The Trump vs. Powell showdown is hitting a boiling point.

After Fed Chair Jerome Powell warned that Trump’s sweeping new tariffs would fuel inflation and signaled no interest rate cuts, the former-turned-current president hit back — hard.

“Termination cannot come fast enough,” Trump wrote on Truth Social, taking his most direct shot yet at the man he once appointed to lead the central bank.

And while Trump hasn’t pulled the trigger, he’s reportedly been privately discussing replacing Powell before his term ends in 2026 — possibly with former Fed governor Kevin Warsh, according to The Wall Street Journal. No decision has been made, but the mere idea has markets and legal experts on edge.

Under federal law, the president can only remove the Fed chair “for cause.” Translation: Not for disagreeing over rates. Any attempt to fire Powell early would likely end up at the Supreme Court, where the limits of presidential power over independent agencies are already under review in a separate case.

Behind the scenes, even Treasury Secretary Scott Bessent is said to be talking Trump down, warning that firing Powell could destabilize markets and further weaken the dollar.

Still, Trump keeps the pressure on: “Powell will face a lot of political pressure,” he told allies, clearly hoping to coax the Fed into rate cuts that would boost growth before the 2026 election.

Polls Show Trump Has the Edge Over Powell — At Least Publicly

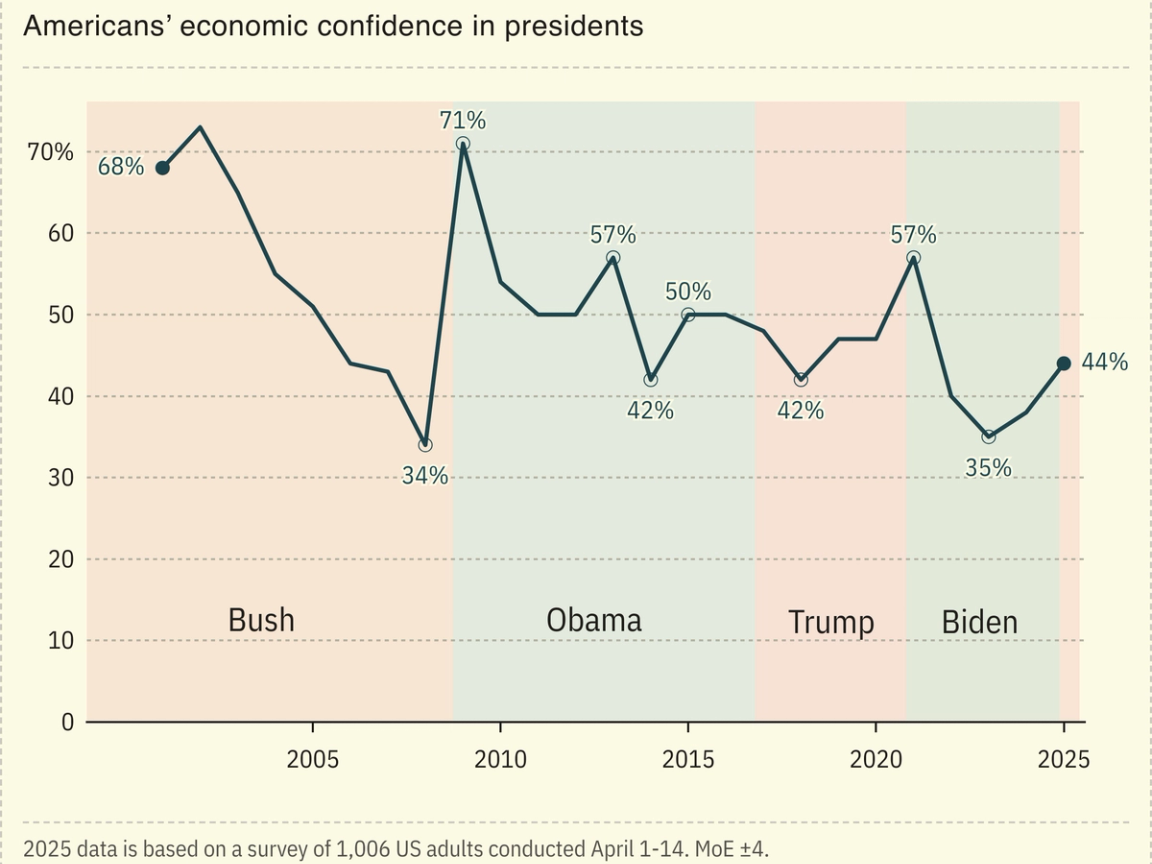

Despite the chaos surrounding tariffs and rate disputes, Trump holds a clear trust advantage over Powell when it comes to the economy.

According to a Gallup poll taken in early April:

- 44% of U.S. adults say they trust Trump to do the right thing on the economy

- That’s compared to just 37% for Powell — a record low for any Fed chair

Even more telling:

- Republicans overwhelmingly back Trump’s economic handling

- Trump’s overall job approval stands at 44%, with 53% disapproving

- His Q1 average approval sits at 45% — well below that of recent predecessors like Biden (56% during the same period)

Bottom Line

Trump’s saber-rattling against the Fed isn’t new — but this time, it’s louder, more personal, and tied directly to his own economic vision heading into the next election cycle.

With inflation creeping back, a tariff war heating up, and rate cuts off the table (for now), Trump sees Powell as an obstacle. Powell sees himself as a firewall against politicized monetary policy.

Whether this ends in Supreme Court drama or more posts on Truth Social, one thing is clear: The Fed’s independence is being tested — and so is Wall Street’s patience.

Related:

OpenAI spends ‘tens of millions of dollars’ on people saying ‘please’ and ‘thank you’

Road to $1 Trillion: How Netflix Plans to Become Tech Giant, Not Just Streamer

The Role of Fiscal Dominance in Monetary Policy

Authorities use high tech, called “Overwatch” to enhance border security

Why are more rich Americans opening Swiss bank accounts recently?

Gold Is at a Record High. Why It Could Climb Even Higher?

Nvidia’s CEO makes surprise visit to Beijing after US restricts chip sales to China

The Rule of 40: Your Ultimate Guide to Evaluating Software Stocks

How does the Eurodollar System Influence Global Markets?

Nvidia faces $5.5 billion charge as US restricts chip sales to China

China to now pay up to 245% tariffs on imports to US: Trump’s latest move