Nvidia (NASDAQ: NVDA) is set to release its Q4 FY2025 earnings today, February 26, 2025, after market close. As the leading AI chipmaker, Nvidia’s earnings report will be a major catalyst for the broader tech sector, influencing not just NVDA stock but also AI-driven companies, semiconductor suppliers, and cloud computing firms.

With high growth expectations, Wall Street is focused on AI chip demand, competition from China’s DeepSeek, and the rollout of Nvidia’s Blackwell series. Here’s what analysts predict for Nvidia’s earnings and how the stock could react.

Market Reactions and Volatility

Historically, Nvidia’s post-earnings stock moves don’t always match results. Despite beating expectations in Q3 FY2025, the stock dropped 3% after earnings, only to rebound later.

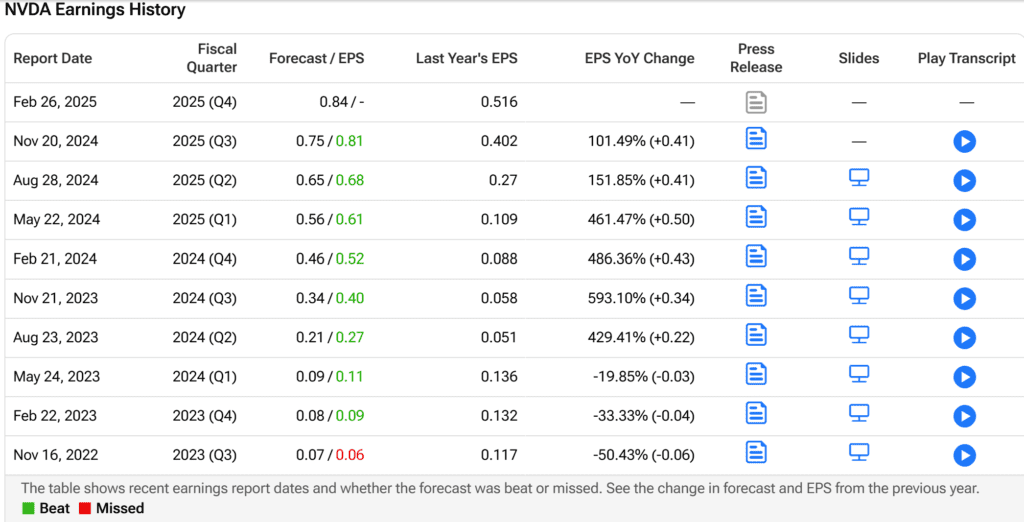

📉 Over the past eight quarters, Nvidia has:

✔ Beaten EPS estimates 7 times

✔ Beaten revenue estimates 8 times

✔ Seen an average 5.3% stock move post-earnings

Some analysts believe expectations might already be priced in, making it harder for Nvidia to rally sharply even after strong results.

