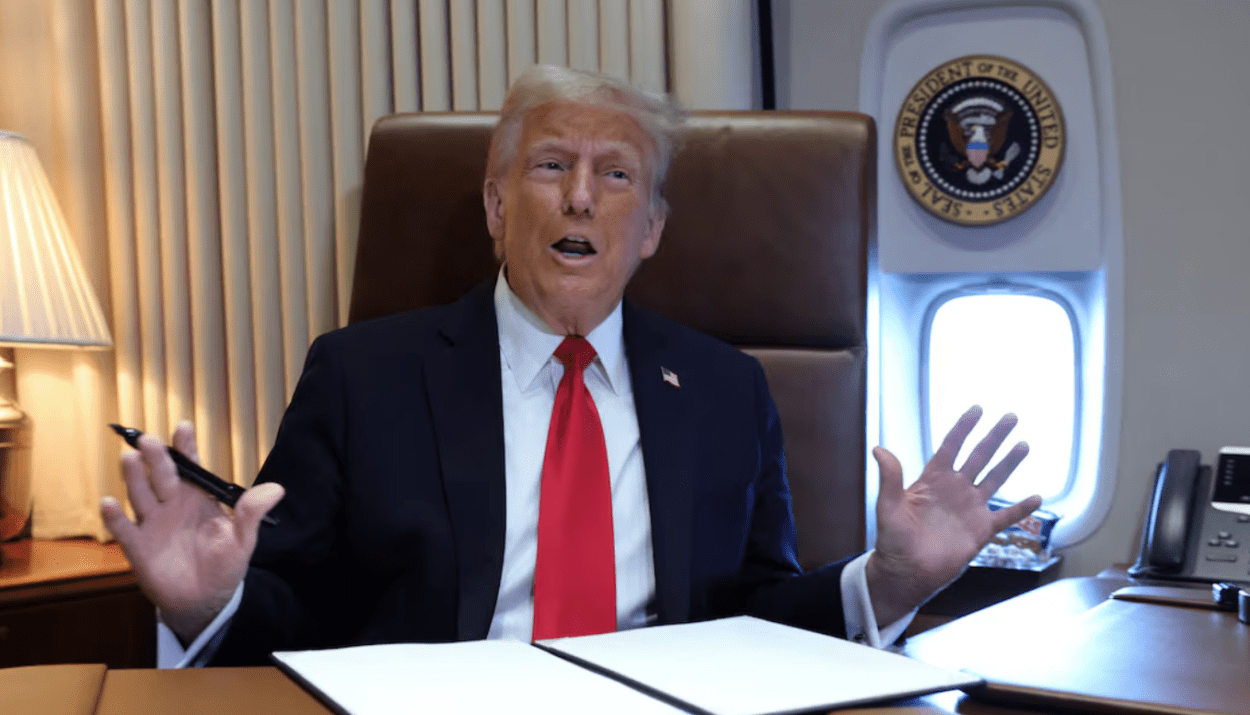

U.S. President Donald Trump announced a 25% tariff on all steel and aluminium imports into the U.S., with reciprocal tariffs set to follow within days. These measures, expected to take effect almost immediately, could have significant implications for multiple sectors of the stock market. (Related: Trump to Announce Reciprocal Tariffs: Is a New Stock Dip Coming?)

Potential Impact on Stocks

1️⃣ Steel & Aluminum Stocks Could Rally

- Winners: U.S. steel and aluminum producers such as Nucor (NUE), U.S. Steel (X), and Alcoa (AA) may benefit as domestic demand for American-made metals rises.

- Losers: Companies that rely on imported steel and aluminum, such as Boeing (BA), Caterpillar (CAT), and Ford (F), could face higher input costs, squeezing profit margins.

2️⃣ Automakers & Aerospace May Take a Hit

- Car manufacturers like General Motors (GM) and Tesla (TSLA) use large amounts of steel and aluminum. Higher costs may lead to price hikes, potentially hurting sales.

- Boeing (BA) and other aerospace manufacturers may struggle with cost increases, especially if retaliatory tariffs hit U.S. exports.

3️⃣ Industrial & Manufacturing Stocks Face Uncertainty

- Companies involved in construction, heavy equipment, and manufacturing (e.g., Caterpillar (CAT) and John Deere (DE)) may see cost pressures that could impact profit margins and stock prices.

4️⃣ Retail & Consumer Goods Stocks Could Feel the Pressure

- If tariffs cause inflationary pressures, consumer goods companies like Walmart (WMT), Target (TGT), and Home Depot (HD) could see higher costs and reduced consumer spending.

5️⃣ Stock Market Volatility Likely to Increase

- Short-term uncertainty may trigger market volatility, especially if China, the EU, or other trading partners retaliate with countertariffs.

- Safe-haven assets such as gold (GLD) and U.S. Treasuries (TLT) could see inflows as investors hedge against market uncertainty.

Conclusion: Trade War Risks Loom

If these tariffs escalate into a broader trade conflict, expect increased volatility across equities, particularly in industrials, autos, and manufacturing. Investors should watch for retaliatory measures from key U.S. trading partners, as well as Trump’s reciprocal tariff announcement later this week, which could further impact global supply chains and market sentiment.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Bullish Momentum vs. Financial Reality in Palantir

Here Are 10 Most Polarizing Stocks in Market Right Now & Why Critics Might Be Wrong

China tech stocks enter bull market: Here’s why and what to expect

After quietly hit a record high, Gold is telling us something

Trumpiverse: Ranking Trump’s Inner Circle

Is AMD is next Intel? An In-Depth Analysis

Is Palantir Proving to be the Dark Horse AI Stock?

Here is why stock market will be HIGHLY tradable: More volatility is coming

Markets are in one of their greatest trading environments of all time. Want to capitalize on it?

Has a new era begun? Investors have never been so optimistic…

Does Billionaire Warren Buffett Know Something Wall Street Doesn’t?

Earnings Calendar for This Week: Stocks to Watch and Forecast

Trump’s Media Group Files for Bitcoin ETF: A Game-Changer for DJT?

Stock Market on Edge: Mixed US Jobs Report Sparks Uncertainty Over Fed’s Next Move