President Donald Trump’s aggressive auto tariffs strategy is taking a direct hit on the industry’s bottom line.

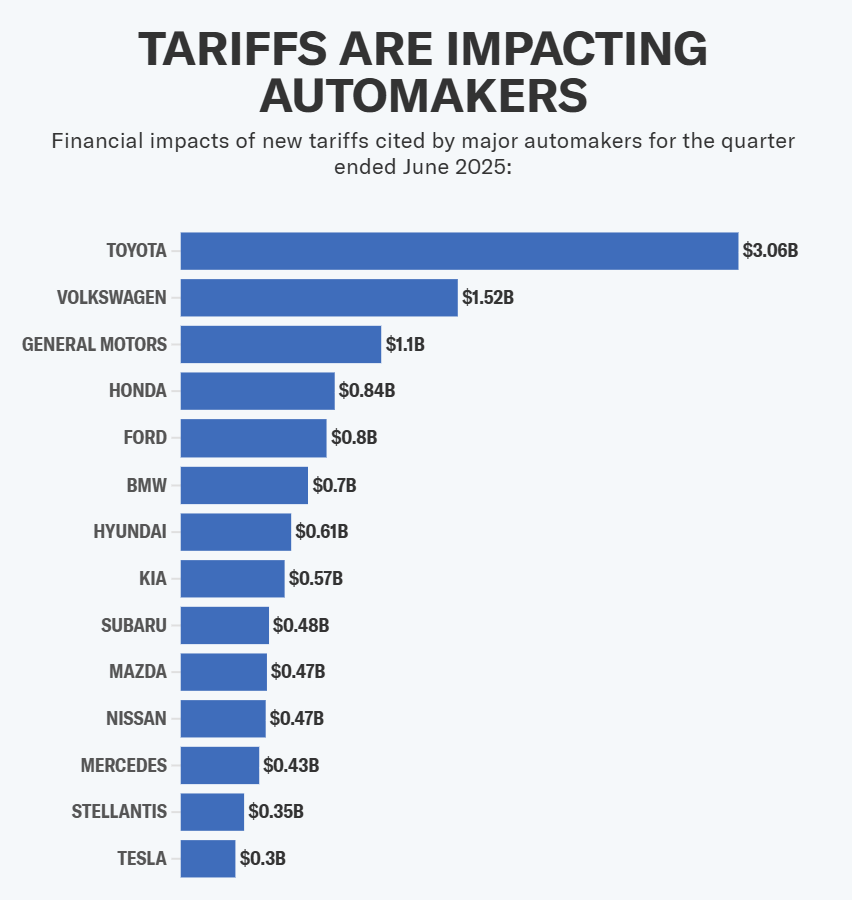

Following the close of the June quarter, public disclosures from the largest automakers put the combined tariff impact at around $11.7 billion.

The losses aren’t confined to foreign brands — every major manufacturer with US operations is affected.

Who’s been hit hardest so far:

- Toyota (TM): $3 billion wiped from fiscal Q1 operating income.

- Volkswagen (VWAGY): Significant multi-billion-dollar tariff charges across its US-bound product lineup.

- General Motors (GM): Material cost increases from parts and vehicles sourced in Mexico and Canada.

- Ford (F): Tariff-related pressures on trucks and imported components.

- Honda (HMC): Margin pressure on imports from Japan and Canadian plants.

- Tesla (TSLA): ~$300 million hit in Q2, mostly from EV battery imports.

The Tariff Structure Squeezing Automakers

The industry is dealing with a multi-layered tariff environment:

- 15% duties on Japanese-built vehicles (affecting Toyota, Honda, Nissan, etc.)

- 25% sector-wide auto tariffs targeting Canada and Mexico — a blow to both foreign automakers and the US “Big Three.”

- Part-specific tariffs on high-value imports like EV batteries, electronics, and drivetrains.

This structure means even US-based production isn’t immune. Tesla, for example, manufactures all vehicles domestically but imports LFP batteries from China, triggering heavy duties.

Tesla’s Case: A Domestic Producer Still Hit Hard

CFO Vaibhav Taneja says tariffs added $300 million in costs last quarter, with two-thirds tied to automotive.

VP of Engineering Lars Moravy confirmed Tesla’s first US LFP battery factory will come online by year-end to reduce exposure.

Despite onshoring moves, Tesla expects full tariff impact in upcoming quarters due to manufacturing lead times.

Why Moving Production Isn’t a Quick Fix

Relocating vehicle assembly is capital-intensive and slow:

- New US assembly plant: 3–5 years, $1–2 billion.

- Retooling an existing facility: ~$500 million.

“Investment for new assembly plants is considerable and requires a larger rationale than a one-term presidential administration,”

— Sam Fiorani, AutoForecast Solutions

This means automakers must weigh the three-year cost of tariffs against the decade-long ROI of a new factory.

Company Responses: Strategic Shifts Underway

General Motors (GM)

- Committing $4 billion to expand US production.

- Bringing gas-powered Chevrolet Blazer and Equinox production from Mexico to US plants by 2027.

- Moving full-size SUV (Chevrolet Tahoe) and light-duty pickup (Silverado) output to Orion, Michigan.

- Reallocating EV production from Orion to Factory Zero (dedicated EV plant).

Honda (HMC)

- Considering adding a third production shift at US facilities to offset tariffs.

- Denied reports of moving Civic sedan production from Canada, but exploring shifts in model production to reduce tariff exposure.

- Analysts warn Honda’s margins will remain deeply negative due to structural EV costs and tariffs.

Ford (F)

- Initially absorbed tariffs via “employee pricing for all” promotions to clear pre-tariff inventory.

- Now raising prices on key models like the Mexican-built Maverick pickup.

- Using reduced incentives and higher finance costs to protect margins.

Toyota (TM)

- Largest single-company hit at $3B in Q1.

- Working to balance Japanese production with increased US output without sacrificing efficiency.

Why Not Just Move Everything to the US?

Analysts point out that production location decisions are complex:

- High-volume, low-margin models (e.g., Nissan Rogue) already built in the US to avoid import costs.

- Low-volume, high-margin luxury models often stay abroad — moving them could erode profitability.

- Supply chains for specialized parts (e.g., EV drivetrains, luxury interiors) are deeply integrated internationally and expensive to replicate.

Consumer Impact: Price Rises Are Coming

The inevitable outcome, say analysts, is higher prices for buyers across all vehicle segments:

- Short term: Automakers absorbed much of the cost in Q2 — visible in earnings reports.

- From fall 2025: Price hikes will become more common, especially on imported and tariff-exposed models.

- 2026 outlook: Rising prices across both imported and domestically made vehicles as production costs and tariffs continue.

“Everyone will pay more,”

— Sam Fiorani, AutoForecast Solutions

CFRA’s Garrett Nelson adds that even with onshoring, product cuts, and cost optimization, automakers will still need to absorb a large portion of tariff costs — and pass some of the rest to consumers.

The $11.7 billion tariff bill is only the beginning. Without policy changes, automakers face a multi-year squeeze that will reshape supply chains, raise vehicle prices, and test profitability, especially as they also juggle costly EV transitions.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Inflation Data, Fed Policy Signals, and Key Earnings in Focus This Week

Trump Explodes Over Nancy Pelosi Stock Ban

Fed Governor Adriana Kugler Resigns, Opening Door for Trump

Trump Imposes New Global Tariff Rates, Effective August 7

What Happens After Tariff Deadline and What Next 72 Hours Look Like for Markets

Trump’s Tariffs Are Real, But Are His Trade Deals Just for Show?

Figma Is Largest VC-Backed American Tech Company IPO in Years