Some trades became unusually crowded around the time Trump took office. Deutsche Bank believes that several major trades, which can be considered the “Wall Street consensus,” ended up having opposite results compared to the market trends during his first term, and a similar pattern might emerge in Trump’s second term.

A strong dollar was Wall Street’s most popular trade consensus

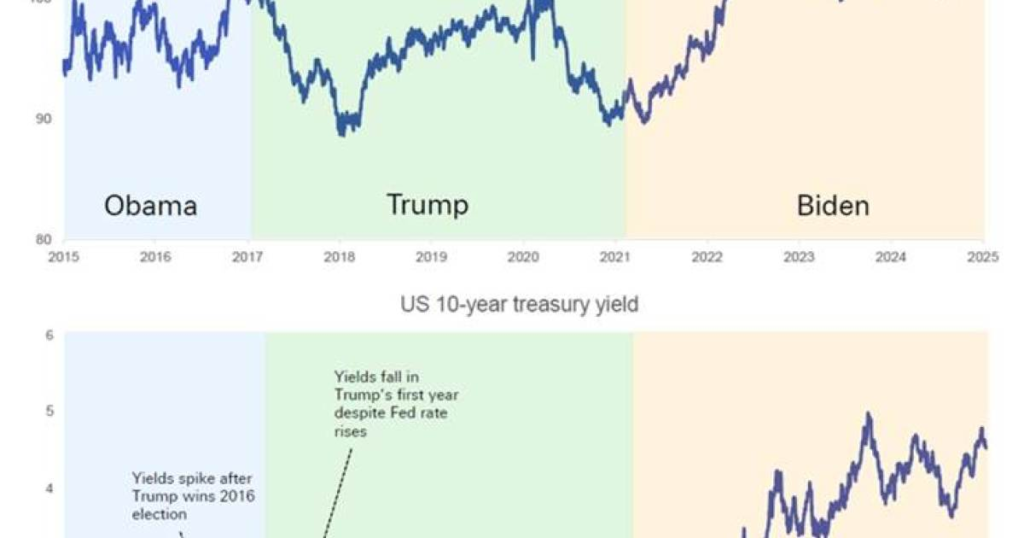

A strong dollar might be the most agreed-upon trade on Wall Street. However, during Trump’s first term, the dollar peaked around his inauguration and continued to fall throughout the first year. The 10-year yield reached its peak around the time of Trump’s first inauguration before declining throughout his first year. After that, it fluctuated in alignment with Federal Reserve policy.

Despite Trump’s promises to implement expansionary fiscal policies at that time, the inflation rate in 2017 remained low, leading investors to lower their expectations for future inflation. Additionally, although the Federal Reserve did raise interest rates in 2017, the pace of increases was slower than market expectations, which also contributed to a weaker dollar index.

The end of the Russia-Ukraine war might strengthen the contrarian Trump trade

Recent talks between the US and Russia in Saudi Arabia have started the negotiations over the Russia-Ukraine war. Although the details of the terms and the parties involved are still in the early stages of alignment, any sign of easing in the conflict will significantly impact asset prices.

From 2016 until February 24, 2022, prior to the outbreak of the Russia-Ukraine war, the Euro consistently stayed above 1.1 against the dollar, and the dollar index remained below 100.

If the Russia-Ukraine conflict ends, the Euro is likely to gain a one-time valuation boost to recover some lost ground, and the dollar could return to below 100. This week’s weakening of the dollar is a result of the potential end of the Russia-Ukraine conflict.

Furthermore, Trump intends to recreate the “Plaza Accord” (currently promoting the “Mar-a-Lago Agreement”) and push for the depreciation of the dollar. If these follow in succession, the dollar is expected to enter a depreciation trend.

