A global frenzy for silver — driven by festival demand in India, solar power expansion, and investor fear trades — has pushed the metal to record highs and sparked the worst market squeeze in decades.

Silver Shortage Sparks Global Chaos

What began as a festival buying rush in India this month quickly spiraled into a global silver crisis.

Vipin Raina, head of trading at MMTC-Pamp India, the country’s largest precious metals refinery, said his firm ran out of silver stock for the first time ever.

“Most dealers are literally out of stock. I haven’t seen a market like this in my 27-year career,” Raina said.

By mid-October, silver jewelry shops across India were sold out, and premiums over international prices had soared from a few cents to over $5 per ounce.

The trigger? Millions of Indian buyers, encouraged by influencers and traders, switched from gold to silver for the Dhanteras and Diwali festivals, betting that silver’s 100-to-1 price ratio to gold meant it was “next to boom.”

From Mumbai to London: A Perfect Storm

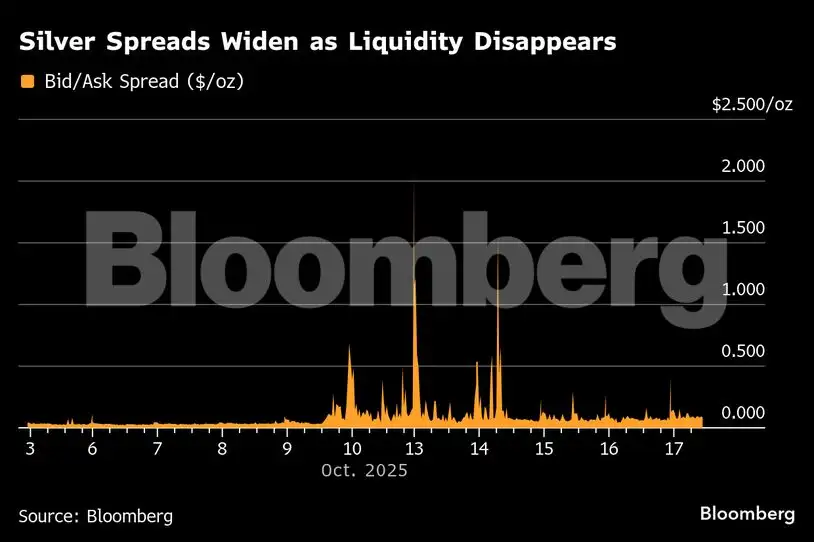

The shockwave soon reached London, the world’s silver trading hub, where liquidity dried up and the overnight borrowing cost for silver skyrocketed to an annualized 200%, according to Metals Focus.

Large banks like JPMorgan, major suppliers to India, reportedly stopped quoting prices, telling clients they had no silver available for October deliveries.

“There’s little to no liquidity left in London,” said Robin Kolvenbach, co-CEO of Swiss refiner Argor-Heraeus. “We’ve basically stopped all silver intake not already under contract.”

Prices hit an all-time high above $54 per ounce, before plunging 6.7% in a single session — the sharpest drop since the Hunt brothers’ attempted corner of the silver market 45 years ago.

How the Market Broke

Bloomberg’s investigation, based on interviews with traders and refiners worldwide, found that the crisis stemmed from a convergence of five major pressures:

- India’s festival demand — the biggest silver rush in decades.

- China’s Golden Week holiday, which briefly halted exports.

- ETF hoarding, with over 100 million ounces absorbed in 2025 alone amid “debasement trade” fears about the U.S. dollar.

- Trump-era tariff anxiety, prompting traders to ship over 200 million ounces to New York to front-run possible import duties.

- Soaring solar industry demand, which has more than doubled silver usage since 2021.

By early October, the free float in London’s vaults — silver not owned by ETFs — had fallen below 150 million ounces, just a fraction of the 250 million ounces traded daily.

India’s Retail Frenzy Freezes ETFs

Back in India, the supply crunch forced asset managers like Kotak, UTI, and State Bank of India to freeze new silver ETF subscriptions, unable to source the metal.

“The FOMO factor worked,” said Satish Dondapati of Kotak Asset Management. “Dealers ran out of metal, and retail investors rushed in.”

In Mumbai’s bullion markets, bidding wars erupted, with wealthy buyers paying any price to secure stock.

Regulators on Edge

While previous silver squeezes — like Warren Buffett’s 1998 buy-up — led to new trading limits, the London Bullion Market Association (LBMA) said it won’t intervene, viewing the turmoil as a genuine supply shortage, not manipulation.

Still, the stress is testing logistics: it takes at least four days to airlift silver from New York’s COMEX warehouses to London, but customs delays and fears of new U.S. tariffs on critical minerals have slowed the process.

Outlook: Relief or Reckoning?

Analysts say relief could come soon as U.S. and Chinese supplies start arriving in London, but volatility will remain extreme.

“The logistics were more complex than anyone expected,” said TD Securities’ Daniel Ghali, who predicted further declines as the squeeze unwinds.

For now, the world’s silver market — worth more than $36 billion in vaulted metal — is limping through one of its most chaotic moments in history.

From sold-out jewelry counters in India to panicked traders in London, the 2025 silver rush is a stark reminder of how global demand, social media hype, and industrial transitions can combine to break even the oldest markets overnight.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Gold Suffers Sharpest Drop in Over a Decade as Rally Cools; Silver Sinks 7%