Money rules your life whether you control it or not. That’s the hard truth most people learn too late. Money might not buy happiness, but financial stress can certainly steal it. A startling 85% of Americans worry about money, according to the Financial Health Network. This stress isn’t just emotional—it’s physical too, increasing your risk of heart disease by 23% and causing headaches, sleep problems, and reduced productivity. Here are 13 principles for financial success, which are timeless.

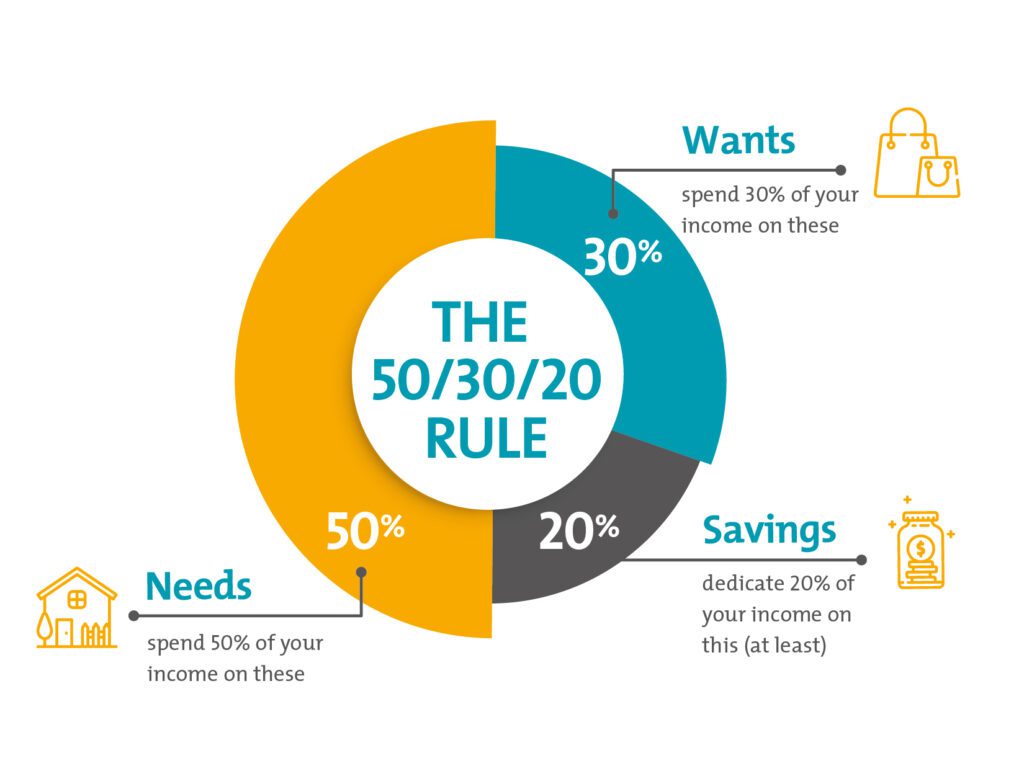

1. The 50/30/20 Rule: Blueprint for Smart Budgeting

Imagine having a clear roadmap for every dollar you earn—no more guessing, no more month-end surprises.

The 50/30/20 rule is one of the simplest yet most effective budgeting techniques ever created. It gives you a straightforward framework for allocating your after-tax income:

- 50% for needs: Housing, groceries, utilities, minimum debt payments, and other essentials

- 30% for wants: Dining out, entertainment, hobbies, and other non-essential spending

- 20% for savings and debt: Emergency fund, investments, and extra debt payments

Why does this rule work so well? It fights our natural “present bias“—our tendency to prioritize immediate rewards over future benefits. By dedicating a specific portion to saving, you’re making your future security non-negotiable.

When I first learned this rule at 20, I was shocked at how quickly I could identify areas where my spending was out of balance. Within three months of adjustment, I had my first-ever emergency fund started.

Steps to implement this rule today:

- List all your current expenses and categorize them as needs, wants, or savings

- Calculate the percentage you’re currently spending in each category

- Identify areas where you can cut back to reach the 50/30/20 balance

- Set up automatic transfers to savings accounts to ensure your 20% is protected

Try this: Challenge yourself to a 30-day no-spend period where you eliminate non-essential purchases. Track how much you save and immediately transfer it to savings. Many people find they can save an extra $300-500 this way!

