oil Prices Plunged and Stocks Rose After Iran’s Missile Attack on US Bases

Markets Brace for Chaos as Strikes, Inflation, and FED: What to watch this week

Iran–Israel–US Conflict Erupts: Nuclear Strikes, Hormuz Threats, and Global Fallout

US-Iran Conflict Escalates After Strikes on Nuclear Sites: What We Know So Far