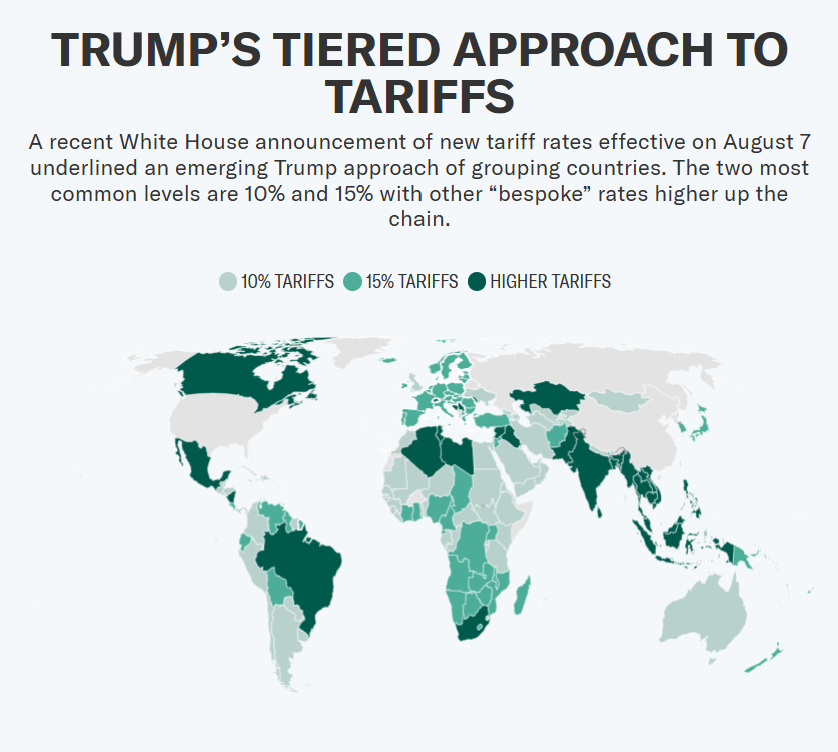

President Donald Trump has unveiled a string of new trade agreements that headline 10%–20% tariff rates for major US partners willing to negotiate. Deals have been announced with the EU, Japan, the Philippines, South Korea, and Vietnam, but nearly all remain informal “handshake” arrangements, with no legally binding text or joint statements.

The result: confusion over what’s actually been agreed, from how sector-specific tariffs will work to what foreign investment pledges really mean.

Handshake Agreements Without Final Text

While Trump touts the deals as major wins, trade officials from other nations stress that final terms are still under discussion.

- EU, Japan, South Korea: No official joint agreements yet; key tariff changes not enacted.

- UK and Indonesia: A bit more formal detail, but questions remain.

- Exemptions: Some countries say they’re exempt from certain sectoral tariffs — Washington hasn’t fully confirmed.

The Sectoral Tariff Puzzle

Trump’s tariff agenda includes sweeping industry-specific rates that are causing headaches:

- Semiconductors: Trump floated 100% tariffs on all foreign chips. The EU and South Korea claim exemptions under their deals.

- Pharmaceuticals: Trump has promised triple-digit rates, but it’s unclear whether partners with new deals will be spared.

- Autos: Current 232 tariffs are 25%, with planned reductions to 15% for EU, Japan, and South Korea — but this hasn’t taken effect.

Japan’s top trade negotiator Ryosei Akazawa visited Washington this week seeking clarity, saying he was assured the auto tariff cut would come “soon.” The US has made no formal announcement.

Foreign Investment Promises: Different Stories

Trump has repeatedly described the deals as “signing bonuses” for the US:

- $600 billion from Europe

- $550 billion from Japan

- $350 billion from South Korea

According to Trump, this is money “to invest in anything I want.”

But foreign officials frame it differently:

- EU: Says the $600B is simply “companies expressing interest” in US projects.

- Japan & South Korea: See the funds as investment vehicles to spur mutually beneficial projects — not blank checks.

Akazawa made it clear: “We can’t cooperate on anything that does not benefit Japan.”

Tariffs as Leverage

Trump has made it clear he intends to enforce these agreements by keeping tariff threats on the table — ready to raise rates if he feels partners aren’t delivering. This stance keeps global trade teams guessing and importers uneasy, particularly those facing bespoke tariff rates as high as 50%.

For now, Trump’s “new trade world” is more political theater than fully codified policy. Without binding agreements, businesses, investors, and foreign governments remain in limbo — watching closely to see which handshake deals turn into real, enforceable trade terms, and which dissolve under the next round of tariff threats.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump Explodes Over Nancy Pelosi Stock Ban

Fed Governor Adriana Kugler Resigns, Opening Door for Trump

Trump Imposes New Global Tariff Rates, Effective August 7

What Happens After Tariff Deadline and What Next 72 Hours Look Like for Markets

Trump’s Tariffs Are Real, But Are His Trade Deals Just for Show?

Figma Is Largest VC-Backed American Tech Company IPO in Years