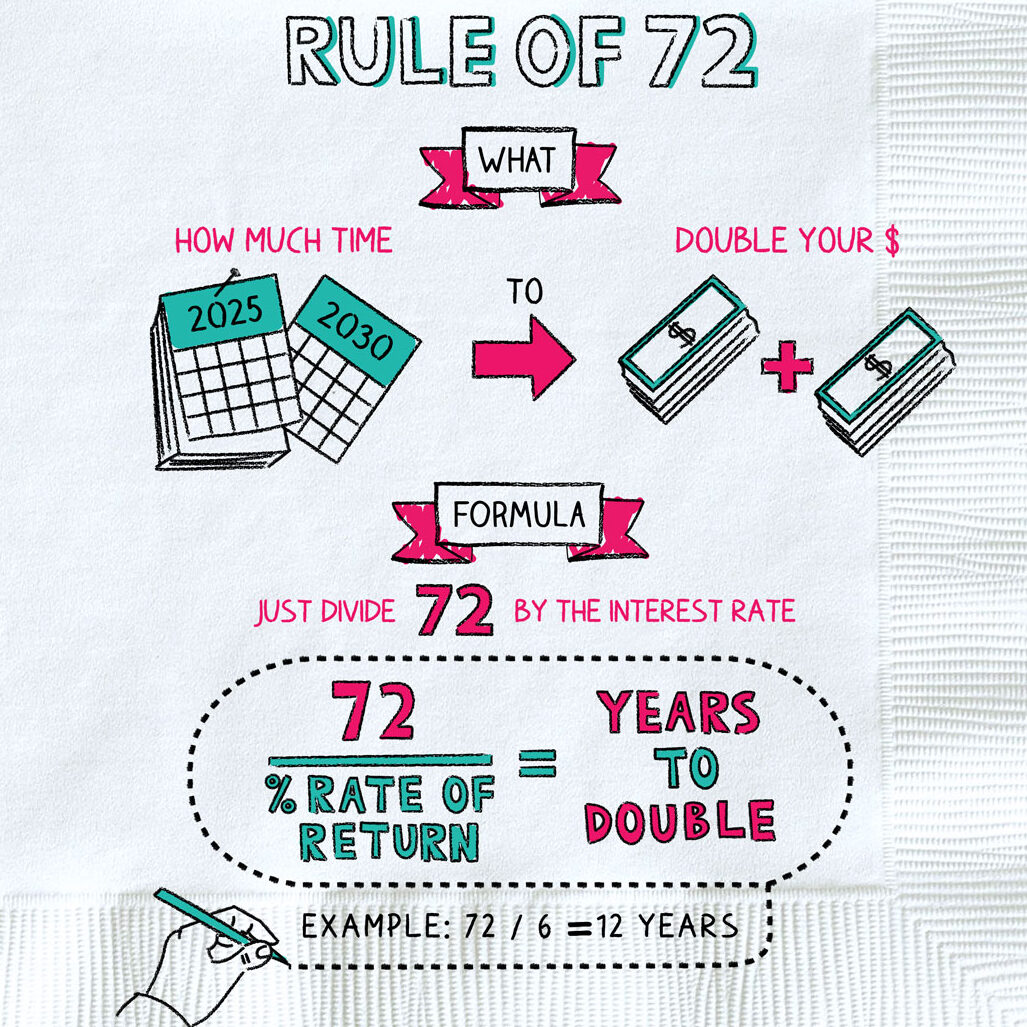

2. The Rule of 72: The Power of Compound Interest

Did you know there’s a simple math trick that can tell you how quickly your investments will grow?

The Rule of 72 is a mental math shortcut that reveals how long it will take for your money to double through compound interest:

Divide 72 by your annual return rate = Years to double your money

For example:

- Money earning 4%: 72 ÷ 4 = 18 years to double

- Money earning 8%: 72 ÷ 8 = 9 years to double

- Money earning 12%: 72 ÷ 12 = 6 years to double

This rule shows why even small differences in return rates matter enormously. A 25-year-old who invests $10,000 at 4% will have $20,000 by age 43. The same person investing at 8% will have $40,000 by that age—twice as much!

