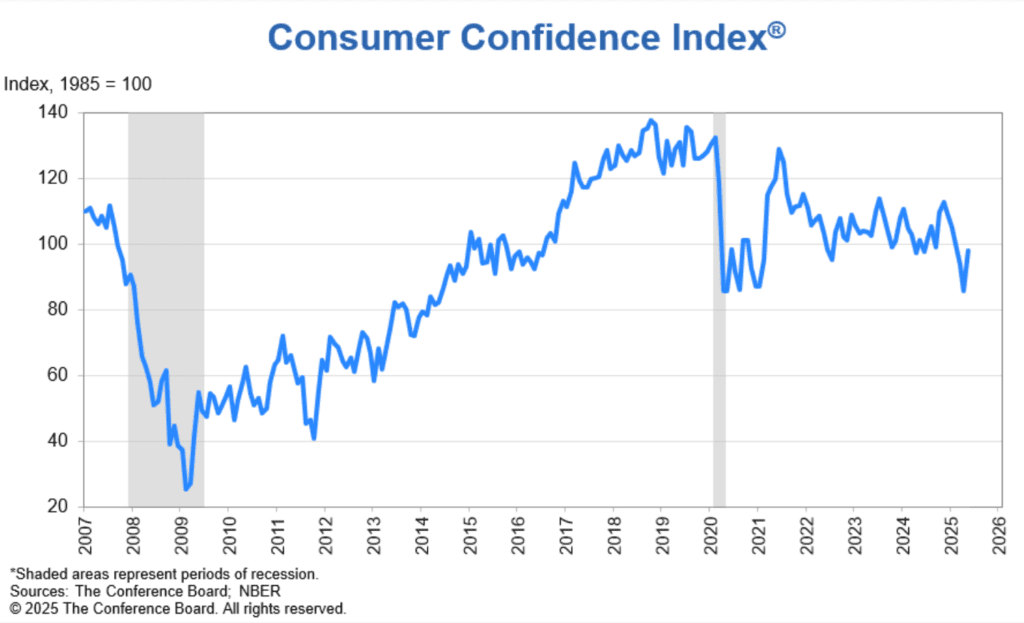

Consumer confidence in the US rebounded sharply in May, breaking a five-month decline, as Americans grew more hopeful about easing tensions between the US and China.

According to new data from the Conference Board, the Consumer Confidence Index surged to 98.0, far exceeding Wall Street’s expectation of 86.0 and up more than 12 points from April’s level of 85.7.

“The rebound was already visible before the May 12 US-China trade deal but gained momentum afterwards,” said Stephanie Guichard, senior economist at the Conference Board.

Key Highlights:

- Present Situation Index rose to 135.9, up 4.8 points from April.

- Expectations Index jumped to 72.8, a gain of 17.4 points – the strongest in over a year.

- Investor optimism climbed: 44% now expect stocks to be higher in the next 12 months (+6.4 pp).

- Job outlook improved: 19.2% expect more jobs in the next 6 months (up from 13.9%).

- Fewer job concerns: Those expecting fewer jobs dropped from 32.4% to 26.6%.

- Perceptions of job abundance remained mixed: 31.8% said jobs are “plentiful,” while 18.6% said jobs are “hard to get.”

What’s Driving the Optimism?

The turnaround in sentiment follows President Donald Trump’s decision on May 12 to pause his most aggressive tariffs against China. The move marked the second rollback of his so-called “reciprocal tariffs” since their introduction in early April, dubbed “liberation day” by the administration.

While uncertainty over trade and tariffs had weighed heavily on consumer and investor confidence since late 2024, the latest developments signaled potential for renewed stability in global trade flows.

A Broad-Based Boost: The Conference Board noted that optimism improved across all age, income, and political groups, but the strongest rebound came from Republican respondents, who had been more aligned with Trump’s aggressive trade stance.

Economists say the sharp rebound could signal stronger-than-expected consumer spending in the second half of the year, especially if further escalations with China are avoided.

“This bounce in confidence is a big psychological shift,” said one strategist.

“If consumers are hopeful again, it could extend the market rally and support Q3 growth.”

With tariffs paused and markets stabilizing, the mood in May marks a rare moment of optimism in what has otherwise been a volatile economic year.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Tesla Sales Crash 49% in Europe Despite EV Boom

Trump Threatens 25% Tariff on Apple as Foxconn Invests $1.5B in India

Trump Media Slams $3B Crypto Report as “Fake News”

China has quietly relaxed export restrictions on rare earth elements

Hedge funds are shorting stocks again, boosting leverage to new record

Trump says he’ll delay a threatened 50% tariff on the European Union until July

Angry Elon Is Back — And He’s Betting Big on Driverless Teslas and AI

Elon Musk’s Qatar Meltdown: “NPCs,” Jeffrey Epstein, Tesla Denial, and Prison Promises

Trump Escalates EU Trade Clash With 50% Tariff Threat: “The Deal Is Set”