Governments impose tariffs on imported goods or services designed to influence trade and protect domestic industries. These financial tools significantly shape economies, impact global markets, and affect everyday consumers. But what exactly are tariffs, and how do they work?

What Are Tariffs?

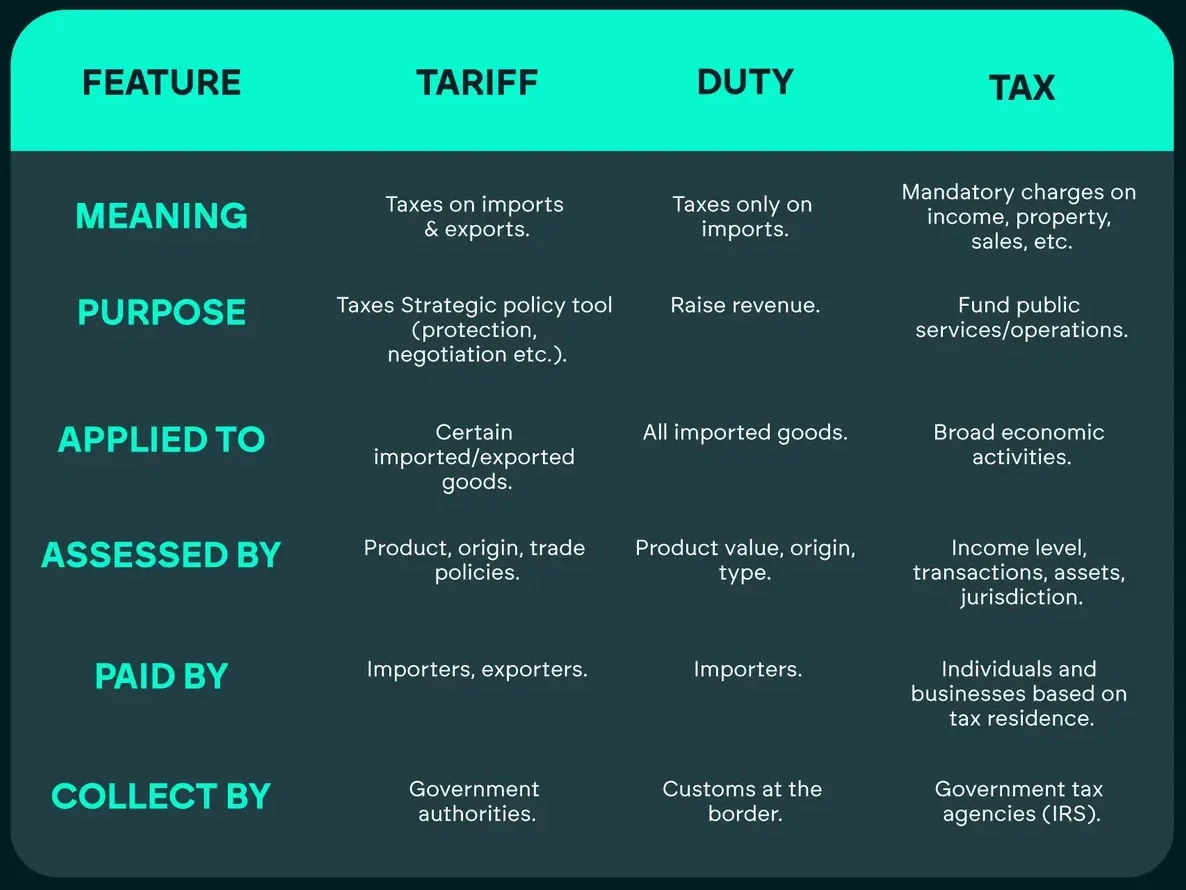

Tariffs are duties levied on imports (and sometimes exports) to achieve a variety of political, economic, and social goals. By increasing the price of imported goods, tariffs make them less competitive compared to local products, encouraging domestic consumption and production.

| Tariff Types | Definition | Example |

|---|---|---|

| Ad Valorem Tariff | A percentage of the product’s value. | A 10% tariff on a $20,000 car adds $2,000 in duties. |

| Specific Tariff | A fixed fee per unit, regardless of the item’s value. | $3 per kilogram of imported rice. |

| Compound Tariff | Combines an ad valorem tariff with a specific tariff. | $50 per ton of steel plus 8% of the shipment value. |

Tariffs are often used to:

- Protect Domestic Industries: Shield local producers from foreign competition.

- Generate Revenue: Provide funding for public projects in developing countries.

- Respond to Political Disputes: Used as a tool in trade wars or negotiations.

Why Do Governments Impose Tariffs?

Protecting Domestic Jobs and Industries

Governments impose tariffs to safeguard jobs in key sectors. For instance, high tariffs on steel imports aim to protect domestic steelworkers, ensuring the local industry remains viable in the face of cheaper foreign alternatives.

Balancing Trade Deficits

Tariffs can reduce trade deficits by discouraging excessive imports and encouraging exports. This is a common strategy for countries heavily reliant on foreign goods.

Negotiating Power

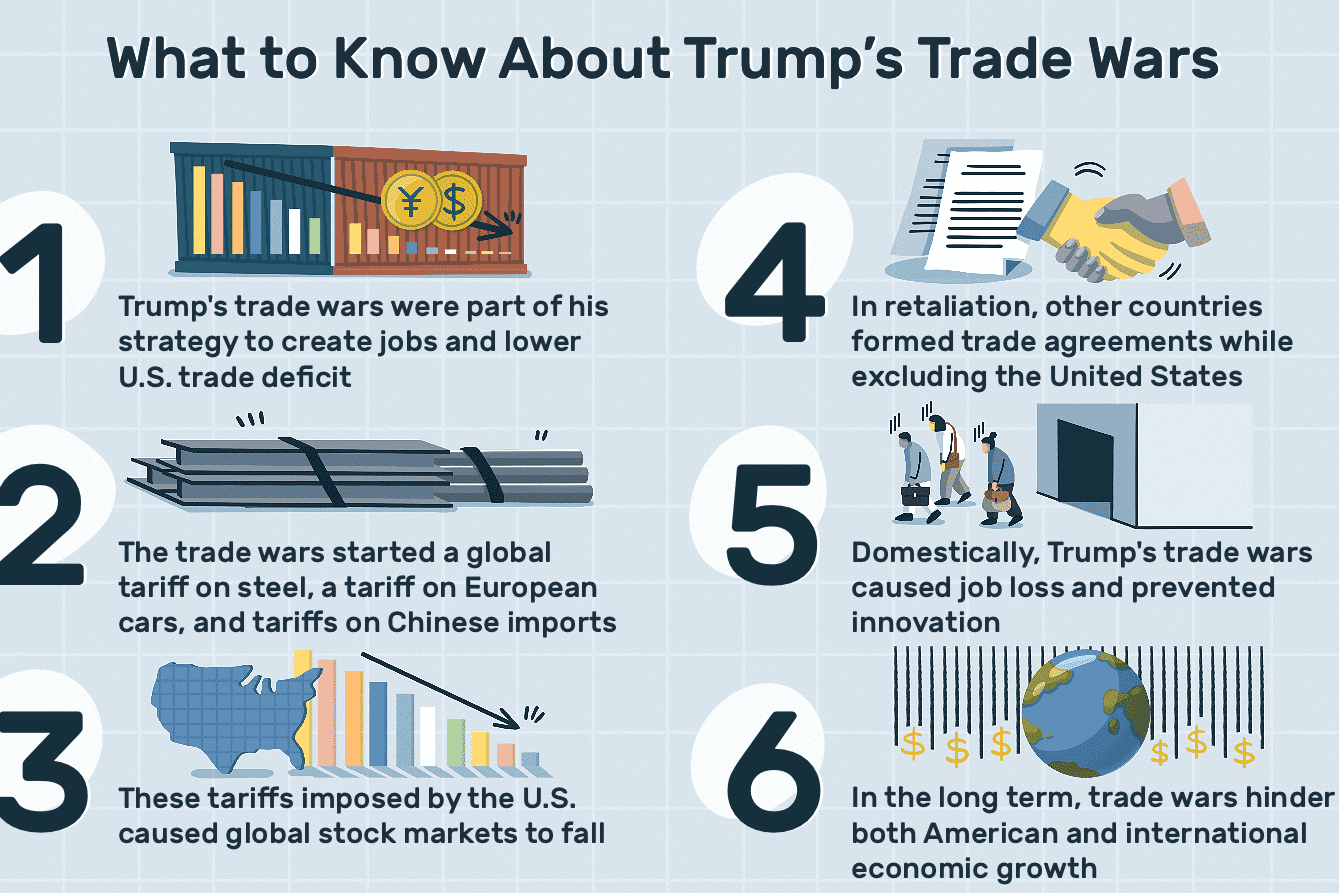

Tariffs are also used as a bargaining tool in trade negotiations. For example, the U.S. imposed tariffs on Chinese imports during trade disputes, encouraging China to renegotiate terms.