As Albert Einstein supposedly said, compound interest is “the eighth wonder of the world.” Whether he actually said this is debated, but the principle remains true: compound interest transforms modest savings into wealth when given enough time.

Start early: If you begin investing just $200 monthly at age 25 with an 8% average return, you’ll have over $620,000 by age 65. Wait until 35 to start, and you’ll have less than half that amount.

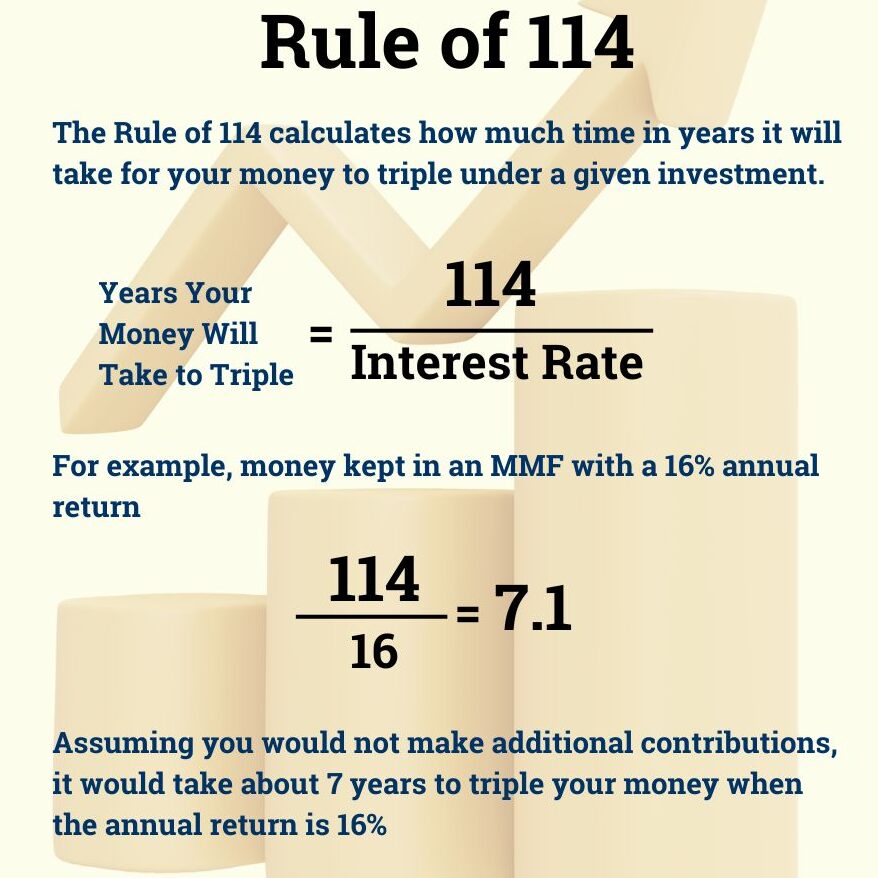

3. The Rule of 114: When Will Your Money Triple?

While everyone talks about doubling your money, what about tripling it?

The Rule of 114 is the less-known cousin of the Rule of 72. It follows the same principle but tells you how many years it will take for your money to triple:

Divide 114 by your annual return rate = Years to triple your money

For example:

- Money earning 6%: 114 ÷ 6 = 19 years to triple

- Money earning 9%: 114 ÷ 9 = 12.7 years to triple

This rule demonstrates why long-term thinking pays off. Many people get discouraged when their investments don’t grow quickly, but understanding this rule helps you set realistic expectations and stay the course.

Example: My neighbor who started investing $200 monthly at age 25 was disappointed to have “only” $30,000 after 8 years. When I showed her the Rule of 114, she realized that by simply staying consistent, that money would likely triple to $90,000 by her early 40s without adding a penny more.

4. The 20/4/10 Rule: Don’t Let Cars Drive Away Your Wealth

The average American spends nearly $10,000 annually on car expenses. Are you letting your vehicle steer you away from wealth?

