If you’re wondering what companies are in S&P 500, you’re asking about a prestigious list of 500 of the largest publicly traded companies in the United States. The S&P 500, or Standard & Poor’s 500, is a stock market index that tracks the performance of 500 of the largest publicly traded companies in the United States.

It is widely regarded as one of the best representations of the U.S. stock market and the broader economy. Furthermore, the S&P 500 is market-capitalization-weighted, meaning that companies with larger market capitalizations have a greater influence on the index’s performance.

How Are Companies Selected for the S&P 500?

Companies are selected for inclusion in the S&P 500 based on several key criteria:

- Market Capitalization: A company must have a market capitalization of at least $14.6 billion to be considered for inclusion.

- Liquidity: The company’s stock must be highly liquid (ratio of 0.75 or greater), meaning it is traded frequently and in significant volumes.

- U.S. Company: The company must be based in the United States.

- Public Float: At least 50% of the company’s shares must be available to the public for trading (a minimum of 250,000 shares in the previous six months before evaluation).

- Financial Viability: The company must have positive earnings in the most recent quarter, as well as over the sum of its most recent four quarters.

- Sector Representation: The S&P 500 aims to represent the major sectors of the U.S. economy, so the inclusion of companies is also based on their industry sector.

- Index Committee Review: The final selection of companies is made by the S&P 500 Index Committee, which reviews candidates based on these criteria and their overall contribution to the index’s market representation.

These criteria ensure that the S&P 500 remains a reliable benchmark for U.S. stock market performance, reflecting the health and diversity of the largest and most influential companies in the country.

What Companies Are in S&P 500?

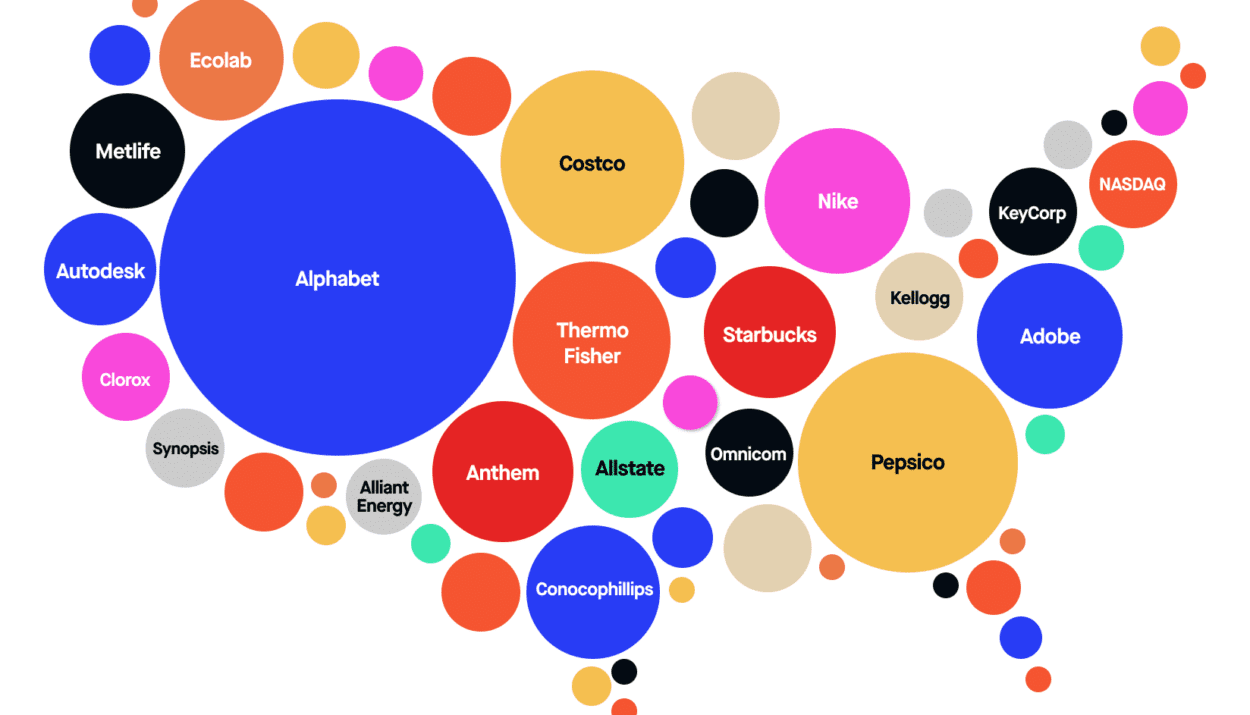

Understanding what companies are in the S&P 500 involves recognizing the major players that dominate the index, as well as the diversity of sectors represented.

