Why stocks are down now: Wall Street started September on its back foot. Stocks dropped because two big risks are colliding at once: uncertainty over President Trump’s tariffs and a jump in bond yields that makes riskier assets less attractive. A U.S. appeals court ruled late last week that most of Trump’s tariffs were illegal, but left them in place until October 14 while the case goes to the Supreme Court. That means businesses, investors, and the government all face weeks of legal limbo.

At the same time, yields on long-term U.S. Treasuries—essentially the interest rates investors demand to lend the government money—spiked to their highest levels in over a month. Higher yields make borrowing more expensive, put pressure on government finances, and weigh directly on stock valuations, especially in technology. Together, these two forces created the sour mood on Wall Street’s first full trading day after the holiday.

Market Recap

Stocks slide on tariff and bond worries

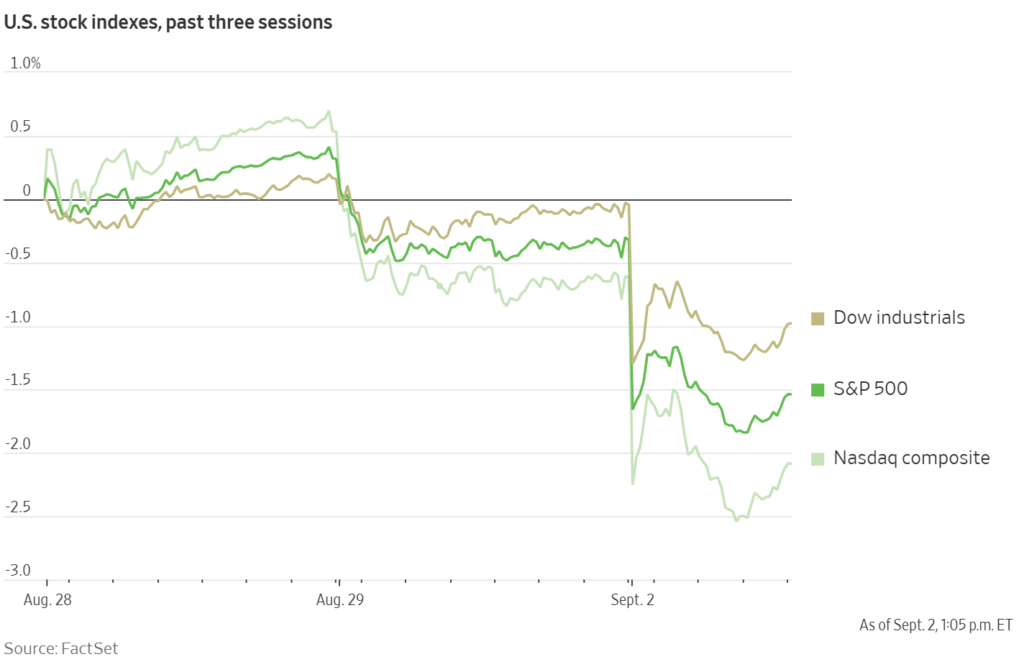

By midday Tuesday, the Dow Jones fell over 500 points (-1.2%), the S&P 500 dropped 1.5%, and the Nasdaq tumbled 1.8%. Tech stocks were hit hardest: Nvidia fell nearly 4%, Apple lost 2%, and Microsoft slipped 1.2%. The VIX volatility index, often called Wall Street’s “fear gauge,” climbed to its highest in a month.

Bond yields bite into valuations

The 10-year Treasury yield moved up to around 4.3%, while the 30-year pushed close to 5%. Rising yields spook equity markets because they raise the cost of capital for companies and make safe bonds look more appealing compared to riskier stocks. The selloff wasn’t limited to the U.S.—longer-term bond yields in Germany, France, and the U.K. also jumped, reflecting global concerns about inflation and government debt.

Safe havens shine: gold sets new records

Investors piled into gold, sending prices above $3,500/oz, a fresh all-time high. Central-bank demand, expectations of Fed rate cuts later this month, and dollar weakness all helped fuel the rally. Silver also stayed firm around the $40 level. Gold miners such as Harmony Gold, Barrick, and Newmont climbed in sympathy.

Bitcoin steady but lagging gold

Bitcoin edged higher near $110K, holding its ground but failing to match gold’s dramatic surge. Strategists noted that some flows have rotated into Ethereum, slightly weakening Bitcoin’s relative performance. Still, investors say Bitcoin could regain dominance if the Fed cuts rates later this month.

