Tariffs are weighing on trade. Consumers feel squeezed. August is often a rough month for equities.

You’ve likely seen these headlines. They’re crafted to spark anxiety, often capped off with a gloomy quote from someone who’s been bearish for years.

But here’s philosophy: don’t obsess over the noise—watch the trend lines.

And the trends today suggest resilience, not collapse.

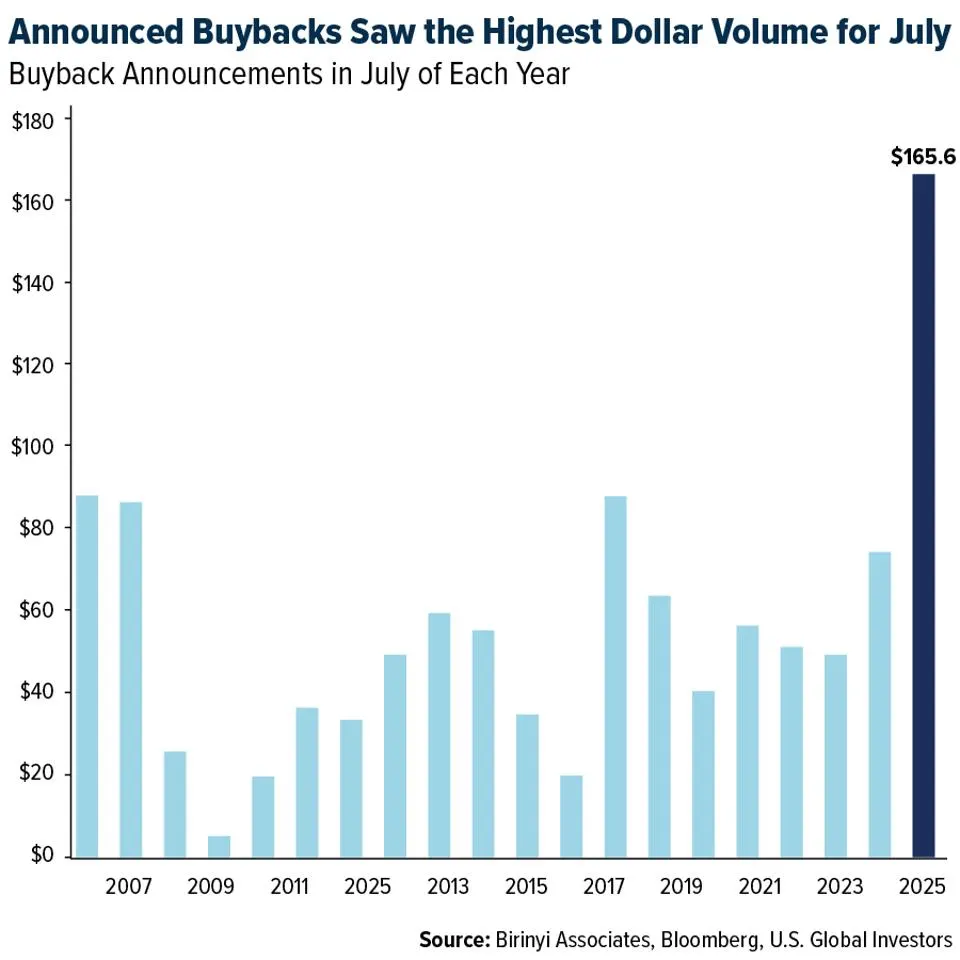

Buybacks At Historic Levels

Companies only allocate billions to repurchase their own shares if they believe the stock is undervalued—or at least a better investment than cash parked on the sidelines.

In July 2025 alone, U.S. corporations unveiled a record $166 billion in buybacks, more than doubling the previous July peak set in 2006.

Year-to-date buybacks: $926 billion—outpacing every prior record at this point in the year.

The biggest spenders? Financials and tech leaders, sitting on huge cash piles and betting big on long-term shareholder value.

Yes, buybacks dipped slightly from the Q1 frenzy, but the pace remains historically strong—and that’s what truly matters.

The IPO Engine Is Roaring Again

The initial public offering market has shaken off its slump.

- 204 IPOs so far in 2025, up 80% from this point last year.

- Q2 alone raised $15 billion across 59 offerings, a 34% jump from Q1.

Unlike the SPAC bubble of 2021, today’s deals are anchored in fundamentals—companies with real growth and profits.

If investors were bracing for collapse, would startups be lining up to go public at billion-dollar valuations? Clearly not.

ETFs Continue To Attract Massive Flows

Money is pouring into exchange-traded funds.

- U.S. ETF assets are nearing $12 trillion.

- July brought in $116 billion of inflows, including a record $44.8 billion into active ETFs.

Active funds now account for 10% of the ETF market, compared to less than 1% just 15 years ago. That shows investors are seeking targeted exposure in themes like AI, defense, energy, and gold.

Corporate Earnings Remain Strong

Earnings season has delivered.

- About two-thirds of S&P 500 companies have reported Q2 results.

- Over 80% beat expectations—the best performance since 2021.

- In tech, powered by AI growth, over 90% posted beats.

