A holiday-shortened week still delivers a heavy lineup of economic data, corporate earnings, and political drama. The August jobs report, Broadcom and Salesforce earnings, and the fallout from a federal court ruling on Trump’s tariffs will set the tone for investors.

Markets on Monday, September 1 (Labor Day)—A Preview

U.S. Markets: Closed for Labor Day. Futures held steady, signaling cautious investor positioning ahead of a packed economic and earnings week.

Europe (Stoxx 600): Rebounded roughly 0.3%, particularly in tech stocks, as traders shrugged off Friday’s losses.

Asia: Mixed tone—Japan’s Nikkei fell ~1.6% (chip stocks weighed heavily), while China’s CSI 300 held its ground, buoyed by enthusiasm over domestic AI developments. Alibaba leapt nearly 19% on optimism around its cloud business. (More about: Asia stocks suffer tech jitters, China plays its own game)

Currencies & Commodities: The U.S. dollar weakened, gold climbed further, and oil eased ahead of a planned OPEC+ production increase.

Crypto Markets: Bitcoin (108K) weakened modestly alongside broader risk-asset sentiment. The cryptocurrency remains sensitive to macro-data and the broader “risk-off” tone, with traders watching the week’s economic releases, like jobs data and CPI, for signals on potential Fed easing.

Labor Market in Focus

The centerpiece of the week is Friday’s August employment report. Economists expect around +75,000 new jobs, an unemployment rate of 4.3% (up from 4.2%), and wage growth of +0.3% month-on-month, +3.8% year-on-year.

This report comes after July’s shock revisions erased more than 250,000 previously reported job gains and pushed Fed Chair Jerome Powell to admit the labor market is in a “curious balance” of slowing supply and demand. Powell warned that downside risks could materialize quickly in the form of higher layoffs.

Other labor data will guide markets before Friday:

- JOLTS job openings (Wed) – expected to slip to 7.23M, signaling cooling demand.

- ADP payrolls (Thu) – forecast +70k, down from +104k.

- Initial jobless claims (Thu) – expected 228k, steady but creeping higher.

Federal Reserve and Policy Drama

The jobs data feeds directly into the Fed’s September 16–17 meeting, where a rate cut is now widely expected.

But there is also political theater:

- Trump’s attempt to remove Fed Governor Lisa Cook remains in legal limbo after a court hearing Friday.

- The Senate will hold a hearing this week for Stephen Miran, Trump’s nominee to fill a Fed seat. If confirmed, Miran would add another voice pushing for more aggressive cuts.

Together, these developments raise questions about Fed independence but don’t change the near-term outlook: markets still expect easing.

