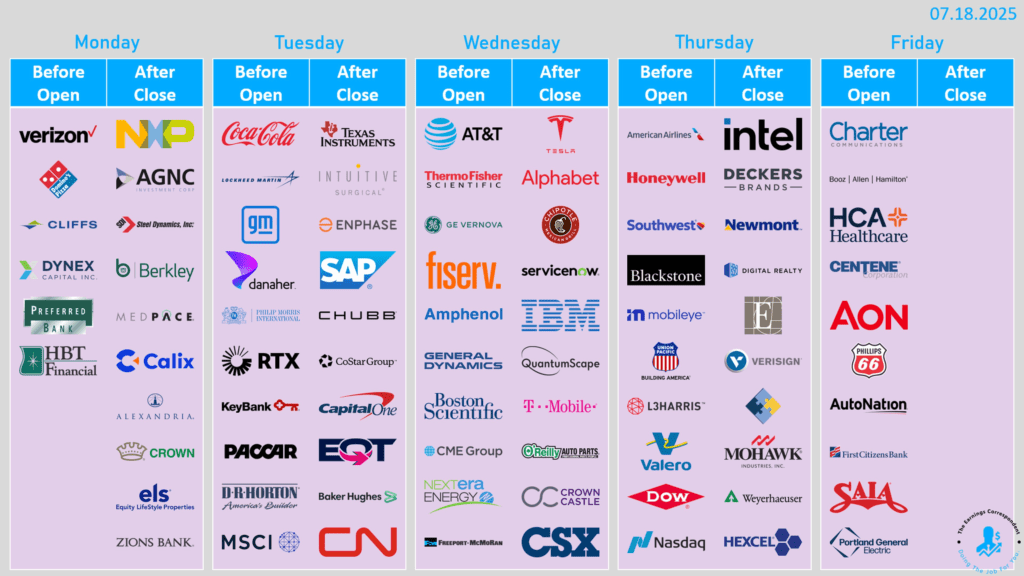

Stocks are perched near record highs, yet volatility could return fast: President Trump says “big trade letters” (35‑40 % duties) may go out any day, Fed officials enter blackout still split on a July cut, and 112 S&P 500 companies—including Alphabet, Tesla, Coca‑Cola and Intel—will report. Here’s what matters, day by day.

Why the setup matters

- Tariff brinkmanship: Trump’s threat of a blanket 15‑20 % levy on EU goods—and fresh letters to other nations—keeps trade risk alive even as investors hope earnings steal the spotlight.

- Fed drama: Governor Christopher Waller openly backs a July cut and says he’d take the chair if offered, but futures see just a 5 % chance. The FOMC enters its quiet period after Wednesday’s data run.

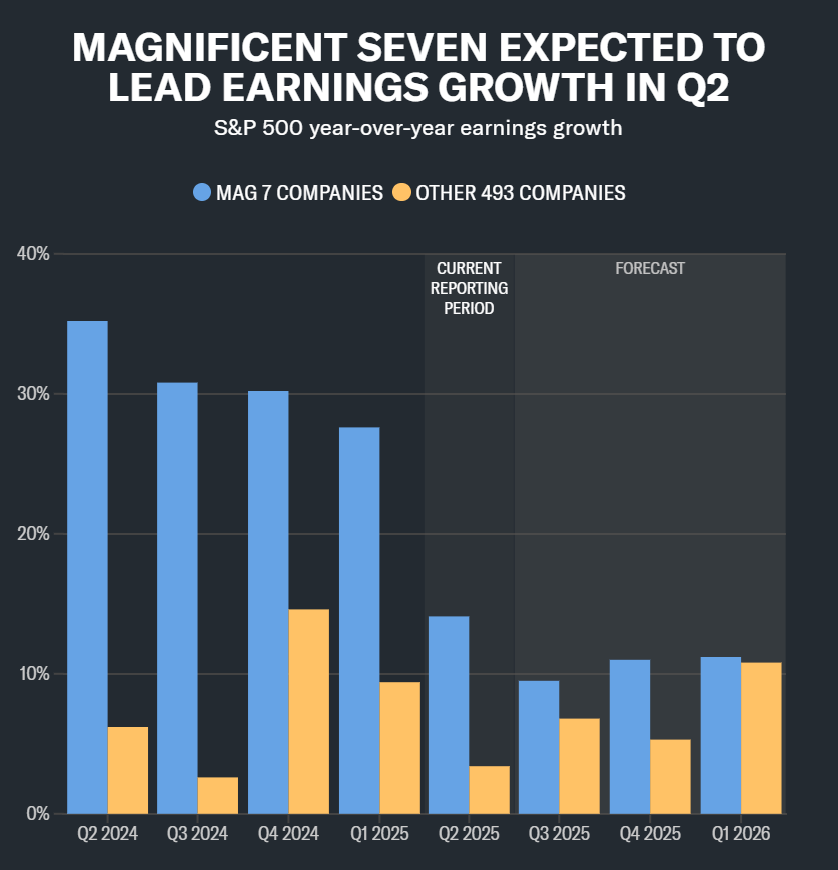

- Earnings breadth test: Big Tech’s results will drive headline growth, but bulls are watching whether the “other 493” finally show stronger momentum—a key sign of market broadening.

