Tesla August sales highlight the company’s diverging fortunes — a slight rebound in China but deepening weakness in Europe as BYD and rivals grab market share.

Tesla ($TSLA) is navigating a turbulent 2025, with fresh sales data underscoring the challenges it faces in both China and Europe. The company’s efforts to refresh its lineup and cut prices are helping in some areas, but competition is accelerating and consumer sentiment is shifting fast.

China: Stabilization With a Catch

In China, Tesla’s sales of locally made EVs fell 4% year-on-year in August, following an 8.4% drop in July. Yet there was a short-term rebound: deliveries of the Model 3 and Model Y surged 22.6% from July, reaching 83,192 units from its Shanghai factory, which also serves export markets.

Still, the year-to-date picture shows weakness. From January to August, Tesla sold 515,552 units in China, down 12.2% compared with 2024. The company is betting on fresh products and pricing moves to reverse the slide:

- A 3.7% price cut on the Model 3 RWD in China, now starting at 259,500 yuan ($36,279).

- Launch of the six-seat Model Y L, priced at 339,000 yuan — slightly more expensive than Xiaomi’s ($1810.HK) hotly anticipated YU7 SUV.

But Tesla’s rivals are scaling up quickly. BYD ($002594.SZ) sold 373,626 vehicles in August, while Xiaomi’s SU7 sedan has consistently outsold the Model 3 since December. With over 240,000 pre-orders locked in for the YU7, Xiaomi is emerging as Tesla’s fiercest new challenger in China.

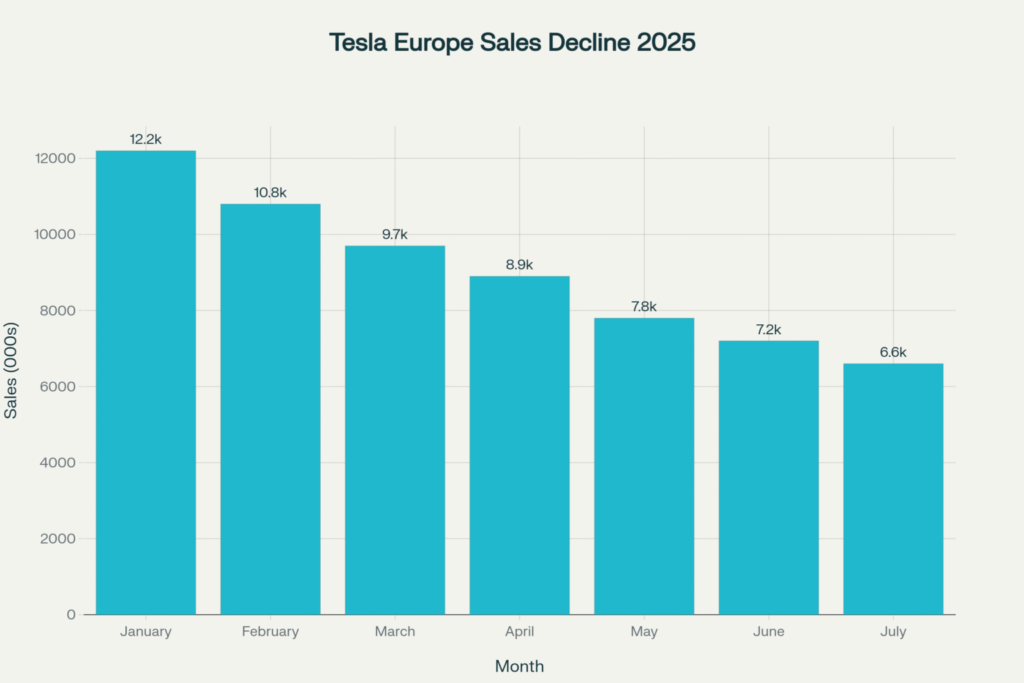

Europe: Eighth Month of Declines

In Europe, the picture is more worrying. Tesla’s sales fell for the eighth consecutive month in August, with sharp declines across most major markets:

- France: –47.3%

- Sweden: –84%

- Denmark: –42%

- Netherlands: –50%

- Italy: –4.4%

There were isolated gains:

- Norway: +21.3%

- Portugal: +28.7%

- Spain: +161% (boosted by subsidies up to $8,200)

But even in these markets, Tesla is losing ground to BYD, which recorded a 218% surge in Norway and an eye-popping 675% year-to-date jump in Spain. Overall, Tesla’s western European market share has slipped from 2.5% to 1.7% in the first half of 2025.

