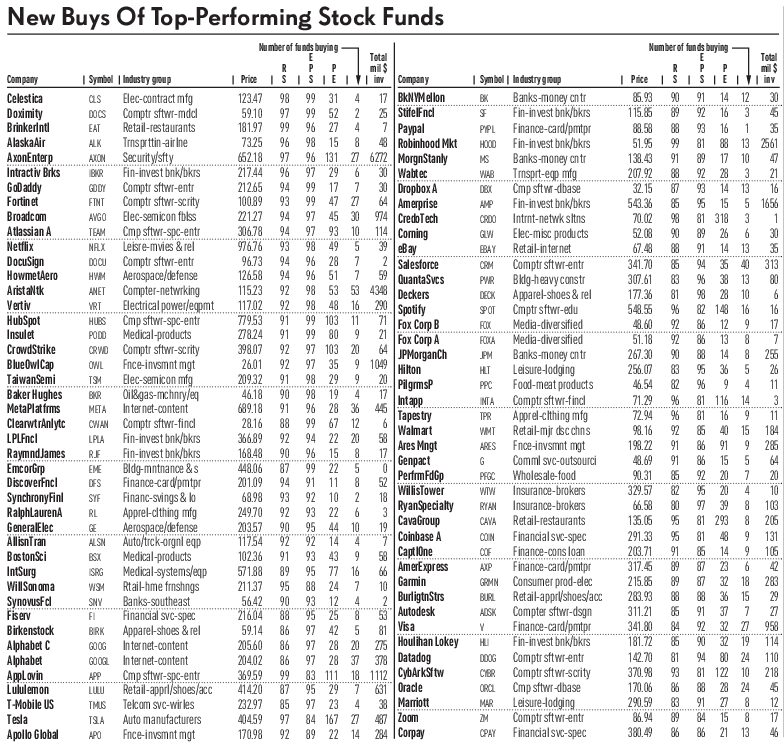

In January 2025, leading mutual funds made significant investments in several high-profile companies, reflecting strategic shifts in their portfolios regarding Investor’s Business Daily. Here’s a breakdown of these notable acquisitions:

| Company | Ticker | Amount Invested |

|---|---|---|

| Axon Enterprise | AXON | $6.28B |

| Arista Networks | ANET | $4.35B |

| Robinhood | HOOD | $2.56B |

| Ameriprise | AMP | $1.66B |

| AppLovin | APP | $1.11B |

| Blue Owl | OWL | $1.05B |

| Broadcom | AVGO | $974M |

| Tesla | TSLA | $487M |

| Meta | META | $445M |

| Alphabet | GOOGL | $378M |

| Salesforce | CRM | $313M |

| CyberArk | CYBR | $218M |

| Lululemon | LULU | $631M |

1. Axon Enterprise (AXON)

- Investment: $6.28 billion

- Details: Axon, renowned for its Taser devices and law enforcement technology, attracted substantial capital from top mutual funds. The company’s strong market position and innovative product line have made it a favourite among institutional investors.

2. Arista Networks (ANET)

- Investment: $4.35 billion

- Details: Arista Networks, a leader in cloud networking solutions, saw significant inflows from major funds, underscoring confidence in its growth trajectory within the tech infrastructure sector.

3. Robinhood Markets (HOOD)

- Investment: $2.56 billion

- Details: The popular trading platform, known for its appeal to younger investors, garnered notable investments, indicating mutual funds’ optimism about its future prospects in the financial services industry.

4. AppLovin (APP)

- Investment: $1.11 billion

- Details: AppLovin, specializing in mobile app technology and AI-driven solutions, attracted significant attention due to its impressive earnings growth and strategic position in the mobile ecosystem.

5. Tesla (TSLA)

- Investment: $487 million

- Details: After a hiatus since August 2023, Tesla reappeared on the list of new buys by top mutual funds, reflecting renewed confidence in the electric vehicle manufacturer’s market position and future potential.

6. Meta Platforms (META)

- Investment: $445 million

- Details: Meta, the parent company of Facebook, continued to be a significant acquisition, highlighting its ongoing influence in the social media and virtual reality spaces.

7. Alphabet (GOOGL)

- Investment: $378 million

- Details: Alphabet, Google’s parent company, remained a key target for mutual funds, emphasizing its stronghold in the tech industry and diverse revenue streams.

These strategic investments by leading mutual funds underscore their focus on companies with strong growth prospects and influential market positions across various sectors.

Related:

Trump’s 25% Tariffs on Steel & Aluminum: What It Means for Stocks

Trump to Announce Reciprocal Tariffs: Is a New Stock Dip Coming?

Key Events to Watch in [Week] & Their Market Impact

Bullish Momentum vs. Financial Reality in Palantir

Here Are 10 Most Polarizing Stocks in Market Right Now & Why Critics Might Be Wrong

China tech stocks enter bull market: Here’s why and what to expect

After quietly hit a record high, Gold is telling us something

Trumpiverse: Ranking Trump’s Inner Circle

Is AMD is next Intel? An In-Depth Analysis

Is Palantir Proving to be the Dark Horse AI Stock?

Here is why stock market will be HIGHLY tradable: More volatility is coming

Markets are in one of their greatest trading environments of all time. Want to capitalize on it?

Has a new era begun? Investors have never been so optimistic…

Does Billionaire Warren Buffett Know Something Wall Street Doesn’t?

Earnings Calendar for This Week For Biotechs, Pharma And Econ, Plus Amazon And Alphabet

Trump’s Media Group Files for Bitcoin ETF: A Game-Changer for DJT?

Stock Market on Edge: Mixed US Jobs Report Sparks Uncertainty Over Fed’s Next Move