- Tech Giants: Technology companies represent a significant portion of the S&P 500, reflecting the sector’s growth and importance in the U.S. economy. Some of the largest tech companies in the S&P 500 include Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Amazon (AMZN), and Meta Platforms (META).

- Healthcare Leaders: The healthcare sector is another major component of the S&P 500, featuring companies like Johnson & Johnson (JNJ), Pfizer (PFE), and UnitedHealth Group (UNH). These companies play a crucial role in both the U.S. and global healthcare markets, driving innovation and delivering essential services.

- Financial Giants: The financial sector is well-represented in the S&P 500, with major banks and financial institutions like JPMorgan Chase (JPM), Bank of America (BAC), and Wells Fargo (WFC) among the top companies. These institutions are central to the U.S. financial system, influencing everything from consumer banking to global finance.

- Consumer Goods: Companies that produce consumer goods are also a key part of the S&P 500. This includes household names like Procter & Gamble (PG), Coca-Cola (KO), and PepsiCo (PEP). These companies are staples in American households, offering products that range from food and beverages to personal care items.

- Energy Sector: The energy sector is represented by giants like ExxonMobil (XOM) and Chevron (CVX), which are key players in the global oil and gas industry. These companies are vital to the U.S. economy, providing energy resources and influencing global energy markets.

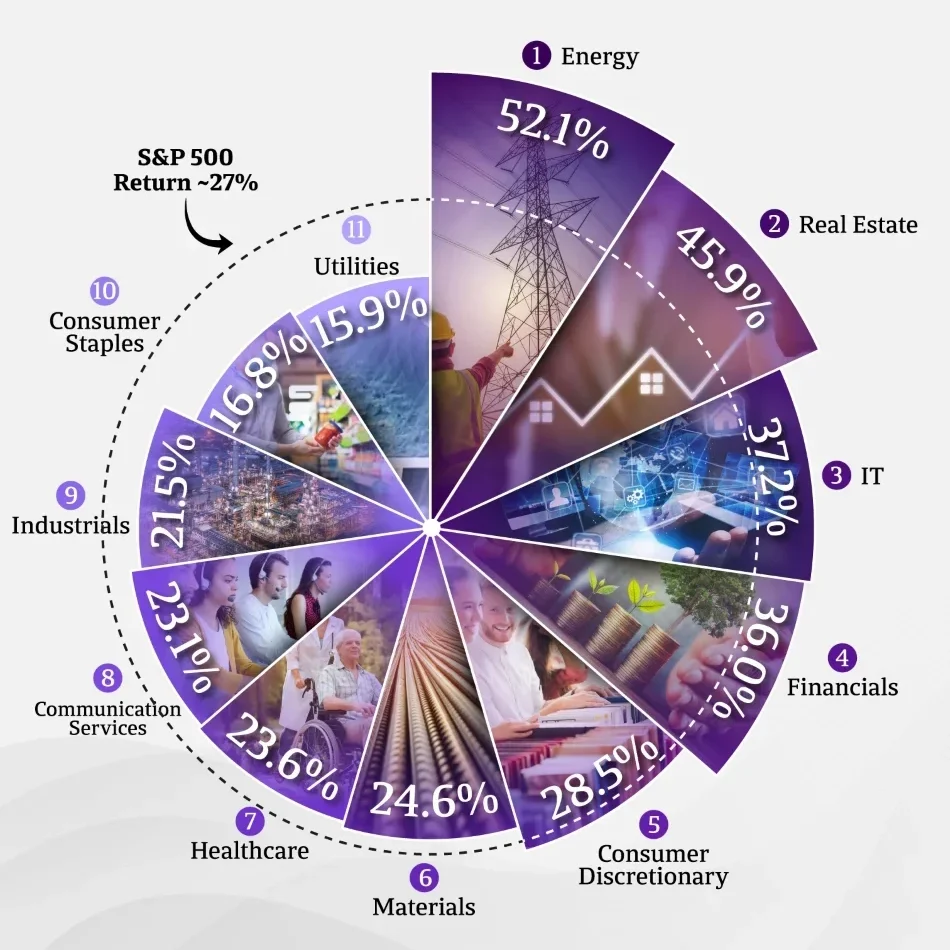

Top Sectors in the S&P 500

The table below lists the S&P 500’s top sectors by weighting as of Aug. 15, 2024. The information technology, financials, healthcare, and consumer discretionary sectors carry a cumulative weight of about 66.37%. Meanwhile, the least-weighted sectors include energy, utilities, and real estate—which have a combined weight of just 8.66%.