Cars are the most common way young people sabotage their financial future. The 20/4/10 rule keeps you safe:

- Put at least 20% down on a car

- Finance for no more than 4 years

- Keep total car costs under 10% of your gross income

This includes not just the payment but insurance, gas, and maintenance too.

Following this rule could free up $3,000-5,000 yearly for investing. Over 30 years at an 8% return, that’s an extra $367,000-$612,000 in your retirement account!

What wealthy people do: Even millionaires often drive practical, reliable cars rather than luxury vehicles. As billionaire Mark Cuban says, “A car loses value the minute you drive it off the lot.“

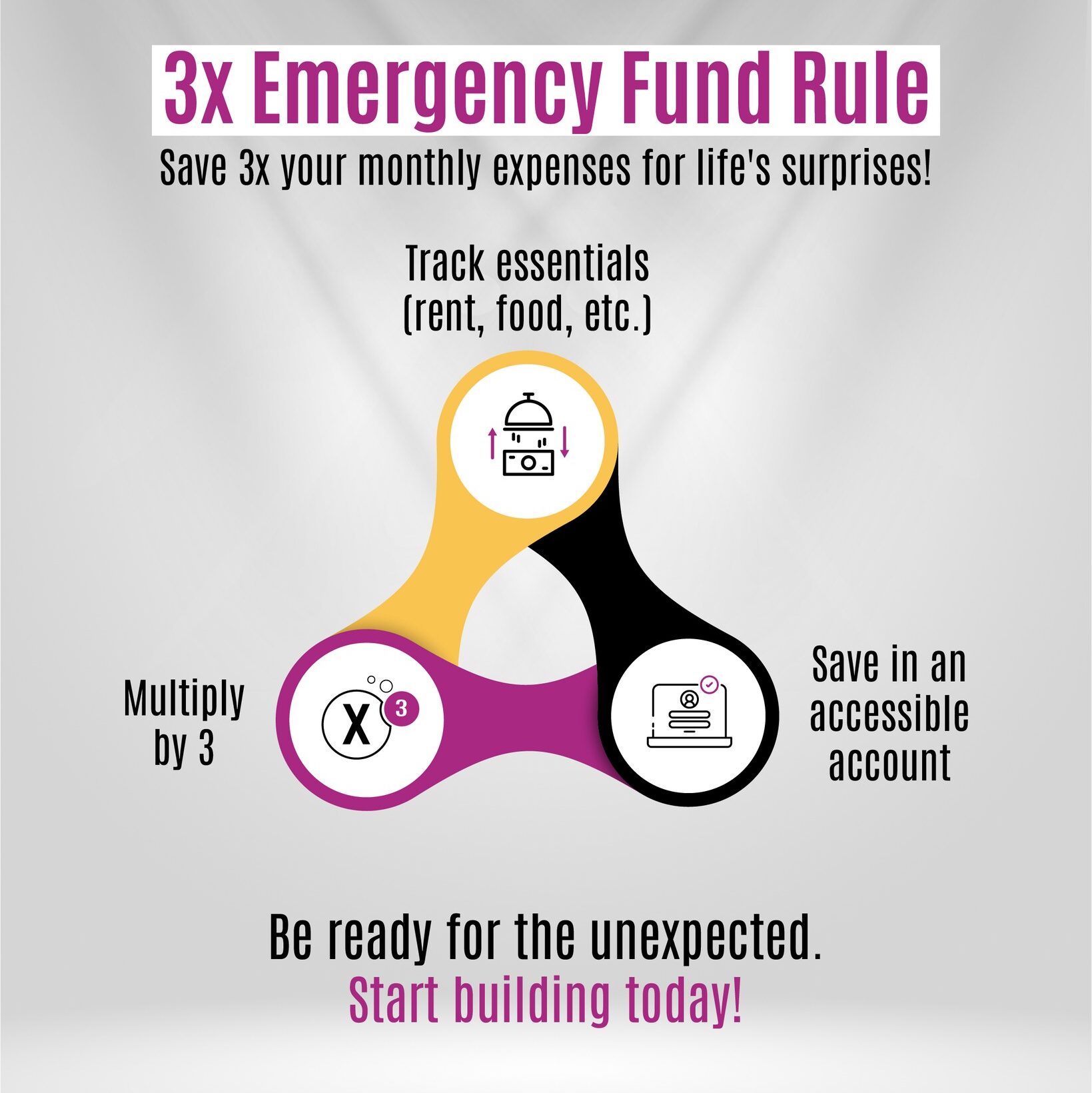

5. The 3X Emergency Rule: Your Financial Safety Net

I used to worry about unexpected expenses and how I would pay for them. The 3X emergency rule helped me build a safety net and reduced my financial anxiety. Knowing I have money set aside for emergencies gives me peace of mind.

Life is unpredictable. Job losses, medical issues, and major repairs don’t announce themselves in advance. The 3X Emergency Rule says:

Keep at least 3 months of essential expenses in a liquid savings account.

For extra security, especially if you have an unstable income or dependents, aim for 6 months of expenses.

Example: My cousin lost his tech job during layoffs but had six months of expenses saved. This gave him time to find the right next role instead of taking the first offer out of desperation. He eventually landed a job with a 20% higher salary than his previous position.

Where to keep your emergency fund: High-yield savings accounts provide some interest while keeping funds accessible. Don’t invest emergency money in stocks or other volatile assets.

A study by the Federal Reserve found that many Americans do not have enough savings to cover a $400 emergency expense.

Imagine if you lost your job tomorrow. How would you cover your expenses? How would an emergency fund help?

6. The 120-Minus-Age Rule: Smart Asset Allocation

As you age, your investment strategy should evolve. This simple formula tells you exactly how.

This rule helps you decide what percentage of your investments should be in stocks versus safer options like bonds:

Subtract your age from 120 = Percentage to put in stocks

For example:

- Age 25: 120 – 25 = 95% in stocks, 5% in bonds

- Age 40: 120 – 40 = 80% in stocks, 20% in bonds

- Age 60: 120 – 60 = 60% in stocks, 40% in bonds