Key Predictions on Nvidia’s Q4 Performance

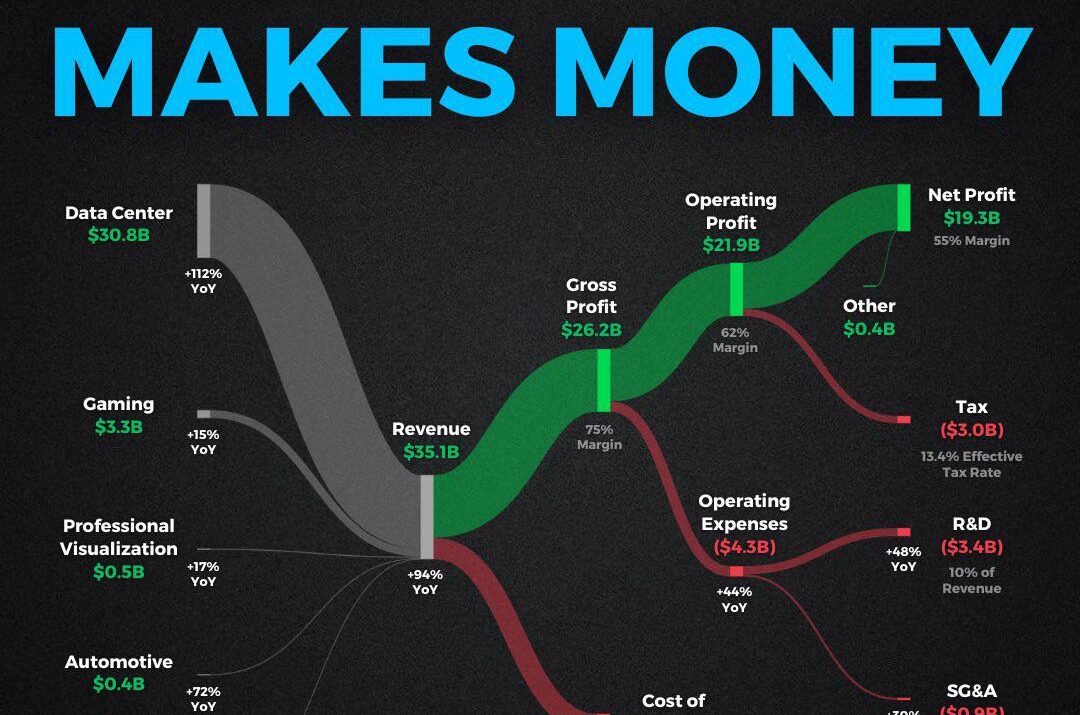

1. Expected Strong Revenue and EPS Growth

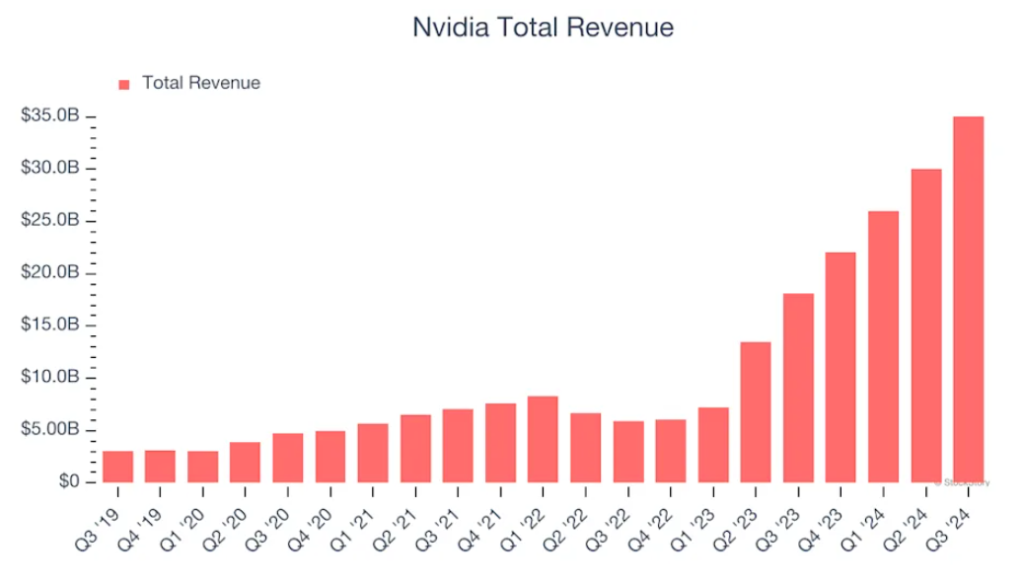

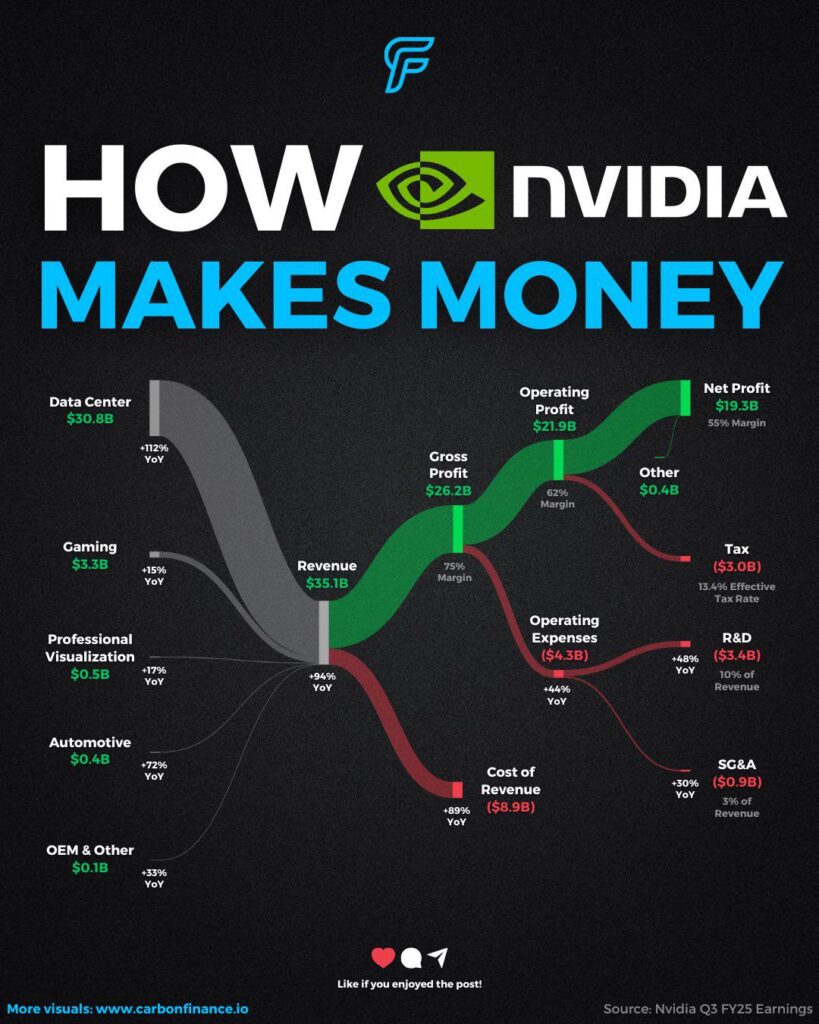

Analysts anticipate record-breaking growth for Nvidia in Q4, driven by exploding demand for AI chips and continued dominance in data centers.

📌 Revenue Estimates: $38.32 billion (+73% YoY)

📌 Net Income: $21.08 billion (+64% YoY)

📌 EPS (Earnings Per Share): $0.85

📌 Gross Margin: 76% (up from 72.3% last year)

Nvidia’s growth is heavily tied to AI infrastructure spending by companies like Microsoft, Amazon, and Google, all of which have announced significant capital investments in AI for 2025.

📌 Data Center Revenue: Expected to double YoY, contributing over $23 billion in sales, driven by H100 GPU demand.

📌 Gaming Segment: Expected to recover slightly, but AI remains the main driver of growth.

Sources: Nasdaq, Morningstar, MarketBeat

2. Bullish Case: More Growth Potential Ahead?

Many analysts believe Nvidia’s AI dominance is only in its early stages, with several tailwinds fueling further growth.

✅ AI Market Expansion: Nvidia holds up to 90% of the AI chip market, positioning it as the primary supplier for generative AI development.

✅ Blackwell Chip Rollout: Nvidia is set to launch its next-gen Blackwell chips later this year, which analysts believe will fuel another revenue surge in late 2025 and 2026.

✅ Institutional Demand: Hedge funds and institutional investors continue to load up on Nvidia stock, signaling confidence in its long-term growth story.