What’s Behind the Weakness?

- Aging lineup — Tesla hasn’t launched a new mass-market model since the Model Y in 2020, relying instead on refreshes.

- Competitive pricing — Rivals like BYD and Xiaomi are offering cheaper, feature-rich EVs that appeal to cost-sensitive buyers.

- Brand pressure — Elon Musk’s political activity, including outspoken support for Donald Trump and far-right parties in Europe, has fueled a backlash among some buyers.

- Falling resale values — Used Teslas in the UK have lost over 40% of their value, tarnishing the brand’s image and resale appeal.

Why Investors Should Care

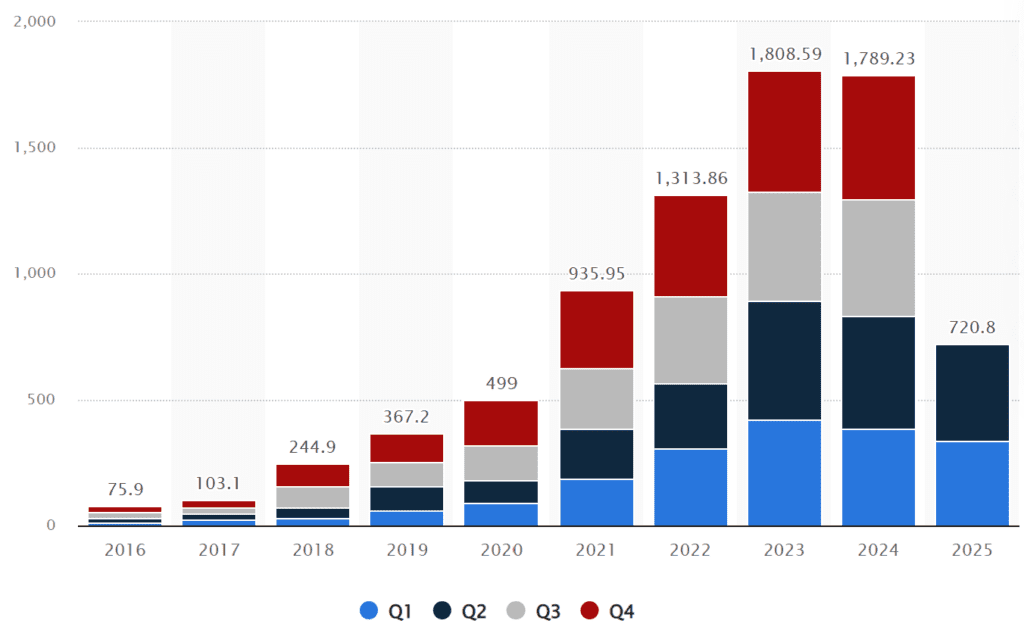

Tesla’s struggles in Europe and softer demand in China signal a major shift in the global EV landscape. Where once Tesla set the pace, new entrants and Chinese automakers are now dictating momentum.

- For markets: The EV race is wide open. Companies with aggressive pricing and constant product refreshes are stealing share, reshaping consumer expectations.

- For Tesla: The pressure to deliver a new, affordable mass-market model is higher than ever. Without it, market share could continue to erode as rivals capture both volume and consumer trust.

- For investors: Reputation is becoming as important as range. Tesla’s long-term valuation depends not just on production numbers but also on consumer sentiment in its most critical markets.

Related reading: Tesla Europe Sales Slump 40% as BYD Triples Registrations

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.