The logic? Younger people have more time to recover from market downturns, so they can take more risk for potentially higher returns.

Easy implementation: Many target-date retirement funds automatically adjust your stock/bond mix following this principle, making it easier than ever to apply this rule.

7. The 10-5-3 Rule: Setting Realistic Return Expectations

This rule helps you understand typical long-term returns from different asset classes:

- Stocks/equity funds: around 10% annually

- Bonds/fixed income: around 5% annually

- Cash/savings accounts: around 3% annually

These are long-term averages – any given year may be dramatically different.

Understanding these patterns helps protect you from get-rich-quick schemes promising unrealistic returns. If someone guarantees 20% annual returns with no risk, that’s a huge red flag.

Risk vs. reward tradeoff: The stock market has historically delivered around 10% average annual returns, but with significant ups and downs. If you can’t tolerate that volatility, you might prefer the more stable but lower returns of bonds.

8. The Rule of 70: Guard Against Inflation and Preserve Purchasing Power

Even if you’re saving money, you might still be getting poorer. Here’s why.

Inflation silently erodes your money’s value over time. The Rule of 70 shows how quickly:

Divide 70 by the inflation rate = Years until prices double

For example:

- 2% inflation: 70 ÷ 2 = 35 years for prices to double

- 4% inflation: 70 ÷ 4 = 17.5 years for prices to double

- 8% inflation: 70 ÷ 8 = 8.75 years for prices to double

This explains why keeping money in a low-yield savings account actually makes you poorer over time. If inflation is 3% but your savings earn only 1%, you’re losing 2% of purchasing power each year.

Historical perspective: A dollar in 1990 has the same buying power as about $2.24 today due to inflation. This means money sitting in a no-interest account for 30 years lost more than half its value!significant ups and downs. If you can’t tolerate that volatility, you might prefer the more stable but lower returns of bonds.

9. The 4% Withdrawal Rule: Planning for Retirement

How much money do you need to retire comfortably? This rule gives you a clear target.

I used to be afraid of retirement because I didn’t know how much I needed to save or how to plan my withdrawals. The 4% withdrawal rule helped me overcome my fears by giving me a clear goal to aim for. I started saving and investing with the goal of having enough to withdraw 4% of my savings each year in retirement and felt more confident in my retirement planning.

