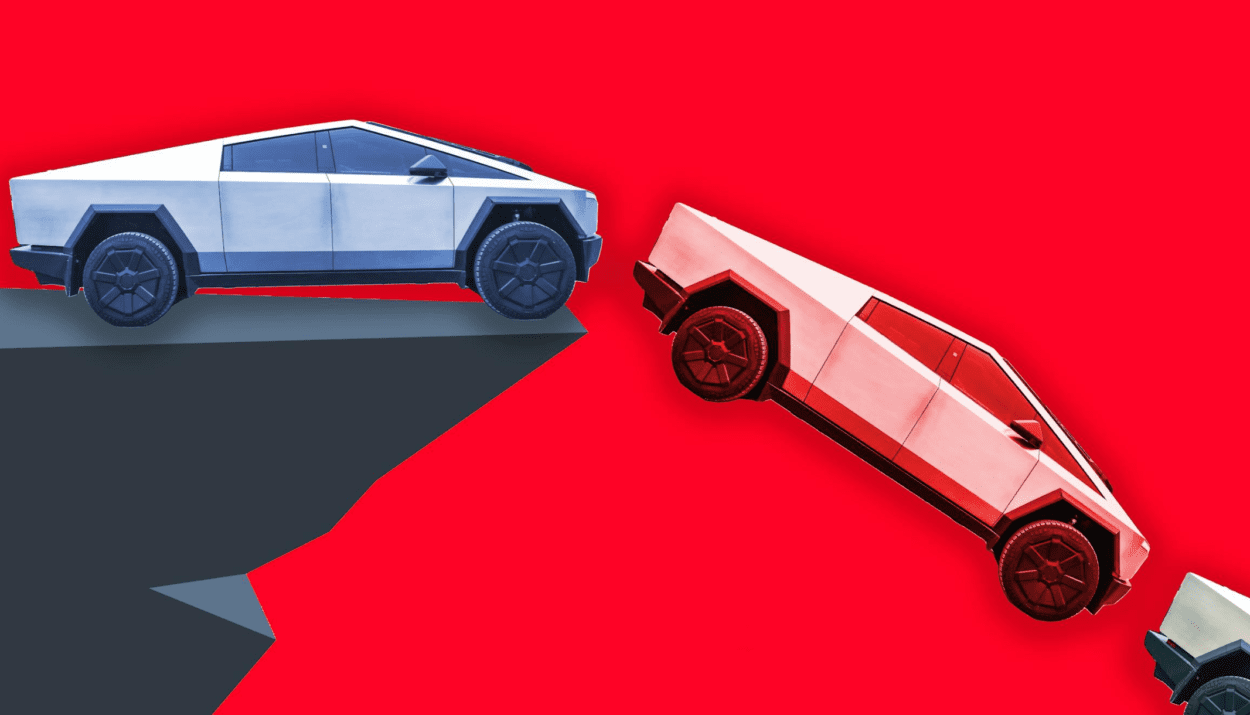

Tesla is rapidly losing ground in Europe — and it’s not just about competition anymore. The EV giant saw its sales drop by a staggering 49% year-over-year in April, even as electric vehicle demand across the continent surged by 34%, data from the European Automobile Manufacturers’ Association (ACEA) confirmed this week.

Key Details:

- Tesla sold only 7,261 vehicles in Europe in April, down from 14,000+ a year earlier.

- Year-to-date sales are down 39% in Europe, painting a bleak picture for one of Tesla’s key international markets.

- The company’s market share in Europe’s EV sector plunged from 9.8% to 3.9%.

- Meanwhile, total EV registrations in Europe hit 184,700 in April — a new record.

- Chinese rival BYD overtook Tesla, posting a 359% sales jump in the same month.

What’s Driving the Crash:

- Backlash against Elon Musk: His political alignment with Donald Trump, public support for Germany’s far-right AfD party, and role in Trump’s government “efficiency” task force (DOGE) triggered protests across Europe.

- Reputational fallout: Tesla showrooms and cars have been vandalized in Berlin and London. Activists accuse Musk of turning Tesla into a political brand.

- Shifting consumer preference: European buyers are turning to hybrid EVs, now representing 35% of the total market — a segment Tesla has no product in.

- Aging product lineup: Apart from a facelifted Model Y, Tesla hasn’t launched new mass-market EVs in years.

- Competitor strength: BYD, Volkswagen, Škoda, and others are ramping up production and pricing aggressively, particularly in entry-level segments.

What Elon Musk Said:

At the Qatar Economic Forum, Musk dismissed the idea of political damage:

“Europe is our weakest market… but sales are strong elsewhere.”

On Tesla’s future:

“I’m back to spending 24/7 at work and sleeping in factory floors.”

He added he would reduce time spent in Washington starting May, to refocus on Tesla after investor backlash and the company’s 71% Q1 profit drop.

Market Reaction:

TSLA stock rebounded 5% early Tuesday, driven by optimism over Musk’s renewed focus. Still, shares are down 16% year-to-date as the brand struggles outside the US and China.

Analysts warn the long-term impact of Musk’s political affiliations could continue to erode trust with Tesla’s traditionally progressive customer base.

“This is a watershed moment,” said JATO’s Felipe Munoz.

“Tesla is no longer leading Europe’s EV race — it’s struggling to keep up.”

Tesla is facing a perfect storm in Europe: political blowback, aggressive rivals, and an outdated lineup. If the trend continues, its dominance in the EV world may soon be history on the continent — especially if consumers continue to punish Elon Musk’s political pivot.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Angry Elon Is Back — And He’s Betting Big on Driverless Teslas and AI

Elon Musk’s Qatar Meltdown: “NPCs,” Jeffrey Epstein, Tesla Denial, and Prison Promises