Even with tariffs and inflationary headwinds, analysts are still raising EPS estimates for Q3.

Tariffs Are A Challenge, Not A Crisis

Yes, tariffs are back. The U.S. effective tariff rate now sits at 18.3%, the highest since the 1930s. Economists estimate a 1.8% bump in prices and around a $2,400 annual hit per household.

But markets adapt. Supply chains shift. Companies re-shore. Consumers adjust. These frictions are real—but hardly fatal.

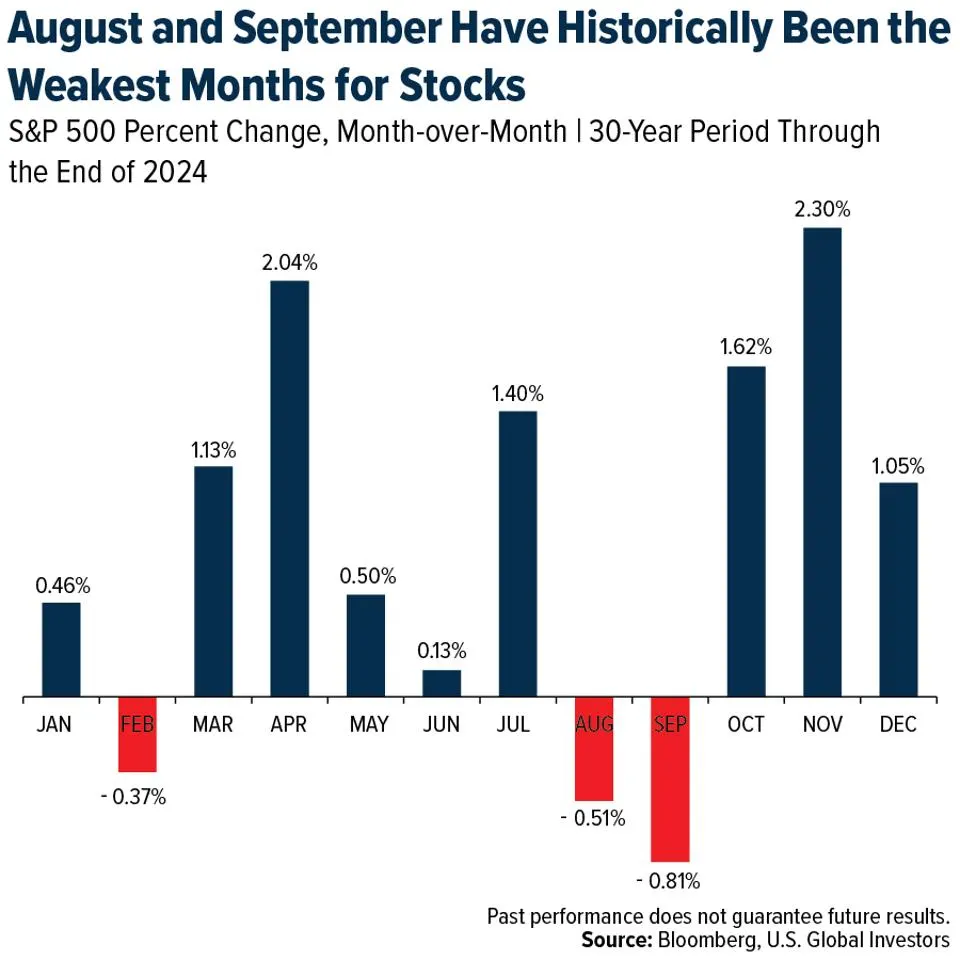

Seasonal Volatility Doesn’t Break The Trend

Historically, August and September are shaky months with thinner liquidity and sharper reactions to headlines.

But zoom out:

- The S&P 500 surged 26% in 2023,

- Added another 25% in 2024,

- And is already up 8–9% in 2025.

Short-term dips are inevitable. Long-term compounding is what counts.

Block Out The Noise

Negative headlines sell clicks. But as investors, the task is simple: focus on the data, not the drama.

And the data shows:

- Corporations are confident (buybacks).

- Capital markets are thriving (IPOs).

- Investor demand is robust (ETF inflows).

- Companies are delivering (earnings beats).

Yes, risks persist. They always do. But the prevailing trends still point to a market that’s strong and resilient.

Ignore the scare tactics. Follow the trend lines.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Secret White House Spreadsheet Ranks US Companies by Loyalty to Trump

Why Stock Market Keeps Climbing Despite Tariffs and Tensions

Billionaire Investors Reveal Q2 2025 Portfolio Moves: Buffett, Ackman, Tepper, Burry & More

Trump’s Auto Tariffs Deliver $11.7 Billion Blow to Global Carmakers — No Relief in Sight

Inflation Data, Fed Policy Signals, and Key Earnings in Focus This Week

Trump Explodes Over Nancy Pelosi Stock Ban

Fed Governor Adriana Kugler Resigns, Opening Door for Trump

Trump Imposes New Global Tariff Rates, Effective August 7

What Happens After Tariff Deadline and What Next 72 Hours Look Like for Markets

Trump’s Tariffs Are Real, But Are His Trade Deals Just for Show?