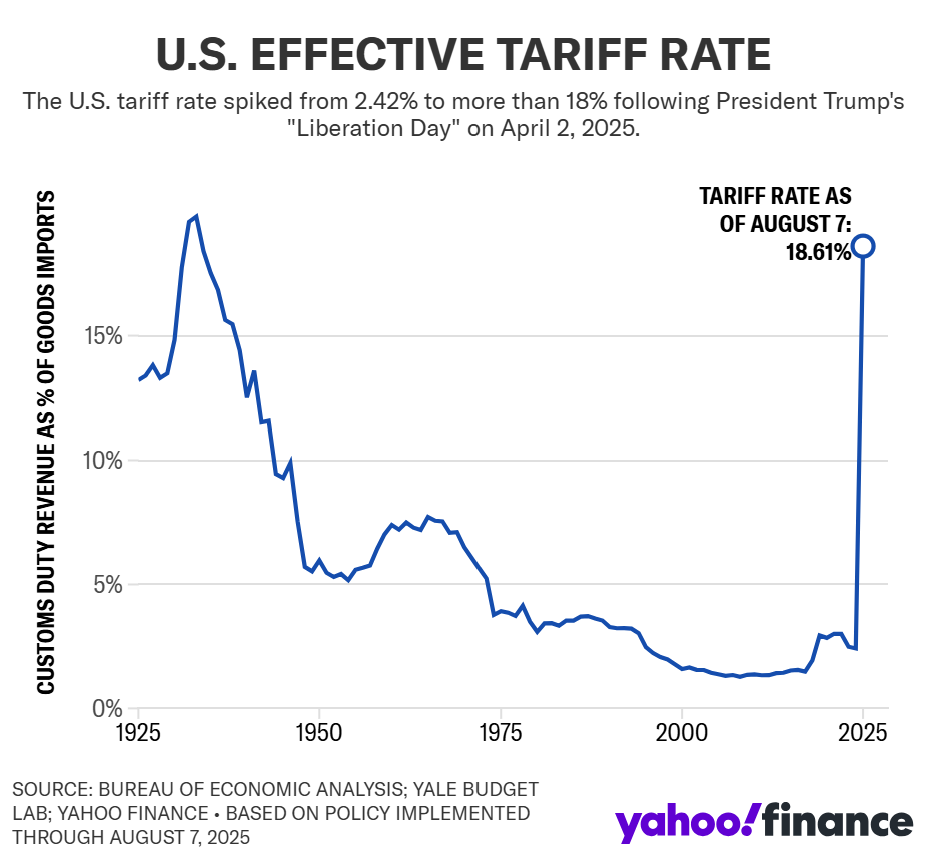

Tariff Uncertainty: Supreme Court Ahead

Markets also face fallout from a federal appeals court ruling that most of Trump’s emergency tariffs are illegal. The court said the IEEPA law doesn’t authorize tariffs, though it left them in place until October 14 to allow a Supreme Court appeal.

More about: What if the tariffs are ruled illegal? and what is next?

If upheld, Trump’s emergency tariffs—which cover a 10% baseline on nearly all imports and higher levies on countries like China, India, and Mexico—could be refunded to importers, removing ~$100 billion in revenue. That would ease costs for import-heavy companies but strip Trump of his key trade weapon.

For now, businesses are left in limbo, with some delaying shipments to avoid duties they might not have to pay. The uncertainty itself weighs on sentiment.

