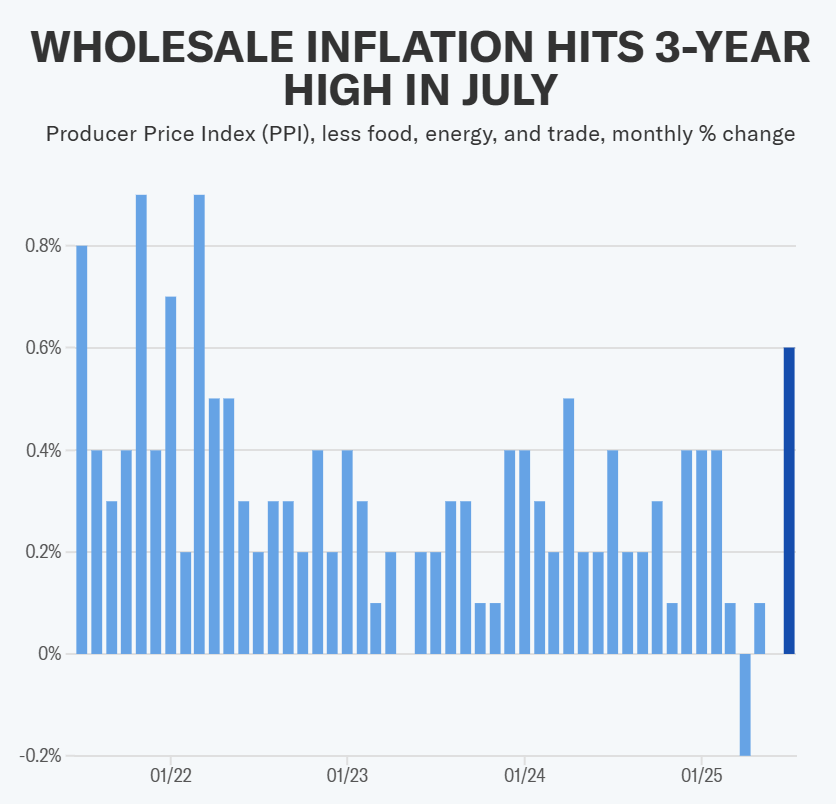

Wall Street’s record-setting rally lost momentum Thursday after July’s Producer Price Index came in far hotter than expected, lifting Treasury yields and tempering bets on an imminent Fed rate cut.

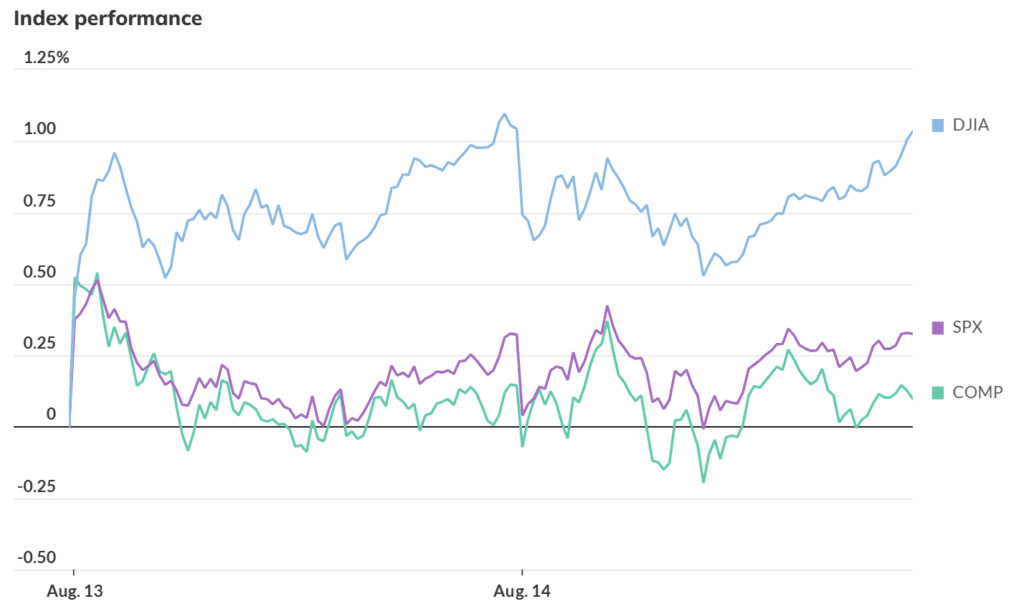

US stocks dipped as traders digested the sharpest monthly jump in wholesale inflation in over three years. The Dow Jones Industrial Average fell 0.33%, the S&P 500 slipped 0.09%, and the Nasdaq Composite edged just 0.01% lower. The pullback came after the S&P 500 and Nasdaq notched back-to-back record highs earlier this week.

July PPI shock: Headline PPI surged 0.9% month-over-month (vs. 0.2% expected), and 3.3% year-over-year — the highest since February. Core PPI, excluding food, energy, and trade services, also jumped 0.9% MoM and 3.7% YoY, both well above forecasts and marking the steepest gains since 2022.

Tariff effects and pass-through risks: Economists warned that rising business costs from tariffs could increasingly be passed on to consumers. Ben Ayers of Nationwide noted that while companies have so far absorbed much of the tariff hit, “margins are being squeezed” and stronger pass-through to consumer prices is likely in the coming months.

Fed dilemma deepens: The inflation spike complicates expectations for a September rate cut. Markets still price in over a 90% chance of a 25-basis-point reduction, but odds for a larger cut have dropped. Mary Daly (San Francisco Fed) urged caution, saying the labor market is softening but not weak enough to justify urgency. Raphael Bostic (Atlanta Fed) warned that weaker jobs data could limit patience on inflation.

Bond and currency moves: Two-year Treasury yields rose six basis points to 3.74%, and the dollar strengthened as traders scaled back aggressive easing bets.

Market leaders and laggards: Gains in big tech kept the S&P’s drop modest, but roughly 400 stocks in the index fell. Bitcoin retreated nearly 3% after briefly touching a record high Wednesday. In corporate highlights, newly listed crypto exchange Bullish (BLSH) surged over 9%, trading around $75 — more than double its IPO price.

The Fed’s preferred inflation gauge, the core PCE index, is expected on August 29. Bank of America estimates it rose 0.3% in July, pushing the annual rate to 2.9%, further above the 2% target. Chair Jerome Powell’s Jackson Hole speech on August 22 will be closely watched for signals on whether the rate-cut cycle will start this fall.

Friday’s retail sales data will cap a volatile week for traders navigating between inflation risks, tariff impacts, and Fed policy uncertainty.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump’s Auto Tariffs Deliver $11.7 Billion Blow to Global Carmakers — No Relief in Sight

Inflation Data, Fed Policy Signals, and Key Earnings in Focus This Week

Trump Explodes Over Nancy Pelosi Stock Ban

Fed Governor Adriana Kugler Resigns, Opening Door for Trump

Trump Imposes New Global Tariff Rates, Effective August 7

What Happens After Tariff Deadline and What Next 72 Hours Look Like for Markets

Trump’s Tariffs Are Real, But Are His Trade Deals Just for Show?