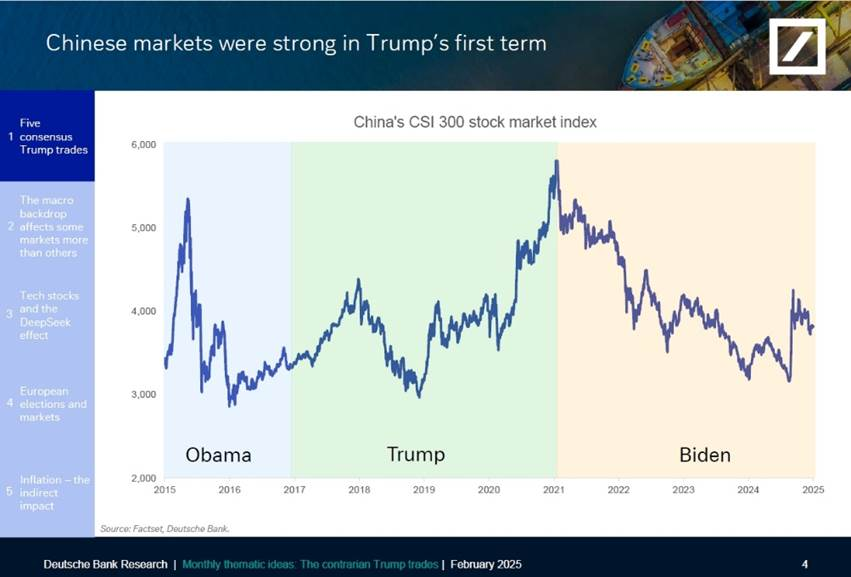

Another contrarian Trump trade is Chinese assets

Despite Trump viewing China as a competitor, Chinese assets were exceptionally strong during Trump’s first term. Similarly, the entire MSCI Emerging Markets Index performed on par with U.S. stocks. Conversely, during the Biden administration, US stocks significantly outperformed the MSCI Emerging Markets Index.

During Trump’s first term, trade protectionism forced the shift of industries and technological upgrades in other countries. Key technological fields such as renewable energy, advanced manufacturing, and battery technology enabled some Asia-Pacific countries to create new export opportunities.

The Trump trade has created opportunities to “buy the dip”

In terms of industry rotation, some of Trump’s big donors during the campaign, such as the military industry, saw their stock prices continue to fall after he took office as the Department of Government Efficiency (DOGE) initiated plans to reduce military expenditures.

However, some industries that were not initially supported have rebounded due to continuous technological advancement and rapid growth in demand. For example, GE Vernova in the wind power field has seen its share price rise by more than 10% since the beginning of the year. The Air Products and Chemicals, Inc., which produces hydrogen, has risen 10.0% since the beginning of the year.

Additionally, as nuclear energy is significant for America’s energy independence, several nuclear power companies have surged in 2025. Centrus Energy’s stock price has soared 67% since the beginning of the year, while Oklo’s stock price has increased by 136%. Below is a list of nuclear energy stocks:

Source: Moomoo

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Hedge Funds Loaded Up AI Stocks at the Fastest Pace Since 2021

These Stocks Could Skyrocket According to “Trends With No Friends” Strategy!

Market Looks Strong—But Whales Are Quietly Exiting, Should You?

Bank of America Sees an ‘Attractive Entry Point’ in These 2 Stocks

Wall Street’s latest favorites – Hedge Funds’ Top Picks in Q4

This Week S&P500 ChartStorm – Bad News Damages Investor Sentiment

Warren Buffett Berkshire now hold a record $334 BILLION in cash, What does he know that we don’t?

Key Earnings Takeaways from This Week: AI, E-Commerce, and Travel Stocks Lead Market

Will Elon Musk Enter Quantum Computing? Here’s Why It Might Happen in 2025

Intel Turbulent Week: Breakup Rumors, Strategic Deals, and What It Means for $INTC Stock

Nvidia CEO Jensen Huang directly addresses DeepSeek stock sell-off, saying investors got it wrong

Gold market cap hit $20 TRILLION for first time in history. Why are people still piling into gold?

Analysis: Is Kelsier’s $200MM insider trading scandal the next FTX?

How Dirty Money From Fentanyl Sales Is Flowing Through China