The markets tumbled on Friday, with the Dow (-1.70%) and S&P 500 (-1.70%) posting steep losses, while the Russell 2000 (-2.94%) took an even bigger hit. The selloff was widespread, but consumer staples (+1.17%) stood out as the only sector in the green. Meanwhile, utilities remained flat, while technology, consumer discretionary, industrials, and energy all shed more than 2%.

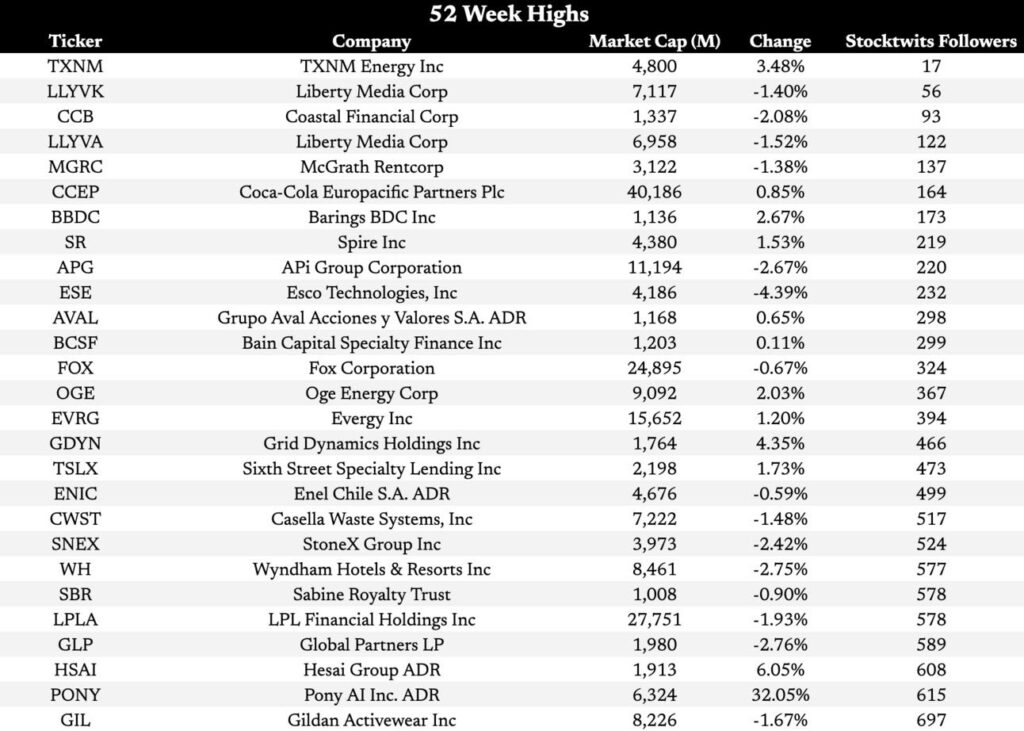

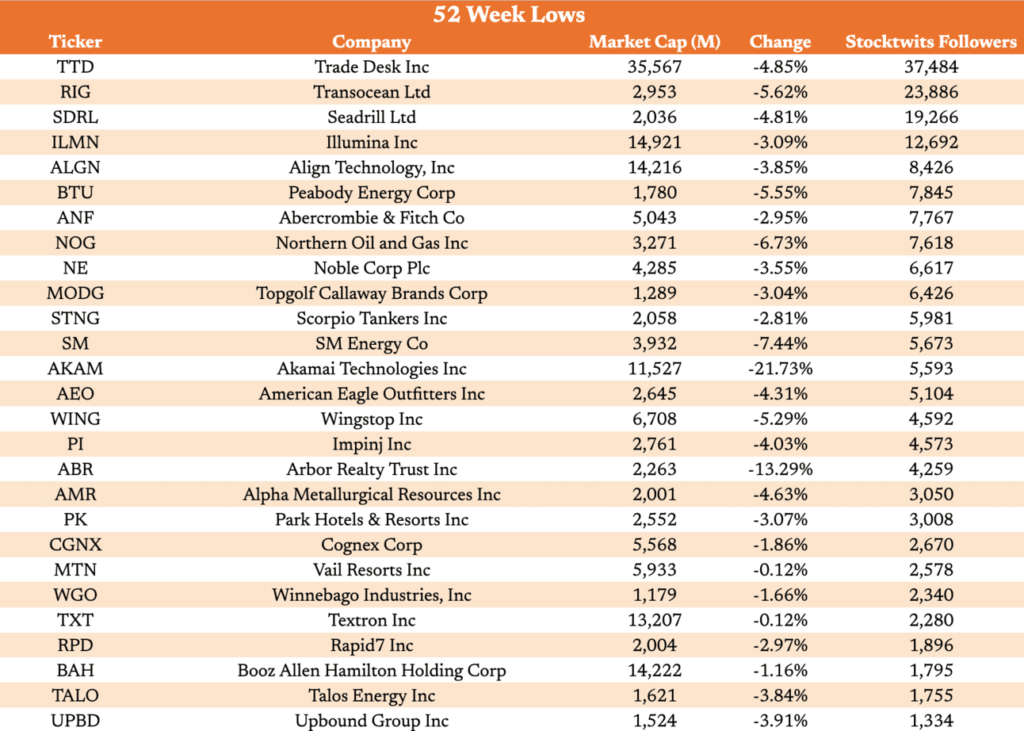

Despite the pullback, new 52-week highs outpaced new lows (84 vs. 65), signaling resilience in select stocks.

Trends With No Friends: The Hidden Gems of the Market

The Trends With No Friends (by Stocktweets) strategy focuses on stocks with:

✅ High Relative Strength (outperforming the market)

✅ Low Stocktwits Following (still under the radar)

Why does this matter? Stocks that are already strong tend to keep running, and those undiscovered by retail investors have massive breakout potential once the crowd catches on.