| Top 10 Sectors in the S&P 500 by Weight | |

|---|---|

| Information Technology | 31.87% |

| Financials | 12.56% |

| Health Care | 12.26% |

| Consumer Discretionary | 9.68% |

| Communications Services | 9.07% |

| Industrials | 7.86% |

| Consumer Staples | 6.05% |

| Energy | 3.70% |

| Utilities | 2.59% |

| Real Estate | 2.37% |

Top 25 Companies by Index Weight

The top 25 companies by index weight in the S&P 500 are crucial indicators of the overall health of the stock market and the broader economy. These companies, representing a significant portion of the index, reflect the performance of key sectors and major corporations.

Factors contributing to the strong performance of these top stocks include a resilient GDP, declining inflation, strong profit margins, competitive positioning, and emerging trends like AI. Additionally, their large size provides a level of safety during economic downturns, making them pivotal in understanding market trends and economic health.

To analyze the weighting of these top companies, the SPDR S&P 500 ETF Trust (SPY) is often used as a proxy since it closely mirrors the S&P 500’s composition, even though its holdings may slightly differ from the index.

A full list is here:

| 1 | APPLE (APPL): | 6.97% |

| 2 | MICROSOFT (MSFT): | 6.74% |

| 3 | NVIDIA (NVDA): | 6.33% |

| 4 | AMAZON.COM, INC (AMZN): | 3.39% |

| 5 | META PLATFORMS INC, CLASS A (META): | 2.52% |

| 6 | ALPHABET INC CL A (GOOGL): | 2.05% |

| 7 | BERKSHIRE HATHAWAY (BRK.B): | 1.73% |

| 8 | ALPHABET INC CL C (GOOG): | 1.73% |

| 9 | ELI LILLY (LLY): | 1.62% |

| 10 | BROADCOM (AVGO): | 1.50% |

| 11 | JPMORGAN CHASE & COMPANY (JPM): | 1.32% |

| 12 | TESLA (TSLA): | 1.22% |

| 13 | UNITEDHEALTH GROUP INC (UNH): | 1.16% |

| 14 | EXXON MOBIL (XOM) | 1.15% |

| 15 | VISA INC. (V): | 0.90% |

| 16 | THE PROCTER AND GAMBLE CO (PG): | 0.87% |

| 17 | COSTCO (COST): | 0.83% |

| 18 | JOHNSON AND JOHNSON (JNJ): | 0.83% |

| 19 | MASTERCARD (MA) | 0.82% |

| 20 | HOME DEPOT, INC. (HD): | 0.77% |

| 21 | ABBIE INC (ABBV): | 0.74% |

| 22 | WALMART (WMT): | 0.64% |

| 23 | MERCK (MRK): | 0.63% |

| 24 | NETFLIX (NFLX): | 0.62% |

| 25 | COCA COLA (KO): | 0.58% |

Why the S&P 500 Matters

Understanding what companies are in the S&P 500 is crucial for investors because the index is widely regarded as a key indicator of U.S. market performance.

- Benchmark for Investors: The S&P 500 is often used as a benchmark for mutual funds, ETFs, and other investment products. Investors use it to gauge the performance of their portfolios against the broader market. Because it includes 500 large-cap companies, the S&P 500 provides a broad view of the market, making it a reliable benchmark.

- Economic Indicator: The S&P 500 is also a critical economic indicator. When the index is rising, it generally suggests that investors are confident in the economy and that companies are performing well. Conversely, a declining S&P 500 can indicate economic challenges or investor uncertainty.

The Impact of S&P 500 Companies

The companies in the S&P 500 are not only influential in the financial markets but also have a significant impact on the global economy.

- Global Influence: Many S&P 500 companies are multinational corporations with operations spanning the globe. Their decisions can affect global supply chains, employment, and economic growth in numerous countries. For example, Apple’s supply chain decisions can impact manufacturing in China, while ExxonMobil’s operations influence global energy prices.

- Innovation: Companies in the S&P 500 are innovation leaders, driving advancements in technology, healthcare, and other industries. Firms like Tesla (TSLA) and Alphabet (GOOGL) are at the forefront of technological innovation, pushing boundaries in electric vehicles, AI, and other cutting-edge fields.

- Corporate Responsibility: Many S&P 500 companies are also leaders in corporate social responsibility (CSR). They invest in sustainable practices, contribute to community development, and prioritize ethical business practices. For instance, companies like Microsoft (MSFT) and Starbucks (SBUX) are recognized for their efforts in sustainability and social impact.

Sources: