As traditional online gambling faces regulatory hurdles in the U.S. and Canada, a rapidly expanding new industry is filling the void: prediction markets. Platforms like Polymarket, Kalshi, and soon-to-launch DraftKings Predictions are allowing users to bet on everything from election outcomes to earnings calls, often operating in a legal gray area.

What Are Prediction Markets?

Prediction markets let users wager on the outcome of real-world events, such as the U.S. presidential election, sports championships, or how many times a word is mentioned in an earnings call. Instead of betting with a bookmaker, users buy shares in “Yes” or “No” outcomes, priced from $0 to $1. When the event settles, correct shares are redeemed for $1, with losers receiving nothing.

For example:

A share for “Blue Jays to win the World Series” might cost $0.32. If they win, the buyer earns $1, pocketing $0.68 in profit.

These markets are often touted as more accurate than traditional polling, thanks to users having financial incentives to predict accurately.

Who’s Leading the Industry?

- Polymarket, backed by Intercontinental Exchange (ICE), recently secured a valuation of $8 billion

- Kalshi, also federally regulated, is now valued at $5 billion

- DraftKings is entering the space through its acquisition of Railbird Exchange, aiming to launch DraftKings Predictions, available across all 50 U.S. states (excluding sports contracts at launch)

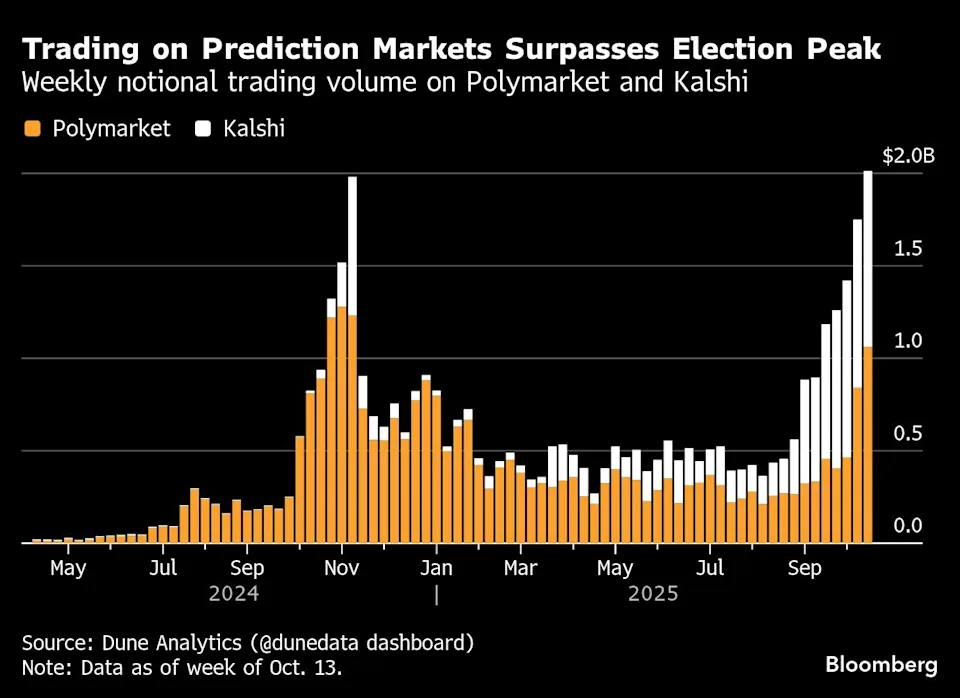

Last week, combined notional volume for Polymarket and Kalshi topped $2 billion, setting a new industry record.

Even major sports leagues are jumping in:

On October 22, the NHL became the first major league to partner with both Polymarket and Kalshi.

Is This Legal?

Prediction markets have so far managed to skirt traditional gambling laws by classifying themselves as financial exchanges, not sportsbooks.

- Kalshi is licensed by the U.S. Commodity Futures Trading Commission (CFTC)

- Polymarket also received federal clearance earlier this year

Despite this, several state regulators, like Maryland’s Lottery and Gaming Commission, argue these platforms function just like gambling sites and have issued cease-and-desist orders.

However, New Jersey and Nevada courts have sided with Kalshi, allowing them to continue operations.

What About Canada?

Canada treats binary options with skepticism. Since 2017, short-term binary contracts (under 30 days) have been deemed illegal.

- Ontario is the only province actively enforcing this rule, having fined Polymarket operators earlier this year

- Kalshi lists all of Canada as a restricted region, while Polymarket only blocks Ontario

Why Are Prediction Markets So Controversial?

- Integrity Risks:

The NFL, NBA, and MLB warned the CFTC that prediction contracts on sports could harm game integrity. - Manipulation & Wash Trading:

In 2024, $30 million in Trump-related election bets came from just four Polymarket accounts, skewing odds. The platform later said they belonged to a single French national with “extensive trading experience.” - Foreign Influence:

With little transparency, concerns over foreign actors influencing odds or sentiment remain a key issue for regulators.

The Future of Betting?

As financial and gaming laws struggle to keep pace with innovation, prediction markets are filling a lucrative gap — offering speculative tools in finance, politics, and pop culture alike.

Critics call it betting in disguise.

Supporters call it the evolution of forecasting.

Either way, the industry is booming, and regulators are watching closely.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Big Tech Earnings, Fed Rate Cut, and Trump–Xi Meeting Set to Define Markets This Week

Asian Markets Soar to Record Highs on Renewed US-China Trade Deal Optimism