(In other words: Trends With No Friends sifts through the noise and discovers stocks above $1B market cap with high relative strength and low Stocktwits following. Stocks that are outperforming tend to continue to outperform. Stocks that have a low Stocktwits following are, by definition, undiscovered by the crowd. Stocks that have both Relative Strength and Low Stocktwits Following can really outperform as more investors discover them. They are ripe to rip.)

Here’s a breakdown of the winners and losers from Friday’s action:

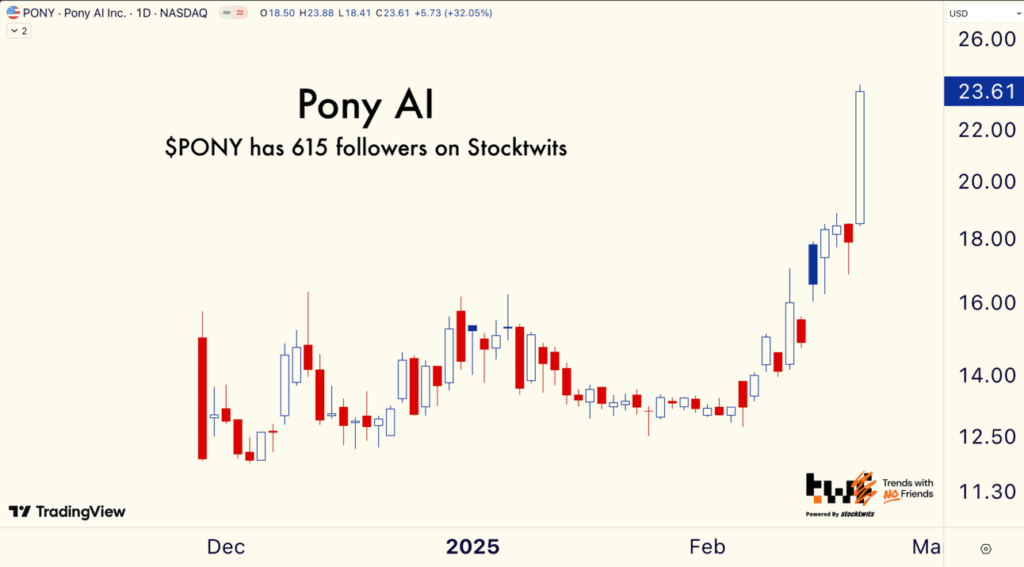

🚀 Best of the Best: Pony AI ($PONY)

The standout performer of the day was Pony AI ($PONY), an autonomous driving software developer. The stock skyrocketed 32.05%, closing at an all-time high and proving its momentum is no joke.

📊 Why is this a big deal? Pony AI has just 615 followers on Stocktwits—meaning it’s still flying under the radar. If institutional and retail interest builds, this stock could continue to see explosive moves in the coming weeks.