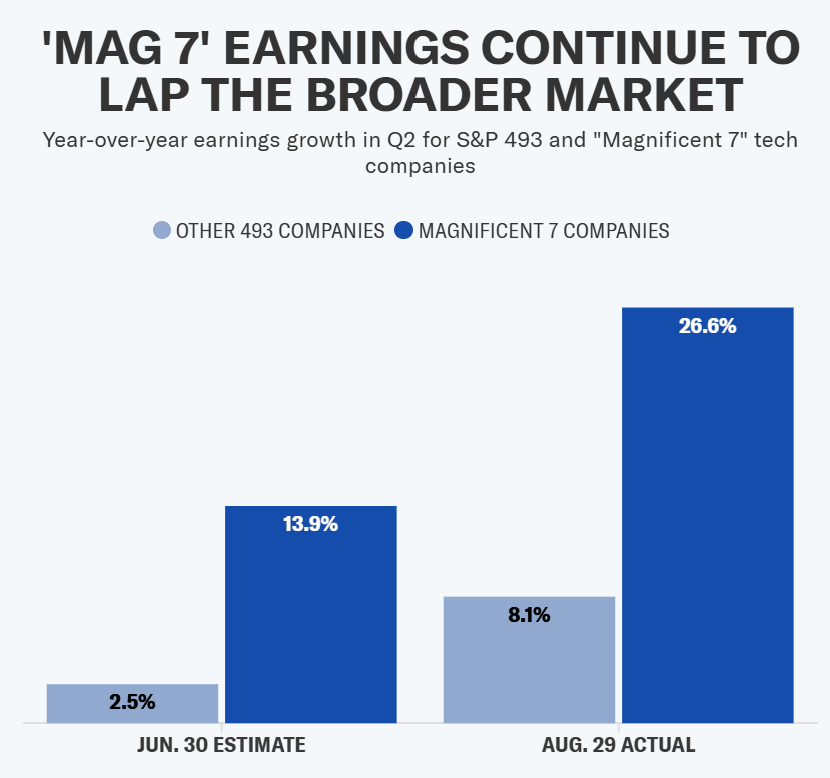

It’s Still a ‘Magnificent’ Market

Second-quarter earnings season is nearly complete, and the Magnificent Seven—Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, and Tesla—once again dominated. Their combined earnings growth hit 26.6%, compared to just 8.1% for the rest of the S&P 500. Meta, Microsoft, Amazon, and Nvidia were among the biggest drivers of overall index growth.

Analysts expect gains for these giants to cool in the coming quarters, while the rest of the S&P 500 could reaccelerate into 2026. Still, their strength explains why the rally since April has been so durable: the Q2 slowdown proved milder than feared, keeping momentum alive. From June 30 through last Friday, the S&P 500 rose 5%, showing just how resilient the market remains.

Key Economic Data Beyond Jobs

- Tuesday: ISM Manufacturing PMI (expected 48.9), S&P US Manufacturing PMI (final).

- Wednesday: Factory orders (expected -1.4%), Fed Beige Book, vehicle sales.

- Thursday: Productivity Q2, trade deficit (expected -$62.6B), ISM Services PMI (expected 50.5), S&P Services PMI (final).

These reports will flesh out whether the economy is slowing in line with Fed expectations.

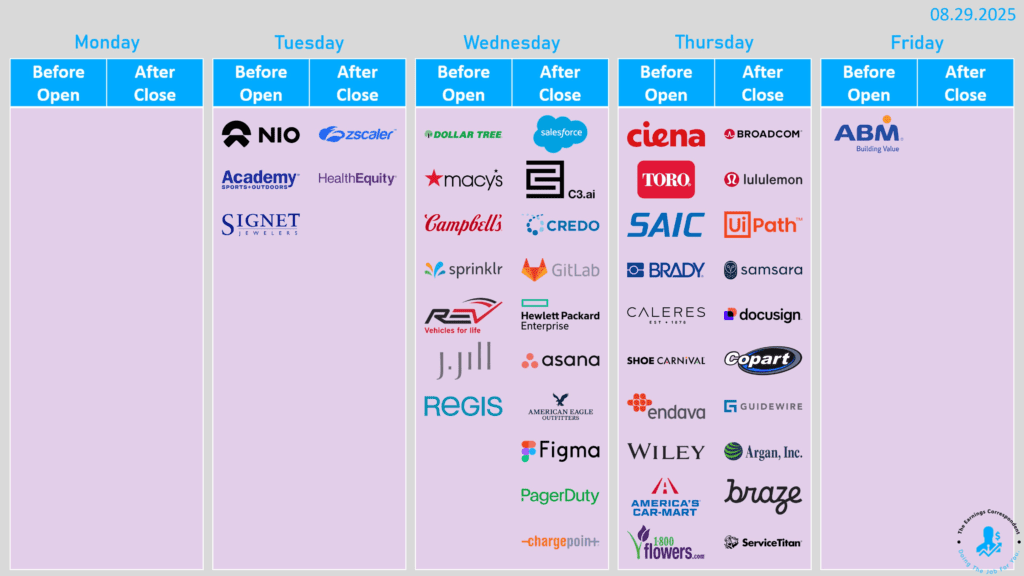

Earnings to Watch

Salesforce (CRM) – Wed:

- Focus on AI integration, new sales forecasts, and margin discipline.

- Investors want proof that AI features are driving demand and renewals.

Figma (FIG) – Wed:

- First earnings since IPO. Spotlight on billings, enterprise adoption, and AI-powered design features.

Broadcom (AVGO) – Thu:

- Key test of the AI semiconductor story after Nvidia.

- Investors will watch AI chip revenue run-rate, hyperscaler demand, and VMware integration.