Calendar snapshot (all times ET)

| Day | Macro Highlights | Key Earnings |

|---|---|---|

| Mon 22 Jul | Leading Economic Index (10:00) | Verizon, Domino’s, Steel Dynamics |

| Tue 23 Jul | Richmond Fed mfg (10:00) | Coca‑Cola, General Motors, Lockheed, Texas Instruments, Philip Morris, Capital One |

| Wed 24 Jul | MBA mortgages (07:00); Existing Home Sales (10:00) | Alphabet, Tesla, AT&T, IBM, GE Vernova, Chipotle, O’Reilly, Hasbro |

| Thu 25 Jul | Jobless claims; S&P Global flash PMIs; New‑home sales | Intel, Blackstone, Honeywell, American Airlines, Dow Inc., Union Pacific, Keurig Dr Pepper |

| Fri 26 Jul | Durable‑goods orders (08:30) | Charter Communications |

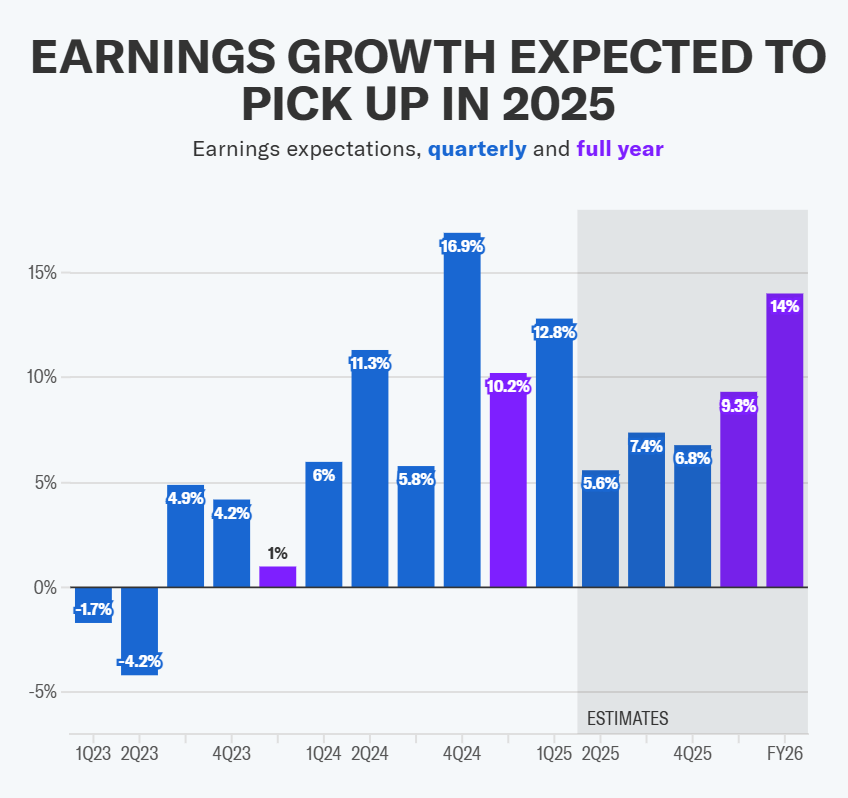

Earnings scorecard so far

The Q2 season is off to a statistically strong—but market‑tepid—start. Big banks opened the floodgates with across‑the‑board beats on net‑interest income and trading revenue, while $NFLX topped both sales and EPS estimates Thursday night and nudged its full‑year revenue outlook higher. Taken together, these reports lifted the S&P 500’s blended earnings‑growth forecast to +5.6 % year‑over‑year, up from 4.8 % a week earlier (FactSet).

Yet price action has been underwhelming. Netflix—up almost 100 % over the past 12 months—slid ~5 % on Friday despite the beat, underscoring how hard it is to impress when multiples are lofty. That dynamic worries some strategists: the index now trades around 24.7 × trailing earnings after a 30 % surge off the April lows. As Evercore ISI’s Julian Emanuel notes, solid prints merely keep the market aloft at those valuations, while even minor misses could trigger sharp pullbacks. William Blair’s Ralph Schackart summed it up after Netflix: “Good results, but tough to clear sky‑high expectations.”

Themes to trade

- Tariff tape bombs: Any White House “deal letter” could jolt cyclicals and EU‑exposed names.

- Magnificent Seven vs. the rest: Alphabet AI capex, Tesla margins and supply‑chain commentary may set the tone for tech multiples. The Magnificent Seven is expected to have grown earnings by 14.1% compared to the year prior during the second quarter. The other 493 stocks in the index are expected to have seen just 3.4% year-over-year earnings growth. That means the prospect of S&P earnings surprising to the upside largely hinges on Big Tech results.

- Broadening watch: Results from Coca‑Cola, Lockheed, Intel and Union Pacific will show whether old‑economy sectors are finally contributing to earnings momentum.

- Rate‑cut odds: Soft PMI or housing data could revive July or September cut bets; a hawkish surprise would do the opposite.

A tariff headline, a Fed leak or a single Big Tech miss could flip sentiment quickly, but if earnings and macro prints hold up, the summer rally has room to run. Stay nimble.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

The 60/40 Portfolio Under the Microscope: 150 Years of Market Stress‑Testing

Trump To Open 401k Market To Crypto, Gold, And Private Equity

93.5 % Battery Material Tariff by US: 5 Stocks Poised to Benefit Most From It

How Nvidia Jensen Huang Persuaded Trump to Sell AI Chips to China

Stocks Inch Up as Trump Softens Tariff Talk; CPI and Bank Earnings Ahead

JPMorgan Targets KOSPI 5,000; Short Bets Hit Record

Tariff Shock, or Just a Ripple? June CPI Faces Market That No Longer Flinches

Week Ahead (July 14 – 18): Inflation Check, Big Bank Earnings, Tech Titans