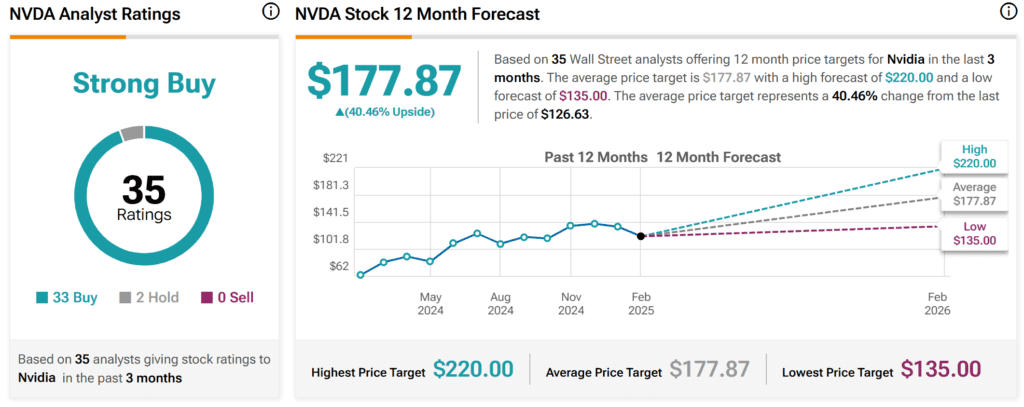

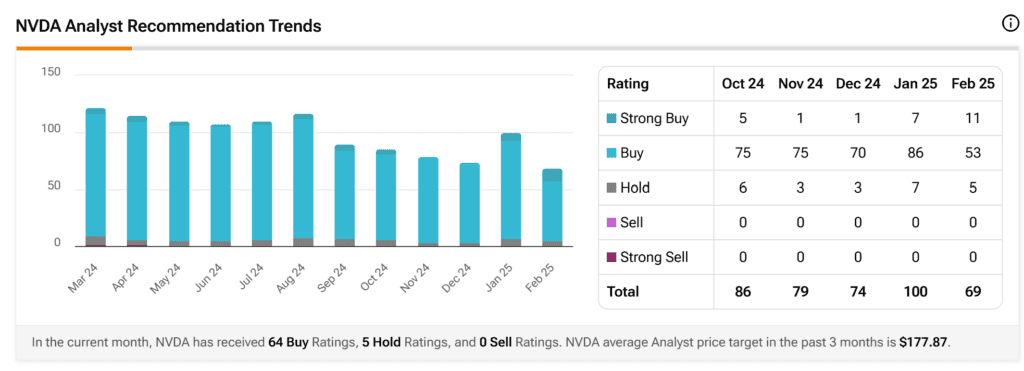

Analyst Price Targets:

📌 Cantor Fitzgerald: $175 price target (39% upside) – “Nvidia’s AI dominance remains intact despite rising competition.”

📌 Goldman Sachs: $180 price target – “Demand for high-performance AI chips will remain strong for years.”

📌 Wedbush: $190 bull-case scenario – “Blackwell chip demand could exceed H100 adoption levels.”

Nvidia’s growth trajectory remains strong, with its AI business acting as the key catalyst for further stock gains.

Sources: Forbes, Investopedia, Business Insider

3. Bearish Case: Is Nvidia Overvalued?

While Nvidia’s fundamentals remain strong, some analysts warn of potential downside risks due to overvaluation concerns and growing AI competition.

🚨 Stock Valuation Concerns: Nvidia’s P/E ratio of 42x remains high compared to historical semiconductor industry averages.

🚨 DeepSeek’s Threat: China’s DeepSeek AI claims to train models with significantly fewer Nvidia chips, potentially reducing future demand.

🚨 Post-Earnings Volatility: Nvidia has a history of sharp post-earnings price swings, making short-term stock moves unpredictable.

Bearish Analyst Views:

📌 Morningstar: $130 fair value estimate – “AI chip demand remains strong, but Nvidia’s valuation already reflects much of its expected growth.”

📌 Morgan Stanley: $140 price target – “DeepSeek and other emerging competitors could pressure Nvidia’s future margins.”

📌 JPMorgan: Neutral rating – “While Nvidia is a strong company, the stock’s recent rally may limit near-term upside.”

Nvidia will need to prove it can sustain its AI leadership to justify its current valuation.

Sources: WSJ, Nasdaq, MarketWatch

Conclusion: Can Nvidia Keep the Momentum Going?

With high expectations for record-breaking earnings, Nvidia’s Q4 report will set the tone for AI stocks, semiconductors, and the broader tech sector.

✔ Bullish Scenario: If Nvidia beats expectations and issues strong guidance, the stock could rally past $150 and extend its AI-driven momentum.

❌ Bearish Scenario: If earnings disappoint or if guidance signals a slower growth trajectory, the stock could pull back toward the $130-$140 range.

📌 Final Analyst Consensus: Cautiously optimistic, with high potential for post-earnings volatility.

Nvidia reports after market close today—how the stock reacts could shape the market’s view on AI growth and semiconductor demand for the rest of 2025. 🚀

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

3 Value Stocks that are Backed by the World’s Largest Activist Hedge Fund

Is $MSTR “forced liquidation” possible and what happens if Bitcoin falls?

Why Nvidia’s earnings are important to the entire US stock market

Daily Market Brief: Stocks Struggle, Bitcoin Drops & Earnings Highlights

Trade War and Market Panic: Are Short-Term Dips Long-Term Opportunities?

The Market Begins a New Trading Trend: Contrarian Trump Trades

Hedge Funds Loaded Up AI Stocks at the Fastest Pace Since 2021

These Stocks Could Skyrocket According to “Trends With No Friends” Strategy!

Market Looks Strong—But Whales Are Quietly Exiting, Should You?

Bank of America Sees an ‘Attractive Entry Point’ in These 2 Stocks

Wall Street’s latest favorites – Hedge Funds’ Top Picks in Q4