Tesla (NASDAQ: TSLA) finds itself both shielded and exposed. While Donald Trump’s sweeping 25% auto tariffs hit the global car market hard, Tesla—thanks to its 100% U.S.-based assembly—has become a rare winner. But Elon Musk is warning: “Tesla is not unscathed.”

With EV rebates frozen in Canada, rising political tensions in Europe, and tariff costs on imported parts creeping higher, analysts are rebalancing their expectations for TSLA. Here’s what Wall Street sees coming.

Market Reaction: TSLA Defies Auto Sell-Off

While Ford, GM, BMW, and Porsche all tumbled 2–6% on Wednesday, Tesla bucked the trend:

📈 TSLA closed up 6.1%, opening at $272.48 and hitting $287.50 by midday Thursday.

📌 5-day gain: +12.4%

📌 YTD return: -39.7% (still recovering from Dec peak)

The rally came despite Elon Musk’s warning on X:

“Tesla is NOT unscathed here. The tariff impact on Tesla is still significant.”

“To be clear, this will affect the price of parts in Tesla cars that come from other countries. The cost impact is not trivial.”

Tariffs: Protection at Home, Pressure Abroad

🚘 Domestic Advantage: Tesla produces 100% of its U.S.-sold vehicles in the U.S.—a key stat as the 25% auto tariffs take effect. That puts it ahead of every legacy automaker, even Ford (78% assembled domestically) and GM (52%).

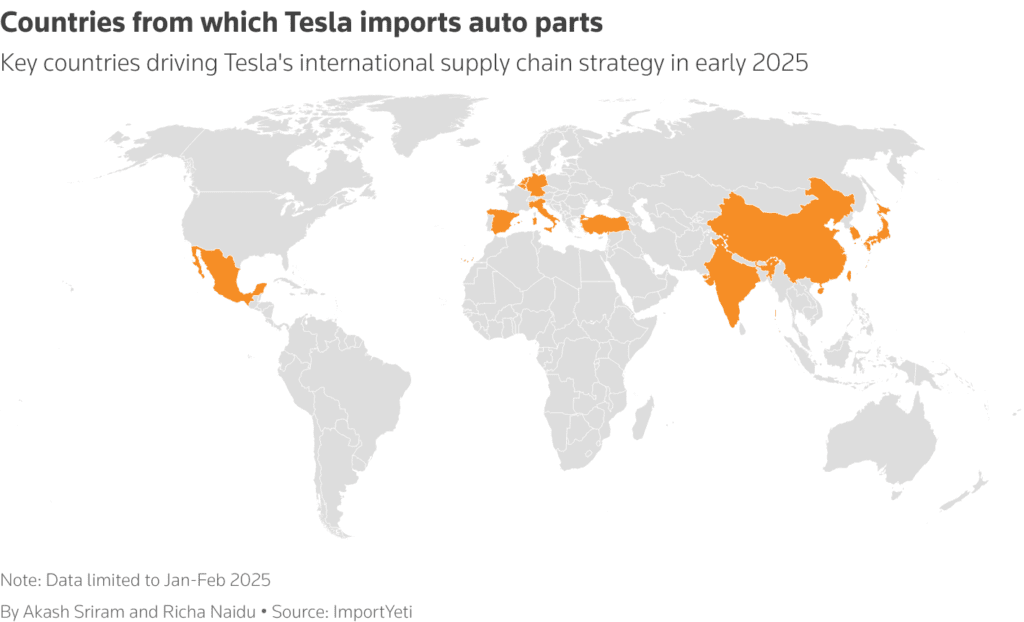

📦 But Not Immune: Tesla imports critical parts—batteries from CATL (China), components from Japan, Korea, and Mexico—making it vulnerable to parts tariffs.

📊 Goldman Sachs estimates the average imported car price could rise $5,000–$15,000 under the new tariffs. Tesla’s parts costs are expected to climb, squeezing margins unless offset by price hikes.

📉 Canada’s Response: Ottawa froze $43 million in EV rebates for Tesla as a retaliatory move, which could reduce Canadian sales in Q2 and beyond.

What Analysts Are Saying

📌 TD Cowen

“Tesla is a relative beneficiary… Model Y competes in a segment where ~50% of rivals face full tariffs. Tesla’s pricing will become more competitive vs. gas-powered cars.”

📌 Morningstar (Seth Goldstein)

“If automakers raise prices, Tesla looks cheaper relative to luxury peers. It gains domestic pricing power but faces foreign headwinds.”

📌 Wedbush Securities

“Despite Elon’s warning, Tesla’s U.S. footprint protects it better than almost any other automaker. The stock is oversold.”

→ Target: $340

📌 Canaccord Genuity

“Still insulated… but international backlash and reduced incentives could drag Q2 international sales. Watch for softening in EU and Canada.”

TSLA Stock by the Numbers

📍 Current Price: $279.42 (+6.1% today) (when article is written)

📌 52-Week Range: $138.80 – $488.54

📈 Market Cap: $924.49B

📊 Trailing P/E: 140.89

📈 Analyst Mean Target: $331.92

📉 Analyst Recommendation: HOLD (29 Buys / 17 Holds / 4 Sells)

International Risk: Tariff Benefit or Brand Backlash?

🇨🇦 Canada froze EV rebates.

🇬🇧 EU sentiment cools on Musk, with several governments reviewing subsidy policies.

🇪🇺 Tesla’s growth in Europe could stall as pro-EV policies wane and trade tensions rise.

🧨 Despite domestic relief, international markets now pose more risk to Tesla’s long-term demand outlook than domestic costs.

Final Take: Buy, Sell, or Hold?

✔️ Bullish Scenario: Tariffs drive legacy automakers’ prices up, giving Tesla pricing power. Domestic sourcing remains a moat.

❌ Bearish Scenario: Parts tariffs eat into margins. Global sentiment and rebate cuts slow international expansion.

📌 Consensus View: Cautiously bullish short-term, but international backlash poses medium-term growth risk.

👉 Want to read how other automakers are hit by tariffs? Click here for the full breakdown of GM, Ford, BMW, Mercedes & more.

Disclosure: This article is for informational purposes only and does not constitute investment advice. Investors should conduct their own research and consult with a financial advisor before making investment decisions.