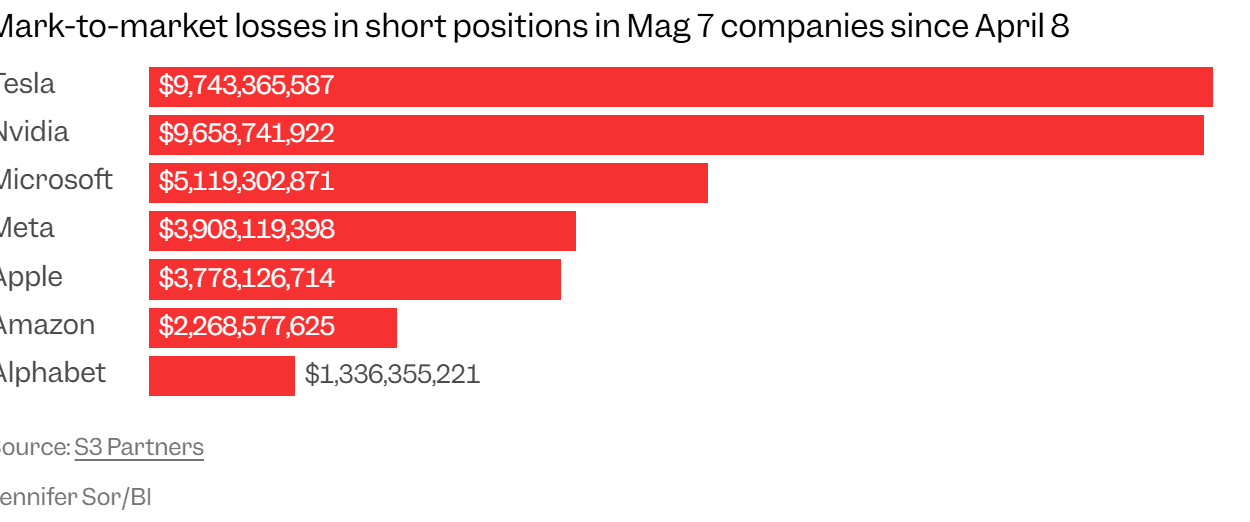

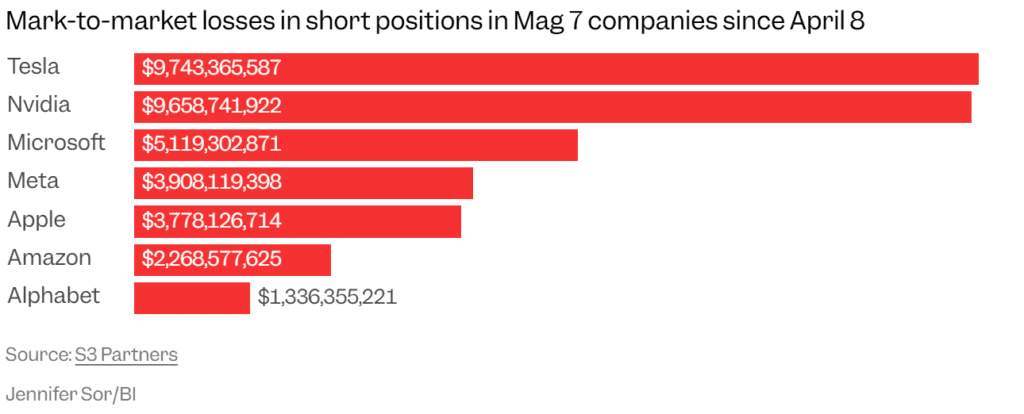

Short sellers have been hit hard by the recent market rally — losing more than $250 billion since the April 8 bottom, according to data from S3 Partners. The surge, which has brought the S&P 500 back within 3% of its all-time high, has turned into a nightmare for bearish investors.

Leading the pain: Nvidia (NVDA) and Tesla (TSLA), with short positions on the two companies racking up more than $19 billion in combined losses.

- Nvidia has been buoyed by easing trade restrictions and bullish sentiment ahead of its May 28 earnings report.

- Tesla soared as Elon Musk refocused on the automaker following his time at the Department of Government Efficiency (DOGE).

But the pain hasn’t been limited to tech giants. Retail favorites like Palantir (PLTR), Hims & Hers (HIMS), and MicroStrategy (MSTR) also staged sharp rallies:

- Palantir is up over 55% since April 8.

- Hims & Hers has more than doubled.

- MicroStrategy — riding bitcoin’s momentum — jumped 68%, with short sellers losing over $5 billion.

These gains have crushed bearish bets and triggered widespread short covering, adding more fuel to the rally.

The surge began after President Trump delayed key tariffs in early April, triggering the S&P 500’s best single-day gain since 2008. Continued pullbacks on tariffs have kept the rally alive, while a lack of negative catalysts gave markets breathing room.

Still, some analysts are skeptical of the rally’s strength.

“I don’t actually think it is so much a validation of strong fundamentals,” said Viktor Hjort, head of strategy at BNP Paribas. “It’s a reflection of the fact that the market was caught short at a time when there was no actual fundamental information available.”

With June approaching and fresh economic data on the way, Hjort warned the market may become more vulnerable.

“We are going into June with a much more balanced, perhaps slowly more vulnerable type of market setup,” he said.

For now, the bulls are winning — and the bears are licking their wounds.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

US at risk of stagflation, Fed right to hold: Jamie Dimon

Why ‘Sell America’ is trending on Wall Street

Trump’s ‘Big, Beautiful Bill’ Moves Forward — But Sparks Backlash Over Debt and Benefit Cuts

Bloomberg Terminal Outage Disrupts Bond Auctions Across Europe

Weak 20-Year Treasury Auction Sends Yields Higher and Stocks Tumbling

Nvidia CEO Slams Biden’s AI Chip Export Curbs as a “Failure,” Backs Trump’s Reversal

White House: China Will ‘Absorb’ Tariffs — Not US Consumers

Bostic Warns on Moody’s Downgrade, Inflation Risk — Leans Toward One Cut

Nvidia Expands in China & Taiwan as US Export Rules Tighten

Earnings Calendar, Fed Speech, Housing Data: What to Watch This Week