Tesla is facing a sharp decline in European sales, with figures showing a nearly 45% year-over-year drop in February — a potential sign of growing consumer backlash against Elon Musk’s political ties to Donald Trump.

According to new data from Jato Dynamics, Tesla sold fewer than 16,000 new vehicles across 25 European markets — including the EU, UK, Norway, and Switzerland — in February 2025, down from 28,000 a year earlier. Its market share slipped to 9.6%, marking its worst February performance in five years. The decline follows a similarly steep 45% drop in January sales.

UK Bucked the Trend

Despite the continent-wide slump, UK registrations rose nearly 21% last month, according to the Society of Motor Manufacturers and Traders (SMMT). Tesla’s Model 3 and Model Y were the second and third most popular models, behind only the Mini Cooper.

Backlash Over Musk’s Political Role

Analysts suggest that Tesla’s European sales may be impacted by Elon Musk’s controversial behavior and political affiliations. As a prominent figure in Trump’s administration, Musk has drawn criticism for:

- Supporting Germany’s far-right AfD party

- Brandishing a “chainsaw of democracy” at a conservative rally

- Accusing UK Labour leader Keir Starmer of covering up grooming scandals

These controversies, coupled with protests at Tesla dealerships, may be contributing to a consumer shift away from the brand.

Model Y Overhaul Also a Factor

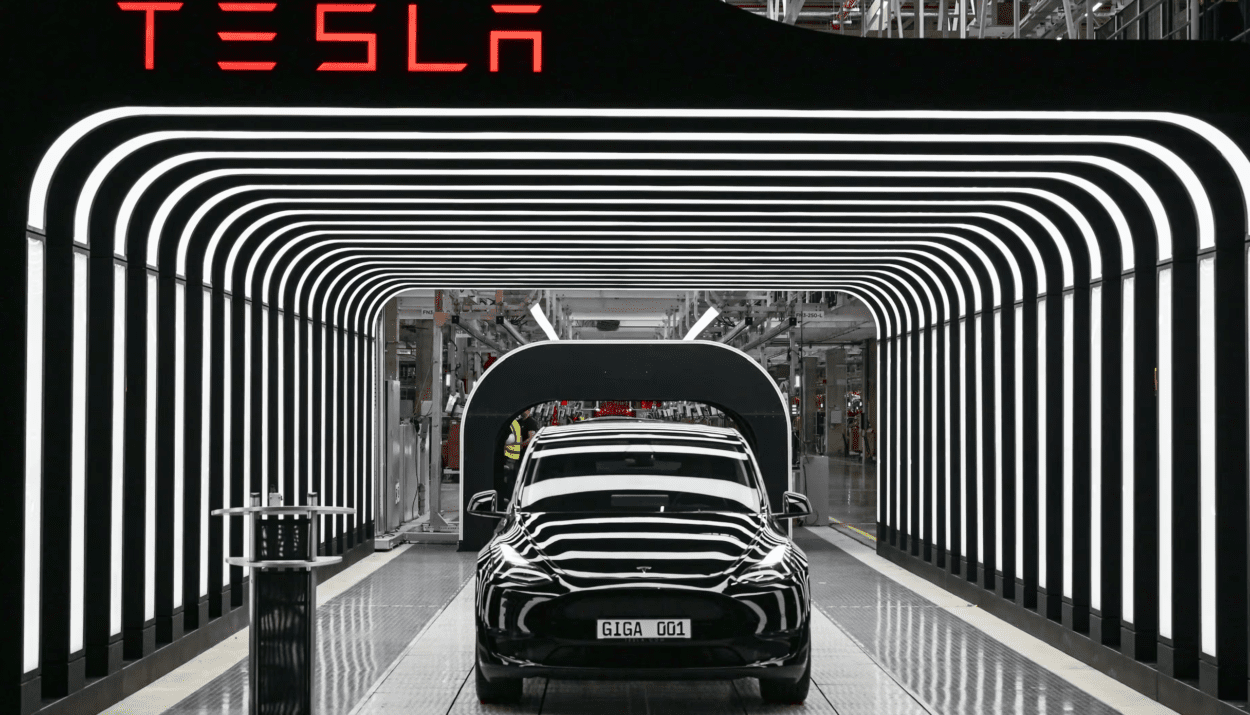

In addition to political backlash, Tesla’s declining figures are attributed in part to a model changeover of the Model Y, its best-selling car.

“Tesla is experiencing a period of immense change,” said Felipe Muñoz, global analyst at Jato Dynamics.

“Brands like Tesla, with limited lineups, are vulnerable to sales dips during model transitions.”

Rivals Surge Ahead in Europe

Tesla’s decline has opened the door for competitors:

- Volkswagen saw a 180% jump in battery electric vehicle (BEV) sales to nearly 20,000 units

- BMW and Mini sold a combined 19,000 BEVs

- BYD recorded a 94% increase in European sales to over 4,000 units

- Polestar boosted sales by 84%, surpassing 2,000 units

BYD Overtakes Tesla in Global Revenue

BYD also overtook Tesla in global annual EV revenue, bringing in 777 billion yuan ($107 billion) in 2024 — up 29% year-over-year. In comparison, Tesla reported $97.7 billion in annual revenue.

Although BYD sold 1.76 million pure electric vehicles compared to Tesla’s 1.79 million, BYD’s total vehicle sales — including hybrids — reached 4.27 million, nearing Ford’s 4.5 million.

Market Value and Outlook

- BYD is now valued at $160 billion, up 50% in 2025

- Tesla’s valuation stands at $780 billion, despite a 33% drop in its share price this year

- Tesla shares rose 6% on Monday, buoyed by a 2% gain in the Nasdaq

Industry Snapshot

Total car sales across the 25 European markets plus the UK, Norway, and Switzerland declined 3% in February to 970,000 units. However, BEV registrations surged 25%, signaling sustained demand for electric vehicles despite Tesla’s dip.

Tesla’s slipping market share in Europe underscores the challenges of brand volatility, limited model variety, and the risks of polarizing public figures. Meanwhile, BYD’s surge reflects China’s growing dominance in the global EV market — and a potential shift in consumer loyalties.

Related: Trump’s Tariff ‘Liberation Day’ Is 9 Days Away: What You Need to Know as Reciprocal Tariffs Loom

Binance CEO says Trump has been ‘fantastic’ for crypto

North Korea launches new unit with a focus on AI hacking

White House Says Gold Reserves May Be Used To Purchase Bitcoin

Gen Z To Become Richest Generation By 2035: Report

Drama Over Quantum Computing Future heats Up

Nvidia Death Cross Has Traders on High Alert as Momentum Withers

Musk: Tesla to build 5,000 Optimus robots in 2025, tells staff not to sell shares

Trump Promises ‘Flexibility’ on Reciprocal Tariffs

MicroCloud Hologram Reports Strong 2024 Financial Results, Eyes Global Expansion

$1M later, here are the takeaways from sponsoring B2B influencers