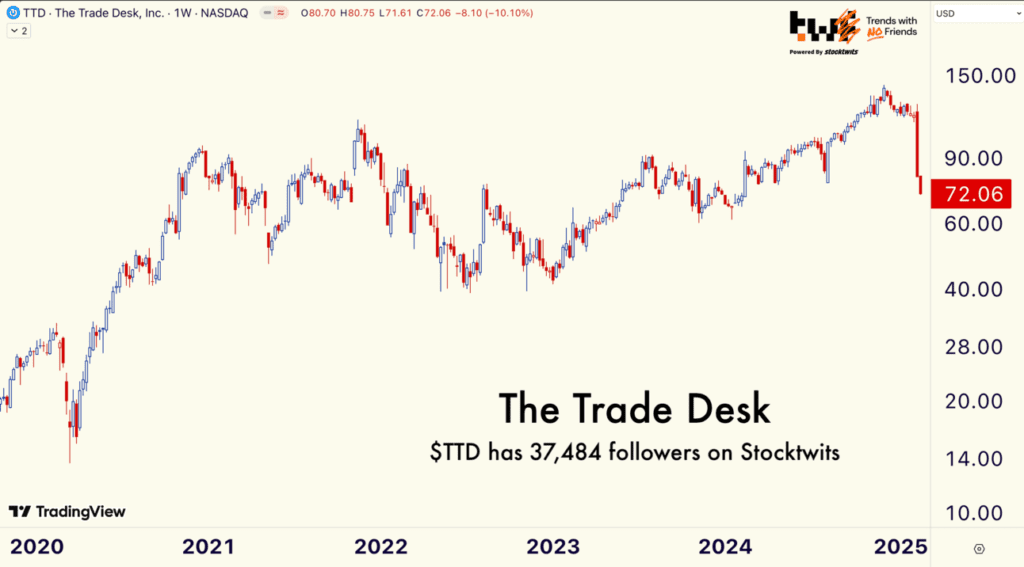

📉 Worst of the Worst: Trade Desk ($TTD)

🔹 -4.85% | Fresh 52-Week Low

On the flip side, Trade Desk ($TTD) got hammered, dropping -4.85% and closing at its lowest level since February 2024.

📊 What’s happening?

The digital advertising software company has 37,484 followers on Stocktwits—showing it’s well-known, but struggling. The technical setup remains weak, with no clear support in sight on the charts.

📈 52-Week Highs & 52-Week Lows

Despite the broader market dip, several stocks hit fresh 52-week highs, while others struggled at new lows.

Key Takeaways

✔️ Undiscovered stocks with strong momentum tend to outperform.

✔️ Pony AI ($PONY) is surging with little retail attention—watch for more upside.

✔️ Trade Desk ($TTD) is breaking down, with technical weakness continuing.

✔️ Markets pulled back sharply, but some sectors like consumer staples held up.

While the broader market faced selling pressure, hidden gems continued to emerge. As always, keeping an eye on stocks with both relative strength and low retail participation can uncover massive future winners.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Market Looks Strong—But Whales Are Quietly Exiting, Should You?

Bank of America Sees an ‘Attractive Entry Point’ in These 2 Stocks

Wall Street’s latest favorites – Hedge Funds’ Top Picks in Q4

This Week S&P500 ChartStorm – Bad News Damages Investor Sentiment

Warren Buffett Berkshire now hold a record $334 BILLION in cash, What does he know that we don’t?

Key Earnings Takeaways from This Week: AI, E-Commerce, and Travel Stocks Lead Market

Will Elon Musk Enter Quantum Computing? Here’s Why It Might Happen in 2025

Intel Turbulent Week: Breakup Rumors, Strategic Deals, and What It Means for $INTC Stock

Nvidia CEO Jensen Huang directly addresses DeepSeek stock sell-off, saying investors got it wrong

Gold market cap hit $20 TRILLION for first time in history. Why are people still piling into gold?

Analysis: Is Kelsier’s $200MM insider trading scandal the next FTX?

How Dirty Money From Fentanyl Sales Is Flowing Through China

Trump plans to impose 25% tariffs on autos, chips and pharmaceuticals – Stock Market Impact

Congressional Stock Trading Scandal: Lawmakers Profit Big on Palantir Stock Surge