A survey by Fidelity found that people who follow the 4% withdrawal rule are more likely to achieve their retirement goals.

The 4% Withdrawal Rule helps determine how much you need to save for retirement:

Divide your desired annual retirement income by 0.04 (or multiply by 25)

For example:

- Need $40,000 yearly in retirement? $40,000 ÷ 0.04 = $1,000,000 needed

- Need $80,000 yearly in retirement? $80,000 ÷ 0.04 = $2,000,000 needed

Research shows that withdrawing 4% annually from a diversified portfolio (adjusted for inflation each year) provides a high probability of your money lasting 30+ years in retirement.

Imagine retiring with enough savings to travel, pursue hobbies, and enjoy life. The 4% withdrawal rule can help you plan for a stable retirement income and achieve your long-term financial goals.

Academic backing: This rule originated from the “Trinity Study” in the 1990s and has been refined over time. Some financial planners now recommend a more conservative 3-3.5% withdrawal rate, especially for early retirees.

Financial independence: If you save 25 times your annual expenses, you’ve likely reached “financial independence” – the point where work becomes optional.

10. The Rule of 144: Quadrupling Your Money

For those with patience, the rewards are exponential. See how long it takes to multiply your money by four.

This lesser-known rule tells you how long it takes for your investment to become four times larger:

Divide 144 by your annual return rate = Years to quadruple your money

For example:

- Money earning 8%: 144 ÷ 8 = 18 years to quadruple

- Money earning 12%: 144 ÷ 12 = 12 years to quadruple

Understanding this rule helps you appreciate the massive difference between short and long-term investing. Many people invest for 5-10 years and are disappointed with the results. But those who stay invested for 20+ years often see life-changing growth.

The power of patience: Think of it this way: $10,000 invested at age 25 could become $40,000 by age 43 at an 8% return rate. That same money at the same return rate would become $160,000 by age 61 and $640,000 by age 79!

11. The 10-15X Income Life Insurance Rule: Protect Your Family

If someone depends on your income, this rule helps ensure they’d be financially secure if something happened to you.

My neighbor didn’t have adequate life insurance. When he passed away, his family struggled financially. They had to sell their home and rely on family for support.

If others depend on your income, life insurance is essential. This rule suggests:

Buy life insurance coverage worth 10-15 times your annual income.

For those with young children or significant debts, some experts recommend up to 20 times your income.

For example, if you earn $50,000 annually, aim for $500,000-$750,000 in term life insurance coverage.

Life is unpredictable. Without adequate life insurance, your family may struggle financially if something happens to you.

Term vs. whole life: Term life insurance (which covers you for a specific period like 20 or 30 years) is much more affordable than whole life insurance and usually the better choice for most people.

Common mistake: Many young adults put off buying life insurance, not realizing that rates increase with age and health issues. Buying a policy in your 20s locks in low rates that can save tens of thousands over the policy’s lifetime.