How Tariffs Affect Consumers

1. Increased Costs

When tariffs are imposed, importers pass the additional costs to consumers. For example, in 2019, tariffs on Chinese electronics increased the price of products like laptops and smartphones by 15–25%.

2. Reduced Product Variety

Higher import taxes can make foreign goods prohibitively expensive, causing companies to stop importing them altogether. For instance, tariffs on luxury European vehicles may reduce their availability in markets like the U.S.

3. Substitution with Local Products

Consumers may switch to domestic alternatives, which can sometimes mean compromising on quality, variety, or price. For example, when the U.S. imposed tariffs on Canadian dairy products, American consumers faced fewer choices of premium dairy brands.

How Tariffs Affect Businesses

| Positive Effects | Negative Effects |

|---|---|

| Protects local manufacturers. | Raises costs for businesses relying on imported raw materials. |

| Encourages local investment and growth. | Complicates supply chains, as businesses must find alternative suppliers or adjust production to avoid tariffs. |

| Creates demand for local products. | Exposes exporters to retaliatory tariffs, reducing their competitiveness in foreign markets. |

For instance, U.S. automotive manufacturers benefited from tariffs on imported steel, but industries dependent on steel, such as construction and appliance makers, faced increased costs.

How Do Tariffs Impact Different Industries?

| Industry | Impact of Tariffs |

|---|---|

| Automotive | Increased costs for imported steel and aluminum raise vehicle prices for consumers. |

| Technology | Tariffs on semiconductors and electronics increase prices for devices like laptops, phones, and smart gadgets. |

| Agriculture | Exporting farmers face retaliatory tariffs, reducing demand for products like soybeans and pork. |

| Textile and Fashion | Import duties on fabrics or finished goods affect retailers and consumers, making clothing more expensive. |

How Different Countries Measure and Implement Tariffs

United States follows the Harmonized Tariff Schedule (HTS), a system that categorizes every type of import. Duties depend on the category and its origin. For example, free trade agreements like NAFTA reduce tariffs for partner countries.

European Union uses a Common Customs Tariff (CCT) across its member states. Imports from non-EU countries face higher tariffs, while free trade agreements, such as with Japan, reduce costs for specific goods.

China operates a tiered tariff system, offering reduced rates to trade partners in agreements like RCEP. However, during the U.S.-China trade war, China retaliated with higher tariffs on American agricultural goods.

India imposes high ad valorem tariffs on agriculture and manufacturing to protect domestic farmers and industries. For instance, tariffs on imported smartphones have encouraged companies like Apple to establish manufacturing plants in India.

Key Statistics in 2024

- Global Tariff Average: The worldwide average tariff rate is 7.6%, but developing countries often have rates exceeding 10%.

- U.S. Tariff Revenue: The U.S. collected over $85 billion in tariffs in 2023, marking an increase from $40 billion in 2018.

- EU Carbon Tariffs: The European Union has introduced “green tariffs” on high-emission imports, targeting industries like steel and cement.

- Chinese Tariffs: China reduced tariffs on over 850 items, including pharmaceuticals and tech components, to encourage innovation.

Case Study: U.S.-China trade war

During the U.S.-China trade war, the U.S. imposed tariffs on over $360 billion worth of Chinese goods.

- Effects on Consumers: Prices for products like electronics, furniture, and appliances surged.

- Effects on Businesses: American farmers faced retaliatory tariffs, losing billions in agricultural exports.

- Global Implications: Companies shifted supply chains to countries like Vietnam and Mexico to avoid high tariffs.

Challenges with Tariffs

| Challenge | Description |

|---|---|

| Trade Wars | Escalating tariffs between countries can disrupt supply chains and harm global economic growth. |

| Inflation | Higher import costs contribute to inflation, as seen during the U.S.-China tariff disputes. |

| Impact on Developing Nations | High tariffs in wealthier countries limit market access for goods from developing nations. |

| Retaliatory Measures | Countries hit by tariffs often impose their own, harming exporters and global trade flows. |

Tips for Consumers and Businesses

| For Consumers | For Businesses |

|---|---|

| Compare domestic and imported product prices. | Diversify suppliers to avoid reliance on tariff-heavy imports. |

| Advocate for fair trade policies to reduce inflation. | Monitor international trade policies to prepare for potential tariff changes. |

| Support local producers to minimize import dependencies. | Explore free trade zones for lower import duties. |

Sources: