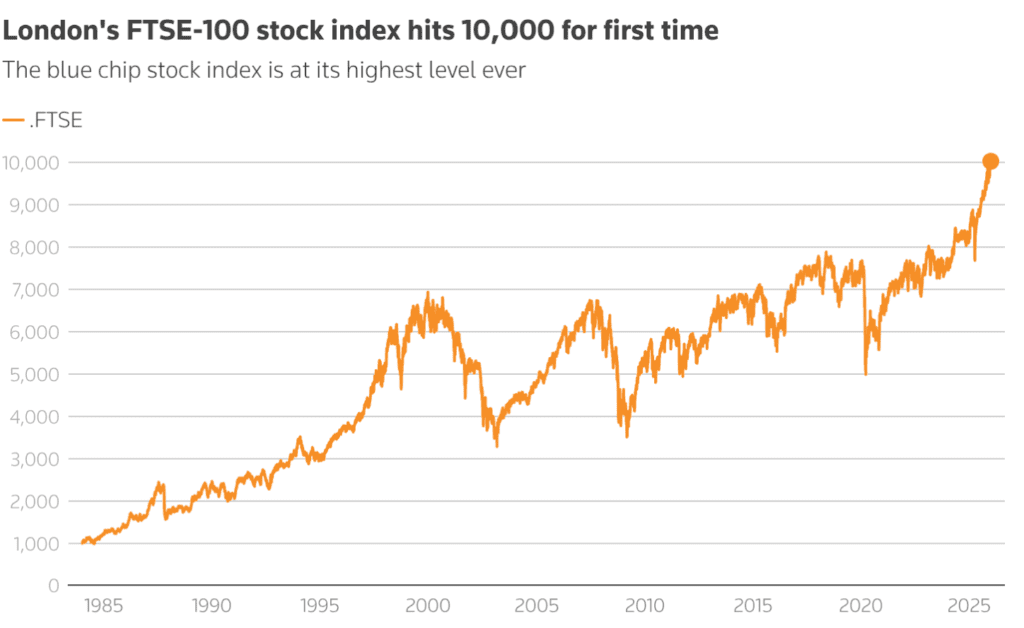

The UK stock market opened in 2026 on a strong note, with the FTSE 100 reaching the 10,000-point level for the first time, marking a major psychological milestone after years of underperformance.

London’s blue-chip FTSE 100 crossed the 10,000 mark early on the first trading day of the new year, extending momentum from a powerful 2025 rally. The index gained nearly 22% last year, its best annual performance since 2009, and outpaced both Europe’s STOXX 600 and the US S&P 500.

Market participants say the move carries more than just numerical significance.

“It’s a positive way to enter 2026,” said Danni Hewson of AJ Bell, noting that UK equities have been overlooked for years. Starting the year with visible momentum could help shift investor psychology.

What Drove the Rally

Unlike markets dominated by technology and AI stocks, the UK rally was led by more traditional sectors.

- Mining stocks surged on the back of record precious metal prices, including companies such as Fresnillo

- Defence firms benefited from rising European military spending, lifting names like Babcock and Rolls-Royce

- Banks, including Lloyds, gained from higher interest rates and steady economic growth

The FTSE’s broad sector mix and relatively low valuations helped attract investors seeking alternatives to expensive global tech stocks.

Why 10,000 Matters

Analysts stress that 10,000 is a symbolic level rather than a fundamental shift. Still, symbolism matters in markets.

“This is an arbitrary number, but it could help bring international attention back to UK equities,” said Rory McPherson of Wren Sterling. He added that the FTSE’s diversified sector exposure and attractive valuations stand out in a global market increasingly concentrated in tech.

The milestone also comes as hopes build that London could see more IPO activity in 2026, after years of weak listings and companies moving their primary listings abroad.

Cautious Optimism Ahead

Despite the strong headline, UK markets still face challenges. The FTSE 100 lagged several global peers in 2025, including Japan, Spain, and Italy. Meanwhile, the domestically focused FTSE 250 rose only about 9% last year, highlighting weaker performance among UK-focused companies.

Even so, UK finance minister Rachel Reeves welcomed the milestone, calling it a vote of confidence in Britain’s economy and a strong start to 2026.

For investors, the FTSE 100’s move above 10,000 does not guarantee smooth sailing ahead, but it signals that UK stocks are firmly back on the radar as the new year begins.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: How Big Tech Created the 2025 AI Boom on Debt

What’s Ahead for Stocks and Gold in 2026? What Markets and Experts Are Watching

Stocks Look Bullish Entering 2026 — But What Could Go Wrong?

FOMO vs. Bubble Angst Signals More Stock Volatility in 2026

Gold Breaks $4,400 as Silver, Copper and Platinum Hit Record Highs: What Comes Next

Markets Enter Final Stretch of 2025 With Santa Rally Hopes: What to watch

Trade, Tariffs, and Treasuries: The Hidden Cost of Trump’s Protectionism

Want to Know Where the Market Is Going? Don’t Trust This, or Any, Forecast.