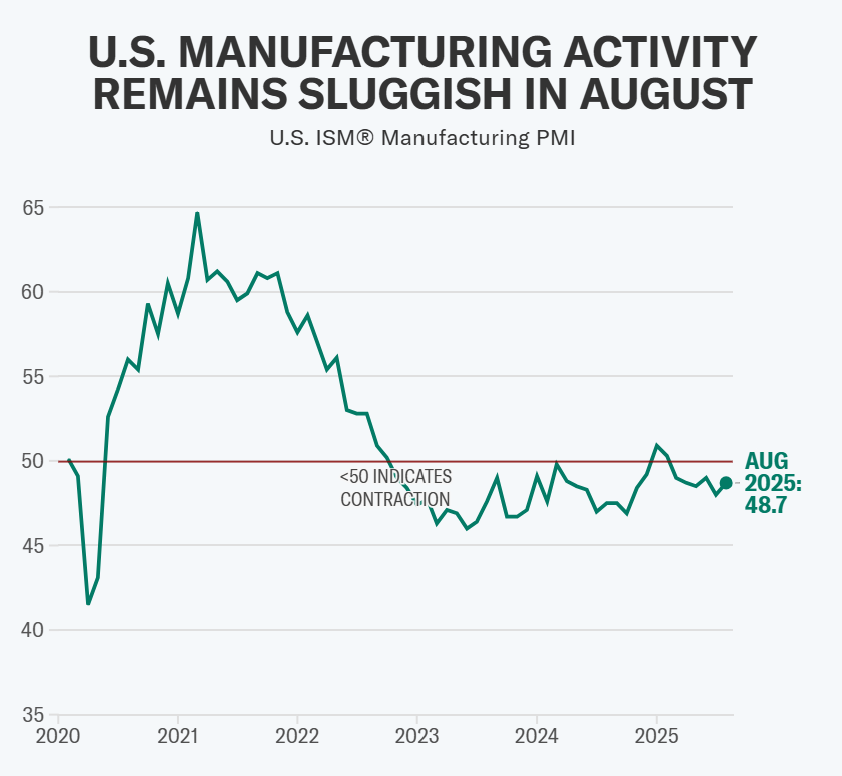

Data Check: Factories Still Struggling

The ISM Manufacturing PMI came in at 48.7 for August—below 50, which means contraction—for the sixth straight month. However, new orders showed signs of life, rising to 51.4, the first expansion since July. Production, though, weakened again, slipping to 47.8.

By contrast, S&P Global’s PMI painted a more upbeat picture, showing the strongest monthly improvement in over two years. But even that report flagged tariffs as a growing problem: factories are stockpiling inventories because they fear higher costs ahead, and input prices are climbing.

In short: US manufacturing is weak overall, but there are early hints of recovery in new orders.

Movers and Headlines

- PepsiCo rose 2.6% after Elliott Management disclosed a $4B stake, setting up an activist campaign to push for changes.

- Kraft Heinz tumbled 6% after announcing a plan to split into two separate public companies to sharpen focus on its brands. Completion is expected in 2026.

- Gold miners rallied strongly with bullion’s surge.

- Tech giants dragged markets lower, continuing the summer pattern of volatility around Nvidia and its peers.

Why It Matters

- Rates vs. stocks: Higher bond yields make equities, especially expensive tech shares, less attractive. Unless yields ease back, stocks could remain under pressure.

- Tariffs in limbo: If tariffs are struck down, importers benefit but government revenues shrink. If they stay, costs for manufacturers and consumers remain high. Either way, uncertainty alone is damaging confidence.

- The jobs test ahead: Friday’s August nonfarm payrolls report is the next big catalyst. A weak jobs number would reinforce expectations for a Fed rate cut on Sept. 17. A strong one could force the Fed to hesitate.

What to Watch Next

- Yields: The 10-year around 4.3% and the 30-year near 5% are critical levels. A break higher could trigger more equity selling.

- Tariff headlines: Any word from the Supreme Court or White House could swing markets.

- Gold’s rally: If bullion holds above $3,500, momentum could accelerate.

- Jobs report (Friday): The single most important release before the Fed’s September meeting.

Markets are under pressure because bond yields keep climbing and Trump’s tariffs are tied up in legal uncertainty. Until we get clarity on both, and Friday’s jobs report, expect choppy trading and investors leaning toward safe havens like gold.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Nvidia Q2 2026 Earnings Preview and Prediction: What to expect

Why Warren Buffett and Hedge Funds Are Betting on UnitedHealth Stock (UNH)