These results will give signals on consumer spending (DLTR, LULU, M, AEO), AI software adoption (C3.ai, DocuSign), and enterprise IT budgets (HPE, CRM, FIG, AVGO).

| Date | Economic Data | Earnings Reports |

|---|---|---|

| Mon, Sept 1 | US markets closed for Labor Day | US markets closed for Labor Day |

| Tue, Sept 2 | – S&P Global US Manufacturing PMI, Aug (final, prior 53.3) – ISM Manufacturing PMI, Aug (48.9 expected, 48 prior) – Construction Spending, Jul | Zscaler (ZS), NIO (NIO), Nebius Group (NBIS), HealthEquity (HQY), Signet Jewelers (SIG), Academy Sports & Outdoors (ASO) |

| Wed, Sept 3 | – MBA Mortgage Applications (week ending Aug 29, prior -0.5%) – JOLTS Job Openings, Jul (7.23M expected, 7.4M prior) – Factory Orders, Jul (-1.4% expected, -4.8% prior) – Wards Total Vehicle Sales, Aug (16M expected, 16.41M prior) – Fed Beige Book | Salesforce (CRM), Figma (FIG), Hewlett Packard Enterprise (HPE), Dollar Tree (DLTR), Campbell’s (CPB), Macy’s (M), C3.ai (AI), American Eagle (AEO) |

| Thu, Sept 4Economic & Earnings Calendar (Sept 1–5, 2025) | – ADP Employment, Aug (+70k expected, +104k prior) – Initial Jobless Claims, week ending Aug 30 (228k expected, 229k prior) – Trade Balance, Jul (-$62.6B expected, -$60.2B prior) – Productivity, Q2 – ISM Services PMI, Aug (50.5 expected, 50.1 prior) – S&P Global US Services PMI, Aug (final, 50.5 expected, 50.1 prior) | Broadcom (AVGO), Lululemon (LULU), DocuSign (DOCU), Samsara (IOT), Guidewire (GWRE), Ciena (CIEN), ServiceTitan (TTAN), Toro (TTC), Copart (CPRT) |

| Fri, Sept 5 | – US Nonfarm Payrolls, Aug (+75k expected, +73k prior) – Unemployment Rate, Aug (4.3% expected, 4.2% prior) – Avg Hourly Earnings, Aug (+0.3% m/m expected, +0.3% prior; +3.8% y/y expected, +3.9% prior) | ABM Industries (ABM) |

Market Setup

- Equities: August ended with the S&P 500 above 6,500 before slipping Friday. Jobs and earnings could decide whether momentum carries into September.

- Rates & USD: Weak jobs = lower yields, softer dollar. Hot jobs = higher yields, stronger dollar, pressure on growth stocks.

- Sectors:

- AI & semis (NVDA, AVGO, CRM, FIG) remain the leadership group.

- Retail (LULU, DLTR, M, AEO) shows consumer resilience or weakness.

- Import-heavy industries could benefit if tariff refunds become likely.

This week brings three intertwined forces:

Jobs & Fed: August payrolls will likely decide a September rate cut. Weak data = green light for easing, strong data = tougher call.

Earnings test: Broadcom, Salesforce, and retail names like Lululemon and Dollar Tree show whether AI growth is real and if consumers are still holding up.

Tariff fight: Appeals court struck down most Trump tariffs, but left them until October. The Supreme Court battle adds fresh uncertainty for trade and markets.

Even though it’s a short holiday week, the stakes couldn’t be higher. Between the jobs report that could lock in a Fed rate cut, earnings that will test both the AI boom and consumer strength, and a looming Supreme Court fight over tariffs, investors have plenty to watch. Put simply, this week could shape the market’s path for the rest of the year.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Nvidia Q2 2026 Earnings Preview and Prediction: What to expect

Why Warren Buffett and Hedge Funds Are Betting on UnitedHealth Stock (UNH)