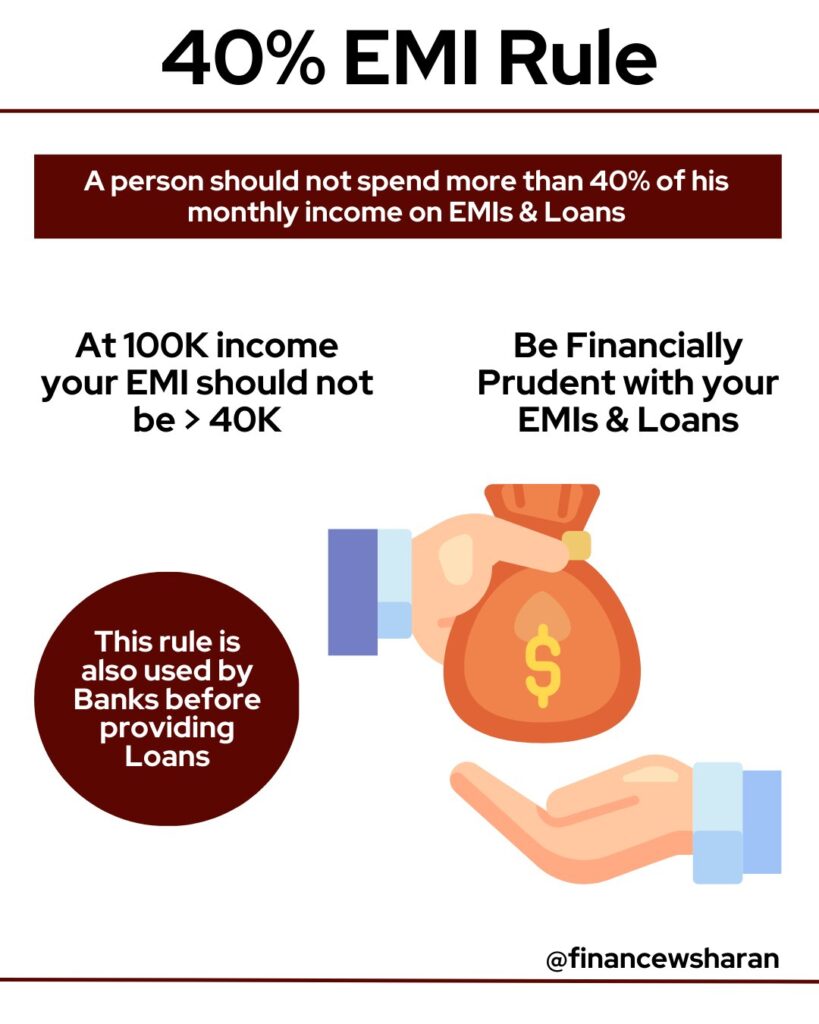

12. The 40% EMI Rule: Avoid the Debt Trap

Want to know if you’re borrowing too much? This simple percentage gives you a clear boundary.

This rule states that your total monthly debt payments should not exceed 40% of your gross monthly income.

This includes:

- Mortgage/rent

- Car payments

- Student loans

- Credit card minimum payments

- Any other loan payments

For example, if you earn $5,000 monthly, keep total debt payments under $2,000.

Banks often use similar calculations when approving loans, but just because you can qualify doesn’t mean you should borrow that much. Staying below 40% gives you financial flexibility for emergencies and opportunities.

Warning sign: If you’re approaching or exceeding this limit, you’re vulnerable to financial distress if your income drops even temporarily.

13. The 10/10/10 Decision Filter

Not sure if a purchase is worth it? This mental trick helps you see beyond the moment.

When making financial choices, ask:

- How will I feel about this in 10 minutes?

- How will I feel about this in 10 months?

- How will I feel about this in 10 years?

This filter prevents both impulsive spending and excessive frugality that sacrifices present happiness for distant goals.

I used to struggle with decision paralysis, especially when it came to major financial choices. The 10/10/10 decision filter helped me break down my thoughts into short-term, mid-term, and long-term perspectives. This made it easier to see the bigger picture and make a decision that I felt confident about.

Example in action: When considering whether to buy a $1,000 TV on credit:

- In 10 minutes: You’d feel excited about your new purchase

- In 10 months: You might regret the payments and interest charges

- In 10 years: You wouldn’t even remember the TV, but might still feel the impact of that debt

14. Important Points to Remember

- Financial stress affects 85% of Americans, causing both emotional and physical health problems including increased heart disease risk.

- The 50/30/20 rule (50% needs, 30% wants, 20% savings) provides a clear framework for budgeting that counters our natural “present bias.”

- Small differences in investment returns create enormous differences over time. The Rule of 72 shows money earning 8% doubles twice as fast as money earning 4%.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

- What percent of 18-29-year-olds are investing in the stock market?

- Why is it important to start investing as early as possible?

- How Much Money Should You Have Saved by Age 30?

- Common Mistakes People Make When Investing and How to Avoid Them

- Behaviors That Prevent Smart Investing Decisions and How to Overcome Them

- How to Get a Startup Business Loan with No Money Online: A Step-by-Step Guide

- How to Invest in Gold and Silver: A Step-by-Step Guide

- How To Invest $1,000 And Grow Your Money in 2025

- CD vs. mutual fund: Which is a better investment?